Kodak 2006 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

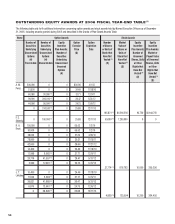

Individual Equity Awards

In connection with his appointment as CFO, Mr. Sklarsky received a grant of 50,000 shares of restricted common stock under the Company’s 2005

Omnibus Long-Term Compensation Plan on October 30, 2006. The restrictions on one-half of these shares lapse on each of the second and fourth

anniversaries of the date of grant. During the restriction period, Mr. Sklarsky is eligible to receive dividends on the restricted shares at the same rate

as dividends are paid on shares of common stock.

Ms. Hellyar received a retention grant of 15,000 shares of restricted common stock under the Company’s 2005 Omnibus Long-Term Compensation

Plan on July 17, 2006. The restrictions on one-half of these shares lapse on each of the third and fifth anniversaries of the date of grant. During the

restriction period, Ms. Hellyar is entitled to receive dividends on the restricted shares at the same rate as dividends are paid on shares of common

stock.

In 2006, the Committee granted Mr. Faraci a special option grant of 25,000 shares in recognition of his substantial contributions in connection with

the completion of a significant transaction. These options have a seven year term and vest in three equal annual installments beginning on the first

anniversary of the grant date.

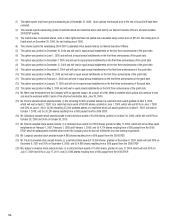

Individual Non-Equity Incentive Bonus Plans

Under the terms of his offer letter, Mr. Langley participated in an individual bonus plan to reward him for achievement of certain performance goals in

the Company’s Graphic Communications Group. Mr. Langley was eligible to receive cash payments conditioned on the achievement of performance

targets during three consecutive one-year performance periods beginning on January 1, 2004. The performance metrics selected for the 2006 perfor-

mance period included: 1) integration of all Graphic Communication Group acquisitions, 2) the transition of leadership for the Graphic Communications

Group, and 3) the achievement of financial targets. The financial targets were digital revenue and total SG&A, which is a metric designed to measure

cost reduction. The performance goals established for the Graphic Communications Group to receive the maximum payout under the plan were digital

revenue of $3.16 billion and total SG&A of 19.6%.

Mr. Meek also participated in an individual bonus and retention plan designed to reward him for successfully restructuring the Global Manufacturing

and Logistics division of the Company. The plan was designed to have a three-year performance period beginning in 2005. The plan’s sole perfor-

mance measure established by the Compensation Committee was the aggregate controllable cost reduction of Global Manufacturing and Logistics for

the three-year period. In order to receive any payout under the plan, Mr. Meek was required to achieve an aggregate controllable cost reduction for

Global Manufacturing and Logistics of $580 million. In order to receive the maximum amount payable under the plan, an aggregate controllable cost

reduction of $830 million was required. The maximum amount Mr. Meek was eligible to receive under the plan was $1,395,000. Any amount earned

under the plan was payable in a single, lump-sum payment in shares of our common stock in 2008, no later than March 31, 2008, provided Mr. Meek

remained employed with the Company through this date or was terminated by the Company without cause prior to this date. As a result of Mr. Meek’s

termination of employment without cause in 2006, he earned the maximum award under the plan as reflected in the Summary Compensation Table on

page 43 of this Proxy Statement. This amount, which is to be paid in shares, is not payable until 2008.