Kodak 2006 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

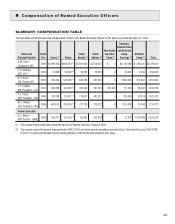

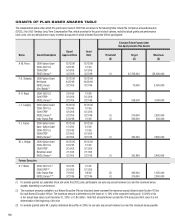

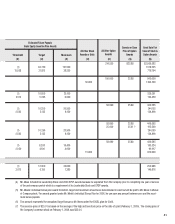

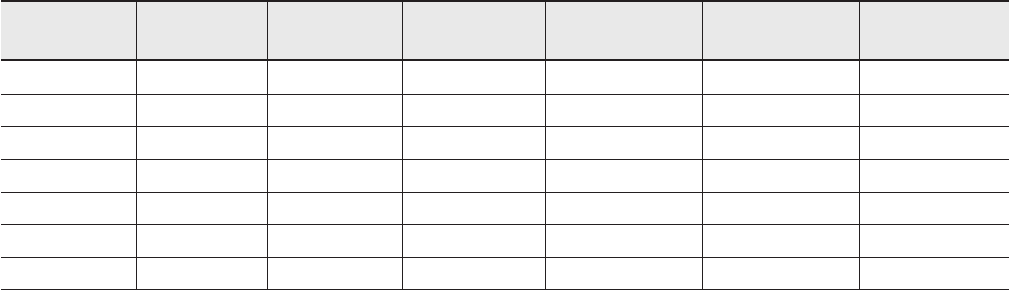

(6) The table below shows the components of the All Other Compensation column, which include a Company match for each Named Executive Offi-

cer’s 401(k) plan contributions, tax gross-ups, perquisites, loan forgiveness to Mr. Brust and certain severance payments payable to Mr. Meek.

Perquisites for 2006 are valued at their incremental cost to the Company. We calculate the incremental cost to the Company of any personal use

of the corporate aircraft based on the direct operating costs to the Company, including fuel costs, FBO handling fees, vendor maintenance costs,

catering, travel fees and other miscellaneous costs. Fixed costs that do not change based on usage, such as salaries and benefits of crew, train-

ing of crew, taxes, and general maintenance and repairs, are excluded.

Total All Other

Name 401(k) Match Tax Gross-ups Perquisites Loan Forgiveness Severance Costs Compensation

A. M. Perez $ $ $269,020 (b) $269,020

F. S. Sklarsky 1,856 (a) 683 2,539

R. H. Brust 6,300 1,857 (a) 42,925 (c) $ 561,000 (h) 612,082

J. T. Langley 6,300 52,100 (d) 58,400

P. J. Faraci 6,300 36,314 (e) 42,614

M. J. Hellyar 10,349 (f) 10,349

D. T. Meek 511 (a) 11,068 (g) $1,564,505 (i) 1,576,084

(a) These amounts represent tax reimbursements on income imputed to the Named Executive Officers.

(b) For Mr. Perez, this amount includes $236,128, the incremental cost to the Company of Mr. Perez’s use of the corporate aircraft for personal

purposes. Due to our executive security program, the Company requires Mr. Perez to use Company aircraft for all travel, whether personal or

business. The amount in this column also includes Company-paid expenses for family members to accompany Mr. Perez at two events that

the Company sponsors for promotional purposes, personal use of the Company’s driver services, executive protection, home security sys-

tems and services, personal IT support, umbrella insurance coverage, an executive physical, and financial planning. In addition, Mr. Perez’s

family members occasionally accompanied him on business trips and on trips when he uses the corporate aircraft for personal purposes, at

no additional cost to the Company.

(c) For Mr. Brust, this amount includes $28,033, the incremental cost to the Company of Mr. Brust’s use of the corporate aircraft for personal

purposes. The amount in this column also includes Company-paid personal use of the Company’s driver services, tickets for Mr. Brust and

family members for entertainment, home security systems and services, personal IT support, photographic equipment, umbrella insurance

coverage, a retirement gift, and an executive physical. In addition, Mrs. Brust occasionally accompanied Mr. Brust on business trips and on

trips when he uses the corporate aircraft for personal purposes, at no additional cost to the Company.

(d) For Mr. Langley, this amount includes Company-paid personal use of the corporate aircraft, personal use of the Company’s driver services,

airfare and other travel costs for personal trips for Mr. and Mrs. Langley, home security systems and services, umbrella insurance coverage,

and expenses for Mrs. Langley to accompany Mr. Langley at an event the Company sponsors for promotional purposes. In addition, Mrs.

Langley occasionally accompanied Mr. Langley on business trips and on trips when he used the corporate aircraft for personal purposes, at

no additional cost to the Company.

(e) For Mr. Faraci, this amount includes $28,694, the incremental cost to the Company of Mr. Faraci’s use of the corporate aircraft for personal

purposes. The amount in this column also includes Company-paid personal use of the Company’s driver services, home security systems

and services, umbrella insurance coverage, and an executive physical. In addition, Mrs. Faraci accompanied Mr. Faraci on the occasion

when he used the corporate aircraft for personal purposes, at no additional cost to the Company.

(f) For Ms. Hellyar, this amount includes Company-paid personal use of the Company’s driver services, home security systems and services,

umbrella insurance coverage, an executive physical and financial planning.

(g) For Mr. Meek, this amount includes tickets for Mr. Meek and family members for entertainment, home security systems and services, photo-

graphic equipment, umbrella insurance coverage, a retirement gift, and financial planning.

(h) For Mr. Brust, this amount represents $561,000 of principal and interest forgiven in connection with the loan from the Company described

on page 47 of this Proxy Statement.

(i) For Mr. Meek, the amount represents $1,395,000 accrued in 2006 for his performance award payable in Kodak shares in 2008 as described

on page 53 of this Proxy Statement, $107,197 of accrued vacation paid to Mr. Meek upon his retirement and $62,308 of severance paid

pursuant to the severance allowance described on page 66 of this Proxy Statement.