Kodak 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006

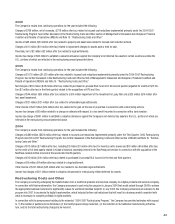

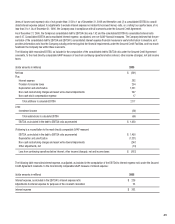

The Company’s results from continuing operations for the year included the following:

Charges of $768 million, net of reversals, ($718 million after tax) related to focused cost reductions implemented primarily under the 2004-2007

Restructuring Program. See further discussion in the Restructuring Costs and Other section of Management’s Discussion and Analysis of Financial

Condition and Results of Operations (MD&A) and Note 16, “Restructuring Costs and Other.”

Income of $46 million ($33 million after tax) related to property and asset sales related to focused cost reduction actions.

Charges of $11 million ($10 million after tax) related to impairment charges for assets sold or held for sale.

Reversals, net of $2 million ($2 million after tax) related to legal settlements.

Income tax charge of $90 million to establish a valuation allowance against the Company’s net deferred tax assets in certain countries outside the

U.S., portions of which are reflected in the restructuring amount presented above.

2005

The Company’s results from continuing operations for the year included the following:

Charges of $1,118 million ($1,020 million after tax) related to focused cost reductions implemented primarily under the 2004-2007 Restructuring

Program. See further discussion in the Restructuring Costs and Other section of Management’s Discussion and Analysis of Financial Condition and

Results of Operations (MD&A) and Note 16, “Restructuring Costs and Other.”

Net charges of $52 million ($38 million after tax) related to purchased in-process R&D incurred in the second quarter (adjusted for credits of $12 mil-

lion ($2 million after tax) in the third quarter) related to the acquisitions of KPG and Creo.

Charges of $44 million ($35 million after tax) related to a $19 million impairment of the investment in Lucky Film and a $25 million ($16 million after

tax) asset impairment.

Charges of $21 million ($21 million after tax) related to unfavorable legal settlements.

Other income of $41 million ($39 million after tax) related to the gain on the sale of properties in connection with restructuring actions.

Income tax charges of $6 million related to a change in estimate with respect to a tax benefit recorded in connection with a land donation.

Income tax charge of $961 million to establish a valuation allowance against the Company’s net deferred tax assets in the U.S., portions of which are

reflected in the restructuring amount presented above.

2004

The Company’s results from continuing operations for the year included the following:

Charges of $889 million ($620 million after tax) related to focused cost reductions implemented primarily under the Third Quarter, 2003 Restructuring

Program and 2004-2007 Restructuring Program. See further discussion in the Restructuring Costs and Other section of MD&A and Note 16, “Restruc-

turing Costs and Other.”

Charges of $12 million ($7 million after tax), including $2 million ($1 million after tax) for inventory write-downs and $10 million ($6 million after tax)

for the write-off of fixed assets related to Kodak’s historical ownership interest in the NexPress joint venture in connection with the acquisition of the

NexPress-related entities incurred in the second and fourth quarters.

Charges of $15 million ($10 million after tax) related to purchased in-process R&D incurred in the first and third quarters.

Charges of $6 million ($4 million after tax) related to a legal settlement.

Other income of $101 million ($63 million after tax) related to two favorable legal settlements.

Income tax charges of $31 million related to valuation allowances for restructuring related deferred tax assets.

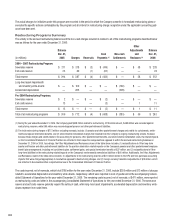

Restructuring Costs and Other

The Company is currently undergoing the transformation from a traditional products and services company to a digital products and services company.

In connection with this transformation, the Company announced a cost reduction program in January 2004 that would extend through 2006 to achieve

the appropriate business model and to significantly reduce its worldwide facilities footprint. In July 2005, the Company announced an extension to this

program into 2007 to accelerate its digital transformation, which included further cost reductions that will result in a business model consistent with

what is necessary to compete profitably in digital markets.

In connection with its announcement relating to the extended “2004-2007 Restructuring Program,” the Company has provided estimates with respect

to (1) the number of positions to be eliminated, (2) the facility square footage reduction, (3) the reduction in its traditional manufacturing infrastruc-

ture, and (4) the total restructuring charges to be incurred.