Kodak 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

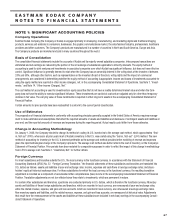

Recently Issued Accounting Standards

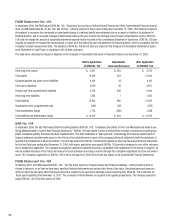

FASB Statement No. 151

In December 2004, the FASB issued SFAS No. 151, “Inventory Costs” that amends the guidance in Accounting Research Bulletin No. 43, Chapter 4,

“Inventory Pricing” (ARB No. 43) to clarify the accounting for abnormal idle facility expense, freight, handling costs, and wasted material (spoilage). In

addition, this Statement requires that an allocation of fixed production overhead to the costs of conversion be based on the normal capacity of the pro-

duction facilities. SFAS No. 151 is effective for inventory costs incurred for fiscal years beginning after June 15, 2005 (year ending December 31, 2006

for the Company). The adoption of SFAS No. 151 in 2006 did not have a material impact on the Consolidated Financial Statements of the Company.

FASB Interpretation No. 47

In March 2005, the FASB issued FASB Interpretation No. 47, “Accounting for Conditional Asset Retirement Obligations” (FIN 47). FIN 47 clarifies that

the term “conditional asset retirement obligation” as used in FASB No. 143, “Accounting for Asset Retirement Obligations,” refers to a legal obliga-

tion to perform an asset retirement activity in which the timing and/or method of settlement are conditional on a future event that may or may not be

within the control of the Company. In addition, FIN 47 clarifies when a company would have sufficient information to reasonably estimate the fair value

of an asset retirement obligation.

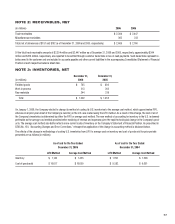

The Company adopted FIN 47 during the fourth quarter of 2005. FIN 47 requires that conditional asset retirement obligations, legal obligations to

perform an asset retirement activity in which the timing and/(or) method of settlement are conditional on a future event, be reported, along with

associated capitalized asset retirement costs, at their fair values. Upon initial application, FIN 47 requires recognition of (1) a liability, adjusted for

cumulative accretion from the date the obligation was incurred until the date of adoption of FIN 47, for existing asset retirement obligations; (2) an

asset retirement cost capitalized as an increase to the carrying amount of the associated long-lived asset; and (3) accumulated depreciation on the

capitalized asset retirement cost. Accordingly, the Company recognized the following amounts in its Statement of Financial Position at December 31,

2005 and Statement of Operations for the year ended December 31, 2005:

(dollar amounts in millions)

Additions to property, plant and equipment, gross $ 33

Additions to accumulated depreciation $ (33)

Additions to property, plant and equipment, net $ —

Asset retirement obligations $ 66

Cumulative effect of change in accounting principle, gross $ 66

Cumulative effect of change in accounting principle, net of tax $ 57

The adoption of FIN 47 reduced 2005 net earnings by $57 million, or $.20 per share.