Kodak 2006 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

0

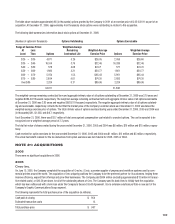

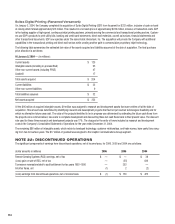

Upon closing of an acquisition, the Company estimates the fair values of assets and liabilities acquired in order to consolidate the acquired balance

sheet. The following table summarizes the estimated fair value of the assets acquired and liabilities assumed at the date of acquisition and represents

the final allocation of the purchase price.

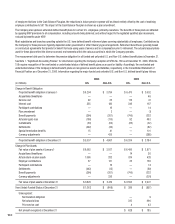

At June 15, 2005 — (in millions):

Current assets

$ 352

Intangible assets (including in-process R&D) 292

Other non-current assets (including PP&E) 180

Goodwill 445

Total assets acquired $ 1,269

Current liabilities $ 241

Non-current liabilities 61

Total liabilities assumed $ 302

Net assets acquired $ 967

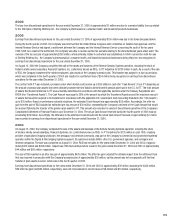

Of the $292 million of acquired intangible assets, approximately $36 million was assigned to in-process research and development assets that were

written off at the date of acquisition. Approximately $48 million was initially assigned to in-process research and development assets during the

second quarter of 2005, which was offset by a $12 million adjustment during the third quarter of 2005 due to a change in the third party valuation.

These amounts were determined by identifying research and development projects that had not yet reached technological feasibility and for which

no alternative future use existed. The value of the projects identified to be in progress was determined by estimating the future cash flows from the

projects once commercialized, less costs to complete development and discounting these net cash flows back to their present value. The discount rate

used for these research and development projects was 23%. The charges for the write-off were included as research and development costs in the

Company’s Consolidated Statement of Operations for the year ended December 31, 2005.

The remaining $256 million of intangible assets, which relate to developed technology, trademarks and customer relationships, have useful lives rang-

ing from six to eight years. The $445 million of goodwill is assigned to the Company’s Graphic Communications Group segment.

As of the acquisition date, management began to assess and formulate restructuring plans at Creo. As of June 30, 2006, management has completed

its assessment and approved actions on these plans. Accordingly, the Company recorded a related liability of approximately $38 million. This liability

is included in the current liabilities amount reported above and represents restructuring charges related to Creo net assets acquired. Refer to Note 16,

“Restructuring Costs and Other,” for further discussion of these restructuring charges.

Kodak Polychrome Graphics

Through April 1, 2005, the Company held a 50% interest in Kodak Polychrome Graphics (KPG). This joint venture between the Company and Sun

Chemical Corporation was accounted for using the equity method of accounting. Summarized unaudited income statement information for KPG for the

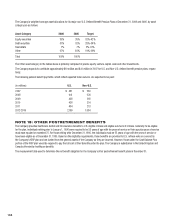

three months ended March 31, 2005 is as follows:

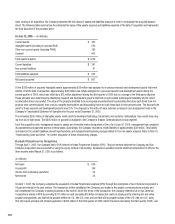

(in millions):

Net sales $ 439

Gross profit 149

Income from continuing operations 34

Net income 34

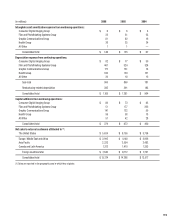

On April 1, 2005, the Company completed its acquisition of Kodak Polychrome Graphics (KPG) through the redemption of Sun Chemical Corporation’s

50 percent interest in the joint venture. The transaction further established the Company as a leader in the graphic communications industry and

will complement the Company’s existing business in this market. Under the terms of the transaction, the Company redeemed all of Sun Chemical

Corporation’s shares in KPG by providing $317 million in cash (excluding $8 million in transaction costs) at closing and by entering into two notes

payable arrangements, one that will be payable within the U.S. (the U.S. note) and one that will be payable outside of the U.S. (the non-U.S. note),

that will require principal and interest payments of $200 million in the third quarter of 2006 (which has been paid during the third quarter 2006), and