Kodak 2006 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

EMPLOYMENT CONTRACTS AND ARRANGEMENTS

Antonio M. Perez

The Company employed Mr. Perez as President and COO under an offer letter dated March 3, 2003. On May 10, 2005, in connection with Mr. Perez’s

election as Chief Executive Offi cer and Chairman of the Board, the terms of his employment were amended. In addition to the compensation described

elsewhere in this Proxy Statement, under his offer letter, as amended, Mr. Perez is eligible to receive a base salary of $1,100,000 and a target award

under the EXCEL plan of 155% of his base salary. Mr. Perez is eligible to participate in all incentive compensation, retirement, supplemental retirement

and deferred compensation plans, policies and arrangements that are provided to other senior executives of the Company. In addition, Mr. Perez is

eligible to receive an enhanced pension benefi t, which is described on page 60 of this Proxy Statement. Mr. Perez’s letter agreement was amended on

February 27, 2007 to provide that his enhanced pension benefi t will vest when he turns age 65, consistent with the Company’s mandatory retirement

policy for our corporate offi cers. The amended letter agreement also provides that if Mr. Perez is terminated before June 1, 2007, he will receive his

enhanced pension benefi t in a monthly annuity, with payments beginning the fi rst month following the six-month anniversary of Mr. Perez’s termina-

tion and continuing until the end of 2007, with the remainder paid in a lump sum on or after January 1, 2008. However, if Mr. Perez is terminated after

January 1, 2008, he will receive his enhanced pension benefi t in a lump sum following the six-month anniversary of his termination. The term of Mr.

Perez’s employment is indefi nite, but he will be eligible to receive certain severance benefi ts in connection with termination of his employment under

various circumstances. For information regarding his potential severance payments and benefi ts, please read the narrative descriptions and tables

below, beginning on page 63 of this Proxy Statement.

Frank S. Sklarsky

The Company employed Mr. Sklarsky as Chief Financial Offi cer under an offer letter dated September 19, 2006, which was further amended on

September 26, 2006. In addition to the compensation described elsewhere in this Proxy Statement, under his offer letter, as amended, Mr. Sklarsky is

eligible to receive a base salary of $600,000 and a target award under the EXCEL plan of 75% of his base salary. For the 2006 plan year, Mr. Sklarsky

was eligible to receive a cash award equal to $75,000, less any amount actually received under the EXCEL plan for the 2006 performance period. Mr.

Sklarsky is eligible to participate in all incentive compensation, retirement, supplemental retirement and deferred compensation plans, policies and

arrangements that are provided to other senior executives of the Company. In addition, Mr. Sklarsky is eligible to receive an enhanced retirement ben-

efi t, which is described under the Pension Benefi ts Table on page 58 of this Proxy Statement. The term of Mr. Sklarsky’s employment is indefi nite, but

he will be eligible to receive certain severance benefi ts in connection with termination of his employment under various circumstances. For information

regarding his potential severance payments and benefi ts, please read the narrative descriptions and tables below, beginning on page 63 of this Proxy

Statement.

Robert H. Brust

On January 31, 2007, Mr. Brust separated from service with the Company in accordance with his planned retirement on February 1, 2007. The Com-

pany employed Mr. Brust under an offer letter dated December 20, 1999, that was most recently amended on March 7, 2005, when the Company and

Mr. Brust entered into a retention agreement to induce Mr. Brust to remain employed with the Company at least through January 3, 2007.

Prior to his retirement in 2007, under his retention agreement, as amended, Mr. Brust was eligible to receive a monthly cash retention benefi t of

$15,000 for each full month of continuous and active employment with the Company during 2006, up to a maximum retention payment of $180,000,

subject to proration in certain limited circumstances. Pursuant to his offer letter, Mr. Brust was also eligible to an enhanced retirement benefi t, which

is described under the Pension Benefi ts Table on page 58 of this Proxy Statement. Mr. Brust’s retention letter also provided for a special severance

benefi t. For information regarding the severance payments and benefi ts that may have been payable in connection with termination of his employment

in 2006 under various circumstances, please read the narrative descriptions and tables below, beginning on page 63 of this Proxy Statement.

In connection with Mr. Brust’s commencement of employment under his December 20, 1999 offer letter, the Company agreed to pay Mr. Brust

$3,000,000 because he forfeited 75,000 restricted shares of his former employer’s common stock as a result of accepting employment with the

Company. The arrangement was structured as a loan, the balance of which would be forgiven over time, to incent Mr. Brust to continue his employ-

ment with the Company and provide him favorable tax treatment. The loan, which was evidenced by a promissory note dated January 6, 2000, bore

interest at a rate of 6.21% per annum, the applicable federal rate for mid-term loans, compounded annually, in effect for January 2000. A portion of

the principal and all of the accrued interest on the loan was forgiven on each of the fi rst seven anniversaries of the loan. Mr. Brust was not entitled

to forgiveness on any anniversary date if he voluntarily terminated his employment or was terminated for cause on or before the anniversary date.

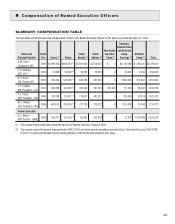

As shown in the Summary Compensation Table above, in 2006, the Company forgave a portion of the principal and interest due under this loan. The

remaining balance of the loan, $500,000, and all accrued interest was forgiven on January 6, 2007, under the arrangement’s terms.