Kodak 2006 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65

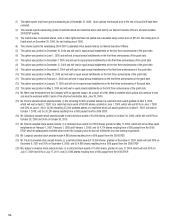

Termination for Disability. In the event Mr. Perez’s employment is terminated as a result of disability pursuant to the Company’s long-term disability

plan, he will be eligible to receive (less applicable withholding):

• applicable benefi ts under the Kodak long-term disability plan;

• a pro rata annual target award under the EXCEL plan payable in a single installment on the normal payment date when awards are paid to

other executives;

• any earned, but unpaid, EXCEL award for the prior performance year;

• waiver of the forfeiture provisions on any restricted stock award (other than unvested restricted shares granted at the time of his employment)

outstanding for at least one year at the time of his termination;

• waiver of the forfeiture provisions on a pro rata portion of the unvested restricted shares granted at the time of his employment;

• continued vesting of any unvested option award granted prior to 2005 outstanding for at least one year at the time of termination of employ-

ment and such options will remain exercisable for the remainder of the term;

• immediate vesting of any unvested option award (granted after 2004) outstanding and such options will remain exercisable for three years

following termination;

• services under Kodak’s fi nancial counseling program for the two-year period following his termination of employment; and

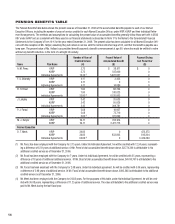

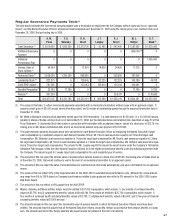

• his supplemental retirement benefi t provided under his individual agreement as set forth in the Regular Severance Payments Table on page 67.

Frank S. Sklarsky

Mr. Sklarsky will be eligible to receive certain severance benefi ts if his employment is terminated prior to October 30, 2011 due to disability or if we

terminate his employment without cause without offering him a reasonably comparable position. He will be eligible to receive a severance allowance

equal to his current annual base salary plus target EXCEL award, less applicable withholding, payable over a twelve-month period commencing on the

six-month anniversary of his last day at work. In addition to outplacement services, he will also be eligible for fully paid continued coverage under the

Kodak medical and dental plan and basic coverage under the Kodak Life Insurance Plan for four months.

As a condition to receiving severance benefi ts, Mr. Sklarsky must execute a general waiver and release in favor of the Company. He will also be

subject to the restrictive covenants under the Eastman Kodak Company Employee’s Agreement. To the extent he breaches the terms of the waiver

agreement or the Employee’s Agreement, he will forfeit the right to receive certain severance benefi ts otherwise payable in connection with termina-

tion without cause.

Robert H. Brust

Mr. Brust voluntarily separated from the Company on January 31, 2007. In connection with his separation, he did not receive any severance benefi ts.

Mr. Brust would have been eligible to receive certain severance benefi ts if his employment was terminated by the Company prior to January 3, 2007

for any reason other than cause or disability. He would have been eligible to receive a severance allowance equal to two times his current annual base

salary plus target EXCEL award, payable over a twenty-four month period commencing on the six-month anniversary of his last day at work. In addi-

tion to outplacement services, he would have also been eligible for fully paid continued coverage under the Kodak medical and dental plan and basic

coverage under the Kodak Life Insurance Plan for four months. In addition, he would have been eligible to receive his supplemental retirement benefi t

provided under his individual agreement.

As a condition to receiving severance benefi ts, Mr. Brust would have had to execute a general waiver and release in favor of the Company. He is sub-

ject to the restrictive covenants under the Eastman Kodak Company Employee’s Agreement and a two-year non-solicitation agreement with respect to

employees or customers of the Company. In the event Mr. Brust breached his waiver and release agreement or the Eastman Kodak Company’s Execu-

tive Employees’ Agreement, all severance payments that would have been paid to him would cease and he would be required to repay all severance

amounts previously paid by the Company.

James T. Langley

The Company currently has no pre-existing agreement with Mr. Langley regarding the payment of cash severance benefi ts in the event his employ-

ment with the Company is terminated. Mr. Langley did have an arrangement for cash severance payments with the Company, but this arrangement

terminated on September 12, 2006.

However, if Mr. Langley’s employment is terminated by the Company without cause or if he voluntarily terminates his employment for any reason,

then his termination will be treated as an “approved reason” with respect to any unvested stock options he holds upon termination of employment

that were granted to him earlier than one year prior to termination of employment. Upon termination of employment, Mr. Langley will be subject to the

restrictive covenants under the Eastman Kodak Company’s Executive Employee’s Agreement.