Kodak 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

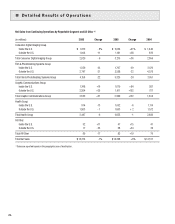

ITEM 6. SELECTED FINANCIAL DATA

Refer to Summary of Operating Data on page 124.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATION

Critical Accounting Polices and Estimates

The accompanying consolidated financial statements and notes to consolidated financial statements contain information that is pertinent to manage-

ment’s discussion and analysis of the financial condition and results of operations. The preparation of financial statements in conformity with account-

ing principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported

amounts of assets, liabilities, revenue and expenses, and the related disclosure of contingent assets and liabilities.

The Company believes that the critical accounting policies and estimates discussed below involve the most complex management judgments due to

the sensitivity of the methods and assumptions necessary in determining the related asset, liability, revenue and expense amounts.

Revenue Recognition

The Company’s revenue transactions include sales of the following: products; equipment; software; services; equipment bundled with products and/or

services and/or software; integrated solutions, and intellectual property licensing. The Company recognizes revenue when it is realized or realiz-

able and earned. For the sale of multiple-element arrangements whereby equipment is combined with services, including maintenance and training,

and other elements, including software and products, the Company allocates to, and recognizes revenue from, the various elements based on their

fair value. For full service solutions sales, which consist of the sale of equipment and software which may or may not require significant produc-

tion, modification or customization, there are two acceptable methods of accounting: percentage of completion accounting and completed contract

accounting. For certain of the Company’s full service solutions, the completed contract method of accounting is being followed by the Company. This

is due to insufficient historical experience resulting in the inability to provide reasonably dependable estimates of the revenues and costs applicable

to the various stages of such contracts as would be necessary under the percentage of completion methodology. When the Company does have suf-

ficient historical experience and the ability to provide reasonably dependable estimates of the revenues and the costs applicable to the various stages

of these contracts, the Company will account for these full service solutions under the percentage of completion methodology. The timing and the

amount of revenue recognized from the licensing of intellectual property depend upon a variety of factors, including the specific terms of each agree-

ment and the nature of the deliverables and obligations. When the Company has continuing obligations related to a licensing arrangement, revenue

related to the ongoing arrangement is recognized over the period of the obligation. Revenue is only recognized after all of the following criteria are met:

(1) the Company has entered into a legally binding arrangement with a licensee of Kodak’s intellectual property, (2) Kodak has delivered the technology

or intellectual property rights, (3) licensee payment is deemed fixed or determinable and free of significant uncertainties, and (4) collection from the

licensee is reasonably assured.

At the time revenue is recognized, the Company also records reductions to revenue for customer incentive programs in accordance with the provisions

of Emerging Issues Task Force (EITF) Issue No. 01-09, “Accounting for Consideration Given from a Vendor to a Customer (Including a Reseller of the

Vendor’s Products).” Such incentive programs include cash and volume discounts, price protection, promotional, cooperative and other advertising al-

lowances and coupons. For those incentives that require the estimation of sales volumes or redemption rates, such as for volume rebates or coupons,

the Company uses historical experience and internal and customer data to estimate the sales incentive at the time revenue is recognized. In the event

that the actual results of these items differ from the estimates, adjustments to the sales incentive accruals would be recorded.

Incremental direct costs of a customer contract in a transaction that results in the deferral of revenue are deferred and netted against revenue in

proportion to the related revenue recognized in each period if: (1) an enforceable contract for the remaining deliverable items exists; and (2) delivery

of the remaining items in the arrangement is expected to generate positive margins allowing realization of the deferred costs. Incremental direct costs

are defined as costs that vary with and are directly related to the acquisition of a contract, which would not have been incurred but for the acquisition

of the contract.

Allowance for Doubtful Accounts

The Company records and maintains a provision for doubtful accounts for customers based on a variety of factors including the Company’s histori-

cal experience, the length of time the receivable has been outstanding and the financial condition of the customer. In addition, the Company regularly

analyzes its customer accounts and, when it becomes aware of a specific customer’s inability to meet its financial obligations to the Company, such

as in the case of bankruptcy filings or deterioration in the customer’s overall financial condition, records a specific provision for uncollectible accounts

to increase the allowance to the amount that is estimated to be uncollectible. If circumstances related to specific customers were to change, the

Company’s estimates with respect to the collectibility of the related receivables could be further adjusted. However, losses in the aggregate have not

exceeded management’s expectations.