Kodak 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On May 5, 2006, Moody’s placed the Company’s ratings on review for possible downgrade. The review was prompted by the announcement to explore

strategic alternatives for the Health Group, declining Health Group revenue and earnings, a Consumer Digital Group revenue decline, and increased

operating loss for the quarter ended March 31, 2006.

On January 10, 2007, Moody’s stated that they will be continuing their review for possible downgrade. They will focus on the sale of the Health Group

(announced on January 10, 2007) and the Company’s fundamental operating performance. They expect to conclude their review concurrent with the

closing of the Health Group sale.

On August 2, 2006, S&P placed its ratings on the Company on CreditWatch with negative implications reflecting the Company’s currently weak

profitability and S&P’s concern that the rapid decline of the traditional business will not be offset by the slower than expected revenue growth in the

Company’s digital business. Resolution of the CreditWatch listing will include S&P’s updated assessment of the Company’s near- and intermediate-

term profit and cash flow potential in light of the difficult operating environment, competition and slower than expected digital sales growth.

On January 10, 2007, S&P stated that they will keep the Company on credit watch with negative implications. They have concerns that the anticipated

debt reduction associated with the sale of the Health Group (announced on January 10, 2007) will not fully offset their view of a negative shift in the

Company’s business portfolio.

The Company is in compliance with all covenants or other requirements set forth in its credit agreements and indentures. Further, the Company does

not have any rating downgrade triggers that would accelerate the maturity dates of its debt. However, the Company could be required to increase the

dollar amount of its letters of credit or provide other financial support up to an additional $73 million at the current credit ratings. As of the filing date

of this Form 10-K, the Company has not been requested to materially increase its letters of credit or other financial support. However, at the current

Senior Unsecured Rating of B2 by Moody’s and B by S&P, Convertible Securities holders may, at their option, convert their Convertible Securities to

common stock. Further downgrades in the Company’s credit rating or disruptions in the capital markets could impact borrowing costs and the nature

of its funding alternatives. However, further downgrades will not impact borrowing costs under the Company’s $2.7 billion Secured Credit Facilities.

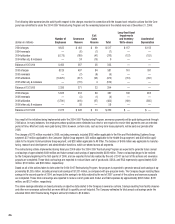

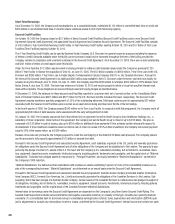

Contractual Obligations

As of December 31, 2006, the impact that our contractual obligations are expected to have on the Company’s liquidity and cash flow in future periods

is as follows:

(in millions) Total 2007 2008 2009 2010 2011 2012+

Long-term debt (1) $ 2,731 $ 17 $ 273 $ 34 $ 36 $ 39 $ 2,332

Operating lease obligations 636 159 131 103 79 63 101

Purchase obligations (2) 1,664 792 393 169 103 68 139

Total (3) (4) $ 5,031 $ 968 $ 797 $ 306 $ 218 $ 170 $ 2,572

(1) Represents maturities of the Company’s long-term debt obligations as shown on the Consolidated Statement of Financial Position. See Note 9, “Short-Term Bor-

rowings and Long-Term Debt.”

(2) Purchase obligations include agreements related to supplies, production and administrative services, as well as marketing and advertising, that are enforceable

and legally binding on the Company and that specify all significant terms, including: fixed or minimum quantities to be purchased; fixed, minimum or variable price

provisions; and the approximate timing of the transaction. Purchase obligations exclude agreements that are cancelable without penalty. The terms of these agree-

ments cover the next two to sixteen years. See Note 11, “Commitments and Contingencies.”

(3) Funding requirements for the Company’s major defined benefit retirement plans and other postretirement benefit plans have not been determined, therefore, they

have not been included. In 2006, the Company made contributions to its major defined benefit retirement plans and other postretirement benefit plans of $187

million ($56 million relating to its U.S. defined benefit plans) and $224 million ($220 million relating to its U.S. other postretirement benefits plan), respectively.

The Company expects to contribute approximately $19 million and $269 million, respectively, to its U.S. defined benefit plans and other postretirement benefit

plans in 2007.

(4) Because their future cash outflows are uncertain, the other long-term liabilities presented in Note 10: Other Long-Term Liabilities are excluded from this table.