Kodak 2006 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

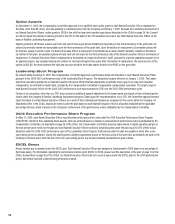

ADDITIONAL EXECUTIVE COMPENSATION PRINCIPLES

Use of Tally Sheets

In 2006, the Committee reviewed all components of our Named Executive Offi cers’ compensation using various tools, including tally sheets prepared

by the Committee’s independent consultant. The tally sheets provided a comprehensive view of each Named Executive Offi cer’s compensation in a

three-part analysis. First, the tally sheets provided an estimate of projected 2006 compensation, including total cash compensation, the total value of

annual long-term equity incentive awards and the value of benefi ts and perquisites received by each Named Executive Offi cer. Second, the tally sheets

projected the value of stock awards held by each Named Executive Offi cer at three different assumed stock prices ($21, $28 and $40) as determined

by the Committee’s independent compensation consultant. Third, the tally sheets provided a summary of severance benefi ts as of December 31, 2006

under various leaving scenarios. The Committee conducted this review in order to holistically assess our Named Executive Offi cers’ total compensa-

tion and, in the case of severance and change-in-control scenarios, the potential payouts.

Policy on Qualifying Compensation

When designing all aspects of compensation, the Company considers the impact of tax treatment, but the primary factor infl uencing program design

is the support of business objectives. Annual bonuses payable under our EXCEL plan are designed to satisfy the requirements for performance-

based compensation as defi ned in Section 162(m) of the Internal Revenue Code. Stock options and Leadership Stock are also intended to satisfy the

requirements for performance-based compensation as defi ned in Section 162(m). Awards earned under the Company’s 2006 Executive Performance

Share Program do not qualify as performance-based compensation within the meaning of Section 162(m) and therefore may not be fully deductible

by the Company. Additionally, in modifying the performance criteria for the 2005-2006 Leadership Stock Program, the Committee recognized that any

awards earned under this plan would no longer satisfy the requirements for performance-based compensation as defi ned in Section 162(m) and would

not be fully deductible. However, the Committee determined that the loss of IRS Code Section 162(m) deductibility was not a decisive factor for either

plan because Kodak was not expected to have a signifi cant tax liability in 2006.

Given the fact that bonuses for 2006 performance were awarded to Named Executive Offi cers in lieu of the EXCEL plan, these bonuses would not

qualify as performance-based compensation within the meaning of Section 162(m).

Share Ownership Program

In order to link the interests of our executives with those of our shareholders, the Company has a share ownership program. All executive offi cers

are required to retain a specifi ed percentage of shares attributable to stock option exercises or the vesting or earn-out of full value shares (such as

restricted shares or Leadership Stock) until they attain specifi ed ownership levels, which are expressed below as a multiple of base salary. To the

extent that an executive has not satisfi ed his or her share ownership level, any restricted stock units awarded under our Leadership Stock program or

EXCEL bonus paid in shares above an executive’s target must be retained by the executive. Restricted stock, restricted stock units, any shares held in

the executive’s account under Kodak’s Employee Stock Ownership Plan or Savings & Investment Plan, and any “phantom stock” selected by an execu-

tive as an investment option in the Executive Deferred Compensation Plan count toward meeting the executive’s share ownership requirement.

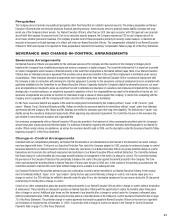

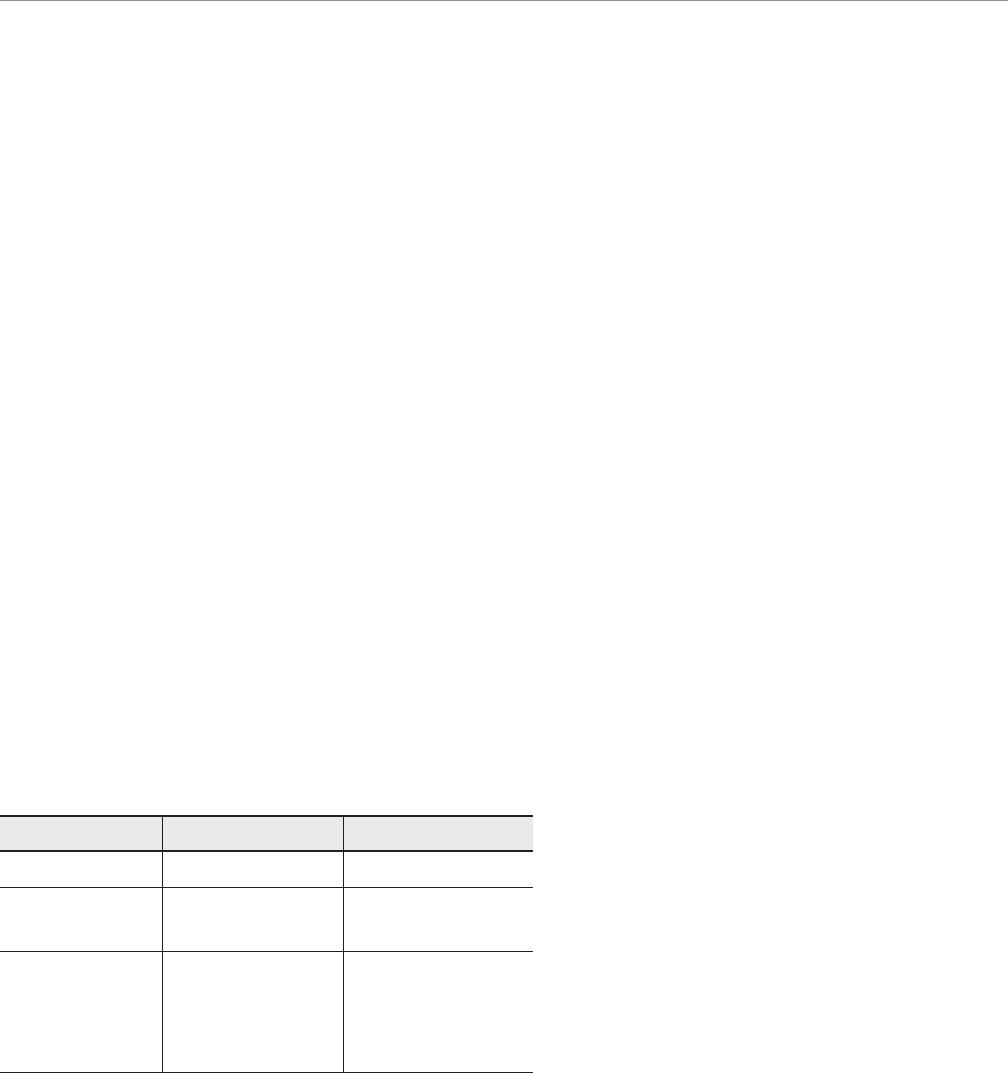

Our Named Executive Offi cers have the following share ownership requirements:

Level Salary Multiple Retention Ratio

Mr. Perez 5x 100%

Mr. Sklarsky

Mr. Brust 3x 75%

Mr. Langley

Mr. Faraci 2x 75%

Ms. Hellyar

Mr. Meek