Kodak 2006 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

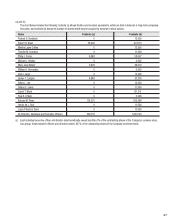

is no maximum opportunity under the EXCEL plan, although the maximum award payable to any Named Executive Offi cer under the plan in 2006 is the

lesser of 10% of the corporate funding pool, 500% of his or her annual base salary as of December 31, 2005, or $5 million. The highest percentage

shown in the performance matrix would require stretch performance.

Our CEO’s and CFO’s EXCEL awards are generally based on the achievement of the Company’s two primary performance metrics, but their actual

bonus under the EXCEL plan may be adjusted downward by the Committee based on performance of the baseline metrics described above. The bonus

opportunity for other Named Executive Offi cers is also initially based on the achievement of the Company’s two primary performance metrics and the

size of the corporate funding pool. However, the actual bonus earned is determined based on the achievement of business unit goals, where applica-

ble, and upon achievement of individual leadership excellence and diversity goals. After the corporate funding pool level has been determined, our CEO

reviews the individual performance of each business unit in comparison to the business unit’s annual goals and allocates a portion of the corporate

funding pool to each business unit. Based on this assessment, our CEO may adjust the payout percentage for a Named Executive Offi cer who heads a

business unit. A Named Executive Offi cer heading a business unit typically receives the same EXCEL award percentage as has been allocated to their

business unit. However, our CEO may propose to adjust this based on an executive’s leadership excellence and performance under the Company’s

diversity and inclusion strategy. After completing this review, our CEO recommends bonus payouts for all other Named Executive Offi cers and other

EXCEL participants to the Committee. Using our CEO’s recommendations as a starting point, the Committee reviews and authorizes bonuses payable

to each of our Named Executive Offi cers.

Bonuses Awarded for 2006 Performance

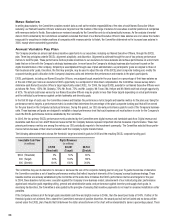

In each of the past three years of our Company’s transformation, we have continued to make signifi cant progress against the goals we set. In 2006,

we achieved $592 million investable cash fl ow versus our target goal of $500 million. In addition, our performance against each of the 2006 baseline

metrics described above was outstanding:

• Drive SG&A Model. We made signifi cant progress on our cost reduction objectives, reaching an SG&A (Selling, General & Administrative

Expenses) rate of 18% of sales. This has resulted in a reduction of $279 million year-over-year, and was slightly below our goal of 17.7%.

• Inventory Reductions. We exceeded the inventory reduction goal by 27%.

• Implement Go-to-Market Strategies Across Consumer Digital Imaging Group and Film Products Group. We reduced the number of

retailers and countries we served directly around the world as we redesigned our model for better productivity.

• Restructure Health Group. We successfully concluded the study of strategic alternatives for our Health Group with the signing of an agree-

ment to divest the business to Onex Healthcare Holdings, Inc. for up to $2.55 billion.

• Deliver Graphic Communication Group synergies. We integrated fi ve subsidiaries into Kodak and built a broad portfolio of products while

taking the opportunity to leverage infrastructure by over-achieving our target of $85M.

• Advance the Traditional Restructuring Plan. As measured by the Company’s manufacturing and footprint reductions, we accelerated 2007

goals into 2006.

Despite these achievements, we did not achieve our threshold digital revenue goal of $7,765 million. Actual digital revenue for 2006 was $7,687 mil-

lion, $78 million below the threshold. This resulted primarily from our decision to give priority to digital margin growth over revenue growth in our digi-

tal capture business, as we fi rst announced to investors on January 30, 2006. As 2006 progressed, we saw more aggressive digital camera pricing,

particularly at the lower price points, than we had anticipated. The Company declined to pursue some consumer digital revenue opportunities where

prices were too low or where we did not yet have a product with an appropriate cost basis to compete. The overall revenue impact of these strategic

participation decisions on digital cameras was greater than $250 million.

As a result, the Company did not achieve the threshold EXCEL performance metric for digital revenue. Given, however, the performance against the

baseline metrics and the Committee’s concurrence that the digital margin decisions were correct decisions to make in the turnaround of consumer

digital earnings, the Committee exercised positive discretion and set the funding of the corporate award pool at 81% of target. In arriving at 81%

funding of the corporate pool, the Committee considered the revenue that could have been generated had we chosen not to execute a margin growth

strategy on digital cameras.

To ensure that all plan awards are fully deductible for U.S. federal income tax purposes, our EXCEL plan states that any positive discretion exercised

by the Committee regarding the plan’s performance targets cannot affect the payment of awards to our “covered employees”, as defi ned in Section

162(m) of the Internal Revenue Code. As a consequence, those employees did not receive a bonus under EXCEL for 2006. However, based on the

Company’s achievements under its 2006 baseline metrics as described above, the Committee granted those employees discretionary performance

bonuses in February 2007. These bonuses are no greater than bonuses received by other participants under EXCEL based on the funding of the

corporate award pool at 81% of target and any additional increase in the payout percentage due to achievement of business unit goals. Unless the

Committee provided otherwise, 50% of the bonus award was paid in cash and the remaining 50% was paid in restricted stock that vests over a three-

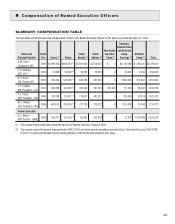

year period subject to an executive’s continued employment. The cash amount of these bonuses awarded to Named Executive Officers for performance

in 2006 appear in the Summary Compensation Table on page 43 of this Proxy Statement.