Kodak 2006 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

AUDIT COMMITTEE FINANCIAL QUALIFICATIONS

The Board has determined that all members of its Audit Committee (William H. Hernandez, Durk I. Jager, Debra L. Lee and Delano E. Lewis) are

independent and are fi nancially literate as required by the NYSE, and that William H. Hernandez and Durk I. Jager possess the qualifi cations of an Audit

Committee Financial Expert, as defi ned by SEC rules, and have accounting or related fi nancial management expertise, as required by the NYSE.

REVIEW, APPROVAL OR RATIFICATION OF TRANSACTIONS

WITH RELATED PERSONS

In February 2007, our Board, based on the recommendation of the Governance Committee, adopted written policies and procedures relating to

approval or ratifi cation of “interested transactions” with “related parties.” Under these policies and procedures, which are posted on our website at

www.kodak.com/go/governance, our Governance Committee is to review the material facts of all interested transactions that require the Gover-

nance Committee’s approval. The Governance Committee will approve or disapprove of the interested transactions, subject to certain exceptions, by

taking into account, among other factors it deems appropriate, whether the interested transaction is on terms no less favorable than terms generally

available to an unaffi liated third-party under the same or similar circumstances and the extent of the related person’s interest in the transaction. No

director may participate in any discussion or approval of an interested transaction for which he or she is a related party. If an interested transaction

will be ongoing, the Governance Committee may establish guidelines for our management to follow in its ongoing dealings with the related party and

then at least annually must review and assess ongoing relationships with the related party.

Under the policies and procedures, an “interested transaction” is any transaction, arrangement or relationship or series of similar transactions,

arrangements or relationships (including any indebtedness or guarantee of indebtedness) in which the aggregate amount involved will or may be ex-

pected to exceed $100,000 in any calendar year, the Company is a participant, and any related party has or will have a direct or indirect interest (other

than solely as a result of being a director or a less than 10% benefi cial owner of another entity). A “related party” is any person who is or was since

the beginning of the last fi scal year for which we have fi led a Form 10-K and proxy statement, an executive offi cer, director or nominee for election as

a director (even if they presently do not serve in that role), any greater than 5% benefi cial owner of the Company’s common stock, or any immediate

family member of any of the foregoing. Immediate family member includes a person’s spouse, parents, stepparents, children, stepchildren, siblings,

mothers- and fathers-in-law, sons- and daughters-in-law, brothers- and sisters-in-law, and anyone residing in such person’s home (other than a ten-

ant or employee).

The Committee has reviewed and pre-approved certain types of interested transactions described below. In addition, our Board has delegated to the

chair of the Governance Committee the authority to pre-approve or ratify (as applicable) any interested transaction with a related party in which the

aggregate amount involved is expected to be less than $500,000. Pre-approved interested transactions include:

• Employment of executive offi cers either if the related compensation is required to be reported in our proxy statement or if the executive offi cer

is not an immediate family member of another executive offi cer or a director of our Company and the related compensation would be reported

in our proxy statement if the executive offi cer was a “named executive offi cer” and our Compensation Committee approved (or recommended

that the Board approve) such compensation.

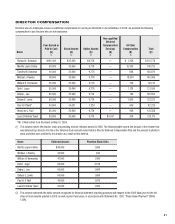

• Any compensation paid to a director if the compensation is required to be reported in our proxy statement.

• Any transaction with another company with which a related person’s only relationship is as an employee (other than an executive offi cer),

director or benefi cial owner of less than 10% of that company’s shares, if the aggregate amount involved does not exceed the greater of

$1,000,000 or 2% of that company’s total annual revenues.

• Any charitable contribution, grant or endowment by the Company to a charitable organization, foundation or university with which a related

person’s only relationship is as an employee (other than an executive offi cer) or a director, if the aggregate amount involved does not exceed

the greater of $1,000,000 or 2% of the charitable organization’s total annual receipts.

• Any transaction where the related person’s interest arises solely from the ownership of the Company’s common stock and all holders of our

common stock received the same benefi t on a pro rata basis (e.g., dividends).

• Any transaction involving a related party where the rates or charges involved are determined by competitive bids.

• Any transaction with a related party involving the rendering of services as a common or contract carrier, or public utility, at rates or charges

fi xed in conformity with law or governmental authority.

• Any transaction with a related party involving services as a bank depositary of funds, transfer agent, registrar, trustee under a trust indenture

or similar services.

Using these policies and procedures, the Governance Committee reviewed two interested transactions with related parties that occurred during 2006.

In both of these cases, the Committee determined that the related person did not have a material interest in the transaction and, therefore, there are

no related party transactions that need to be disclosed in this Proxy Statement under the relevant SEC rules.