Kodak 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

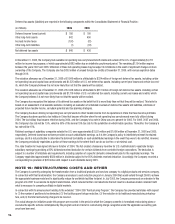

The differences between income taxes computed using the U.S. federal income tax rate and the provision (benefit) for income taxes for continuing

operations were as follows:

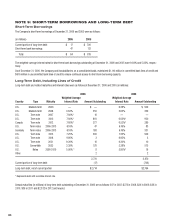

(in millions) 2006 2005 2004

Amount computed using the statutory rate $ (121) $ (280) $ (40)

Increase (reduction) in taxes resulting from:

State and other income taxes, net of federal 6 — (9)

Export sales and manufacturing credits (14) (28) (30)

Operations outside the U.S. (16) (101) (89)

Valuation allowance 393 995 (10)

Tax settlements and adjustments, including interest 16 (13) 1

Other, net (10) (18) (5)

Provision (benefit) for income taxes $ 254 $ 555 $ (182)

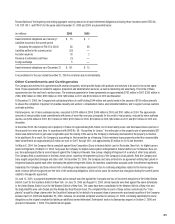

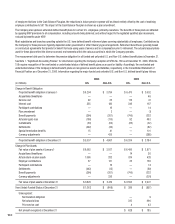

Valuation Allowance – U.S.

The Company has performed the required assessment of positive and negative evidence regarding the realization of the net deferred tax assets in

accordance with SFAS No. 109. This assessment included the evaluation of scheduled reversals of deferred tax assets and liabilities, estimates of

projected future taxable income, carryback potential and tax planning strategies.

As of December 31, 2006, the Company has a valuation allowance of $1,525 million relating to its net deferred tax assets in the U.S. of $1,767 mil-

lion. The remaining net deferred tax assets in excess of the valuation allowance of $242 million relate primarily to current year losses and certain tax

credits which the Company believes it is more likely than not that the assets will be realized. The Company continues to record a valuation allowance

on all U.S. tax benefits until an appropriate level of profitability in the U.S. is sustained or until the Company is able to generate enough taxable income

through other tax planning strategies and transactions.

As of December 31, 2005, the Company had a valuation allowance of $1,116 million relating to its net deferred tax assets in the U.S. of $1,195 million.

The valuation allowance of $1,116 million is attributable to (i) the charges totaling $961 million that were recorded in the third and fourth quarters of

2005 and (ii) a valuation allowance of $155 million recorded in a prior year for certain state tax carryforward deferred tax assets which the Company

believes it is not more likely than not that the assets will be realized. The remaining net deferred tax assets in excess of the valuation allowance of $79

million relate to certain foreign tax credit deferred tax assets relating to which the Company believes it is more likely than not that the assets will be

realized.

Valuation Allowance – Outside the U.S.

As of December 31, 2006, the Company has a valuation allowance of approximately $324 million relating to its net deferred tax assets outside of the

U.S. of $728 million. The valuation allowance of $324 million is primarily attributable to certain net operating loss and capital loss carryforward assets

which the Company believes are not more likely than not to be realized.

During the fourth quarter of 2006, based on the Company’s assessment of positive and negative evidence regarding the realization of the net deferred

tax assets, the Company recorded additional valuation allowances of $90 million against its net deferred tax assets in certain jurisdictions outside the

U.S. In accordance with SFAS No. 109, the Company’s assessment included the evaluation of scheduled reversals of deferred tax assets and liabilities,

estimates of projected future taxable income, carryback potential and tax planning strategies. Based on the Company’s assessment of realizability, the

Company concluded that it was no longer more likely than not that these net deferred tax assets would be realized and, as such, recorded a valuation

allowance of $90 million.

As of December 31, 2005, the Company had a valuation allowance of $212 million relating to its net deferred tax assets outside of the U.S. of $569

million. The valuation allowance of $212 million was attributable to certain net operating loss and capital loss carryforwards for which the Company

believes it is not more likely than not that the assets will be realized.

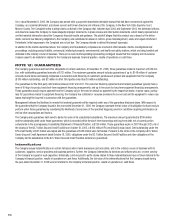

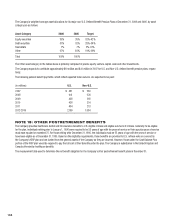

Tax Settlements, Including Interest

During 2006, the Company has continued to be audited by various taxing authorities. No material settlements were reached during the year. Although

management believes that adequate provision has been made for such issues, there is the possibility that the ultimate resolution of such issues could

have an adverse effect on the earnings of the Company. Conversely, if these issues are resolved favorably in the future, the related provisions would

be reduced, thus having a positive impact on earnings. It is anticipated that audit settlements will be reached during 2007 in the United States and

in certain foreign jurisdictions that could have a significant earnings impact. Due to the uncertainty of amounts and in accordance with its accounting

policies, the Company has not recorded any potential impact of these settlements.