Kodak 2006 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research and Development Costs

R&D costs for the FPG segment decreased $49 million, or 55%, from $89 million in 2005 to $40 million in the current year and decreased as a

percentage of sales from 2% in the prior year to 1% in the current year. The decrease in R&D was primarily attributable to significant reductions in

spending related to traditional products and services.

Earnings From Continuing Operations Before Interest, Other Income (Charges), Net and Income Taxes

Earnings from continuing operations before interest, other income (charges), net and income taxes for the FPG segment were $358 million in 2006

compared with earnings of $540 million in 2005, representing a decrease of $182 million or 34%, resulting from the factors outlined above.

Graphic Communications Group

On April 1, 2005, the Company became the sole owner of KPG through the redemption of Sun Chemical Corporation’s 50 percent interest in the KPG

joint venture. Under the terms of the transaction, the Company redeemed all of Sun Chemical’s shares in KPG by providing $317 million in cash at

closing and by entering into two notes payable arrangements, one that will be payable within the U.S. (the U.S. note) and one that will be payable

outside of the U.S. (the non-U.S. note), that required a principal and interest payment of $200 million in the third quarter of 2006, and payments of

$50 million annually from 2008 through 2013. The total payments due under the U.S. note and the non-U.S. note are $100 million and $400 million,

respectively. The aggregate fair value of these notes payable arrangements of approximately $395 million as of the acquisition date was recorded as

long-term debt in the Company’s Consolidated Statement of Financial Position.

On June 15, 2005, the Company completed the acquisition of Creo Inc. (Creo), a premier supplier of prepress and workflow systems used by commer-

cial printers around the world. The Company paid $954 million (excluding approximately $11 million in transaction related costs), or $16.50 per share,

for all of the outstanding shares of Creo. The Company used its bank lines to initially fund the acquisition, which has been refinanced with a term loan

under the Company’s Secured Credit Agreement.

During the second quarter of 2006, the Company indicated that, as a result of ongoing integration of acquisitions within the Graphic Communications

Group, it had become increasingly difficult to report results by the discrete businesses that were acquired. Therefore, beginning with the third quarter

of 2006, results for the GCG segment are reported using the following SPG structure:

• Digital Prepress Consumables – digital plates, chemistry, media and services

• NexPress Color – equipment, consumables and services for NexPress color products, and direct image press equipment

• Commercial Inkjet Printing Solutions – Versamark equipment, consumables and service

• Workflow and Prepress – workflow software, output devices, proofing equipment, and services

• Other Digital – electrophotographic black and white equipment and consumables, document scanners and services, wide-format inkjet, imag-

ing services

• Traditional – analog plates, graphics and other films, paper, media equipment, archival products

As the GCG segment completes its integration process and further aligns the discrete businesses, starting in the first quarter of 2007, the GCG seg-

ment results will be reported using the following organizational structure:

• Enterprise Solutions - workflow software and digital controller development

• Digital Printing Solutions - all continuous inkjet and electrophotographic products, including equipment, consumables and service

• Prepress Solutions - prepress consumables; output devices; wide-format inkjet printers, media, and inks; proofing hardware, media and

software; and related services

• Document Imaging Business - document scanners and services, and imaging services

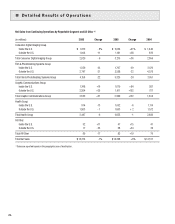

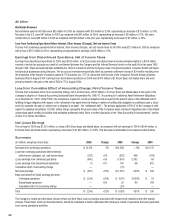

Worldwide Revenues

Net worldwide sales for the Graphic Communications Group segment were $3,632 million for 2006 as compared with $2,990 million for the prior

year, representing an increase of $642 million, or 21%. The increase in net sales was primarily due to the KPG and Creo acquisitions in 2005, which

together contributed $639 million or approximately 21.4 percentage points to the year-over-year increase in sales. Also contributing to the increase

in net sales were volume increases, which increased sales by approximately 4.3 percentage points and which were largely attributable to the digital

prepress consumables SPG, and favorable foreign exchange, which increased sales by approximately 0.8 percentage points.

These increases were partially offset by negative price/mix, which decreased 2006 net sales by approximately 5.0 percentage points, primarily driven

by the digital prepress consumables SPG, the traditional prepress consumables SPG, the NexPress color SPG, and the workflow and prepress SPG.

Net sales in the U.S. were $1,248 million for 2006 as compared with $1,079 million for the prior year, representing an increase of $169 million, or

16%. Net sales outside the U.S. were $2,384 million in 2006 as compared with $1,911 million for the prior year, representing an increase of $473

million, or 25%.