Kodak 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FASB Statement No. 155

In February 2006, the FASB issued SFAS No. 155, “Accounting for Certain Hybrid Financial Instruments (an amendment of FASB Statements No. 133

and 140).” This Statement permits fair value measurement for any hybrid financial instrument that contains an embedded derivative that otherwise

would require bifurcation. SFAS No. 155 is effective for all financial instruments acquired, issued, or subject to a remeasurement event occurring after

the beginning of an entity’s first fiscal year that begins after September 15, 2006 (year ending December 31, 2007 for the Company). Additionally,

the fair value option may also be applied upon adoption of this Statement for hybrid financial instruments that had been bifurcated under previous

accounting guidance prior to the adoption of this Statement. The Company is currently evaluating the impact of SFAS No. 155.

FASB Interpretation No. 48

In July 2006, the FASB issued FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes” (FIN 48). FIN 48 clarifies the accounting and

reporting for uncertainty in income taxes recognized in accordance with SFAS No. 109, “Accounting for Income Taxes.” This Interpretation prescribes

a recognition threshold and measurement attribute for financial statement recognition and measurement of a tax position taken or expected to be

taken in a tax return, and also provides guidance on various related matters such as derecognition, interest and penalties, and disclosure. The Com-

pany will adopt FIN 48 in the first quarter of 2007, and does not expect the adoption of this Interpretation to have a material impact on its Consolidated

Financial Statements.

FASB Statement No. 157

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements,” which establishes a comprehensive framework for measuring fair

value in GAAP and expands disclosures about fair value measurements. Specifically, this Statement sets forth a definition of fair value, and estab-

lishes a hierarchy prioritizing the inputs to valuation techniques, giving the highest priority to quoted prices in active markets for identical assets and

liabilities and the lowest priority to unobservable inputs. This Statement is effective for financial statements issued for fiscal years beginning after

November 15, 2007, and interim periods within those fiscal years. The provisions of SFAS No. 157 are generally required to be applied on a prospec-

tive basis, except to certain financial instruments accounted for under SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities,”

for which the provisions of SFAS No. 157 should be applied retrospectively. The Company will adopt SFAS No. 157 in the first quarter of 2008.

FASB Statement No. 158

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans (an amend-

ment of FASB Statements No. 87, 88, 106, and 132(R)),” which is effective in fiscal years ending after December 15, 2006. This Statement requires

an employer to recognize the overfunded or underfunded status of a defined benefit postretirement plan as an asset or liability in its statement of

financial position, and to recognize changes in that funded status in the year in which the changes occur through comprehensive income. SFAS No.

158 does not change the amount of actuarially determined expense that is recorded in the Consolidated Statement of Operations. SFAS No. 158 also

requires an employer to measure the funded status of a plan as of the date of its year-end statement of financial position, which is consistent with the

Company’s present measurement date. The adoption of SFAS No. 158 did not have any impact on the Company’s Consolidated Statement of Opera-

tions, Statement of Cash Flows, or compliance with its debt covenants.

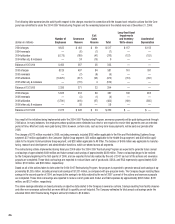

The table below discloses the impact of adoption on the Company’s Consolidated Statement of Financial Position as of December 31, 2006.

Before Application Adjustments After Application

of SFAS No. 158 Increase/(Decrease) of SFAS No. 158

Other long-term assets $ 3,421 $ 304 $ 3,725

Total assets 14,016 304 14,320

Accounts payable and other current liabilities 4,100 43 4,143

Total current liabilities 4,928 43 4,971

Pension and other postretirement liabilities 3.318 646 3,964

Other long-term liabilities 1,282 1 1,283

Total liabilities 12,242 690 12,932

Accumulated other comprehensive loss (249) 386 (635)

Total shareholders’ equity 1,774 (386) 1,388

Total liabilities and shareholders’ equity $ 14,016 $ 304 $ 14,320