Kodak 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236

|

|

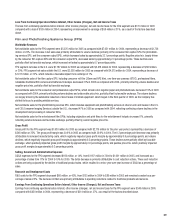

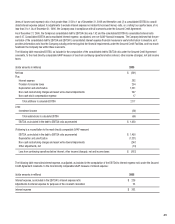

items of income and expense) ratio of not greater than: 3.50 to 1 as of December 31, 2006 and thereafter, and (2) a consolidated EBITDA to consoli-

dated interest expense (subject to adjustments to exclude interest expense not related to borrowed money) ratio, on a rolling four-quarter basis, of no

less than 3 to 1. As of December 31, 2006, the Company was in compliance with all covenants under the Secured Credit Agreement.

As of December 31, 2006, the Company’s consolidated debt to EBITDA ratio was 1.92 and the consolidated EBITDA to consolidated interest ratio

was 6.07. Consolidated EBITDA and consolidated interest expense, as adjusted, are non-GAAP financial measures. The Company believes that the pre-

sentation of the consolidated debt to EBITDA and EBITDA to consolidated interest expense financial measures is useful information to investors, as it

provides information as to how the Company actually performed against the financial requirements under the Secured Credit Facilities, and how much

headroom the Company has within these covenants.

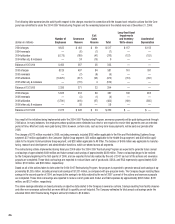

The following table reconciles EBITDA, as included in the computation of the consolidated debt to EBITDA ratio under the Secured Credit Agreement

covenants, to the most directly comparable GAAP measure of loss from continuing operations before interest, other income (charges), net and income

taxes:

(dollar amounts in millions) 2006

Net loss $ (601)

Plus:

Interest expense 262

Provision for income taxes 254

Depreciation and amortization 1,331

Non-cash restructuring charges and asset write-downs/impairments 247

Non-cash stock compensation expense 17

Total additions to calculate EBITDA 2,111

Less:

Investment income (60)

Total subtractions to calculate EBITDA (60)

EBITDA, as included in the debt to EBITDA ratio as presented $ 1,450

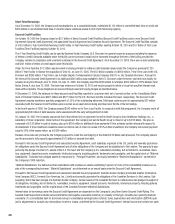

(Following is a reconciliation to the most directly comparable GAAP measure)

EBITDA, as included in the debt to EBITDA ratio as presented $ 1,450

Depreciation and amortization (1,331)

Non-cash restructuring charges and asset write-downs/impairments (247)

Other adjustments, net (74)

Loss from continuing operations before interest, other income (charges), net and income taxes $ (202)

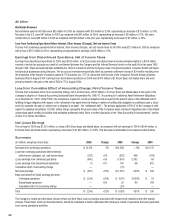

The following table reconciles interest expense, as adjusted, as included in the computation of the EBITDA to interest expense ratio under the Secured

Credit Agreement covenants, to the most directly comparable GAAP measure of interest expense:

(dollar amounts in millions) 2006

Interest expense, as included in the EBITDA to interest expense ratio $ 239

Adjustments to interest expense for purposes of the covenant calculation 23

Interest expense $ 262