Kodak 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

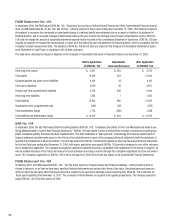

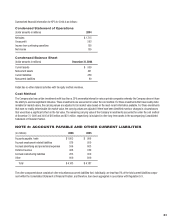

FASB Statement No. 158

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans (an amend-

ment of FASB Statements No. 87, 88, 106, and 132(R)),” which is effective in fiscal years ending after December 15, 2006. This Statement requires

an employer to recognize the overfunded or underfunded status of a defined benefit postretirement plan as an asset or liability in its statement of

financial position, and to recognize changes in that funded status in the year in which the changes occur through comprehensive income. SFAS No.

158 does not change the amount of actuarially determined expense that is recorded in the Consolidated Statement of Operations. SFAS No. 158 also

requires an employer to measure the funded status of a plan as of the date of its year-end statement of financial position, which is consistent with the

Company’s present measurement date. The adoption of SFAS No. 158 did not have any impact on the Company’s Consolidated Statement of Opera-

tions, Statement of Cash Flows, or compliance with its debt covenants.

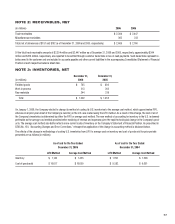

The table below discloses the impact of adoption on the Company’s Consolidated Statement of Financial Position as of December 31, 2006.

Before Application Adjustments After Application

of SFAS No. 158 Increase/(Decrease) of SFAS No. 158

Other long-term assets $ 3,421 $ 304 $ 3,725

Total assets 14,016 304 14,320

Accounts payable and other current liabilities 4,100 43 4,143

Total current liabilities 4,928 43 4,971

Pension and other postretirement liabilities 3,318 646 3,964

Other long-term liabilities 1,282 1 1,283

Total liabilities 12,242 690 12,932

Accumulated other comprehensive loss (249) 386 (635)

Total shareholders’ equity 1,774 (386) 1,388

Total liabilities and shareholders’ equity $ 14,016 $ 304 $ 14,320

SAB No. 108

In September 2006, the SEC staff issued Staff Accounting Bulletin (SAB) No. 108, “Considering the Effects of Prior Year Misstatements when Quan-

tifying Misstatements in Current Year Financial Statements.” SAB No. 108 was issued in order to eliminate the diversity of practice surrounding how

public companies quantify financial statement misstatements. This SAB establishes a “dual approach” methodology that requires quantification of

financial statement misstatements based on the effects of the misstatements on each of the company’s financial statements (both the statement of

operations and statement of financial position). The SEC has stated that SAB No. 108 should be applied no later than the annual financial statements

for the first fiscal year ending after November 15, 2006, with earlier application encouraged.SAB No. 108 permits a company to elect either retrospec-

tive or prospective application. The Company’s prospective application requires recording a cumulative effect adjustment in the period of adoption, as

well as detailed disclosure of the nature and amount of each individual error being corrected through the cumulative adjustment and how and when it

arose. The Company’s application of SAB No. 108 in the fourth quarter of 2006 did not have any impact on its Consolidated Financial Statements.

FASB Statement No. 159

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities,” which permits entities to

choose to measure, on an item-by-item basis, specified financial instruments and certain other items at fair value. Unrealized gains and losses on

items for which the fair value option has been elected are required to be reported in earnings at each reporting date. SFAS No. 159 is effective for

fiscal years beginning after November 15, 2007. The provisions of this statement are required to be applied prospectively. The Company expects to

adopt SFAS No. 159 in the first quarter of 2008.