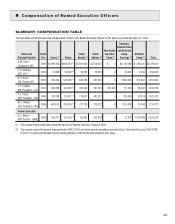

Kodak 2006 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

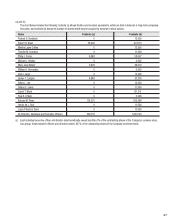

Relative Leadership Assessment

Consistent with our leadership excellence strategy that strong individual performance merits superior awards, the number of options and target

Leadership Stock annually allocated to our executive officers, including our Named Executive Officers, other than our CEO, may be adjusted upward or

downward based on individual performance. The Company’s Relative Leadership Assessment program evaluates our Named Executive Officers’ rela-

tive leadership performance and execution of his or her responsibilities as compared to his or her peers within the Company. Leadership performance

is assessed against defined leadership qualities and skills. An executive may receive an adjustment upward to as much as 150% of his target shares

or his or her incentive opportunity may be completely eliminated based on this assessment. Our CEO makes a recommendation to the Committee

regarding the performance of each Named Executive Officer, excluding himself. The Committee has the discretion to accept or reject the CEO’s recom-

mendation and to decide whether or not to apply Relative Leadership Assessment adjustments in connection with annual equity award grants.

Stock Option Program

Since the fall of 2003, only the Company’s corporate officers, including our Named Executive Officers, are eligible for annual option grants. Stock

options granted in December 2006 have a seven-year term and become exercisable in three equal annual installments beginning one year after the

grant date. All options fully vest upon the third anniversary of the grant date. The exercise price of the options is the mean between the high and low

price at which Kodak shares trade on the NYSE on the grant date.

Consistent with the Committee’s strategy to close our Named Executive Officers’ total direct compensation competitive pay gap and to increase the

relative percentage of long-term variable equity incentives, the number of options granted to our Named Executive Officers in 2006, which are shown

in the Grants of Plan-Based Award Table on page 50 of this Proxy Statement, generally increased over the number granted in 2005.

Leadership Stock Program

All of the Company’s executives, including our Named Executive Officers, are eligible to participate in the Company’s Leadership Stock Program.

Awards under this program are granted in the form of performance stock units which, if earned, are paid in the form of shares of Kodak common

stock. In 2006 and in prior years, the Leadership Stock Program was based on a two-year performance cycle with a new cycle beginning each Janu-

ary. The program’s awards are exclusively performance-based to further strengthen the relationship between pay and performance. In 2006, the

program’s two-year performance cycle was intended to direct the focus of our Named Executive Officers over two calendar years to encourage and

reinforce actions leading to achievement of the Company’s long-term strategic plan. The Committee established the performance criteria for each two-

year performance cycle in February of the first year of the performance cycle.

Leadership Stock may be earned by our executives at the end of the two-year performance cycle if the Company achieves the aggregate performance

target established for the two-year cycle. The actual number of stock units earned by an executive is based on the executive’s target allocation mul-

tiplied by the applicable performance percentage based on the Company’s performance. Any unearned units are forfeited at the end of the two-year

performance period. The payment of any stock units earned under the program for any performance cycle is delayed for one year contingent on the

executive’s continued employment with the Company, except in limited termination of employment circumstances, such as retirement, death, disability

or an approved reason. During this one-year vesting period, dividend equivalents accrue on the stock units, but payment of the dividends is also

subject to this one-year vesting period. At the end of the one-year period, the stock units and the dividend equivalents earned on these stock units are

paid to the executive in the form of shares of Company stock.

The Committee redesigned our Leadership Stock Program for the performance period beginning in 2007. The 2007 performance cycle has a one-year

performance cycle and a two-year vesting period. The Committee believes that, during the Company’s digital transformation, a one-year performance

cycle will permit the Committee to more effectively set targets to motivate our Named Executive Officers to achieve the Company’s strategic business

plan of digital transformation. In other respects, the 2007 performance cycle will operate substantially similar to prior performance cycles.

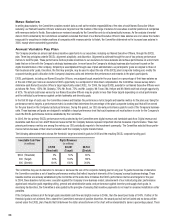

2005-2006 Performance Cycle

For the 2005-2006 Leadership Stock Program performance cycle, the program’s sole performance metric was initially set as Company operational

earnings per share. This performance metric was changed in October 2005 in light of the Company’s announcement in July 2005 that it would no

longer report operational earnings per share. As a result, the Committee changed the performance metric for this performance cycle to digital earnings

from operations (DEFO). DEFO is a non-GAAP performance metric that measures total earnings of the Company’s digital strategic products included

within earnings from continuing operations, before: 1) restructuring charges, 2) interest, 3) other income charges and 4) income taxes. This perfor-

mance metric was selected to further encourage and reinforce executive actions implementing the Company’s transition to a digital company.

In order to receive a payout under the plan, the Company’s aggregate DEFO for the two-year performance period was required to be greater than $750

million. In order for participants to receive 100% of their target allocation, the Company would need to achieve DEFO equal to $1.075 billion. To receive

the maximum payout under the plan, equal to 200% of each participant’s target allocation, the Company’s aggregate DEFO would need to reach $1.4

billion.

The Company did not reach the threshold performance target under the plan for the 2005-2006 performance cycle. Consequently, no shares were

earned by any executives, including our Named Executive Officers for this cycle.