Kodak 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.0

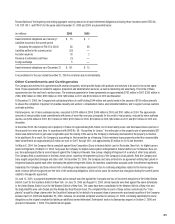

On or about November 9, 2005, the Company was served with a purported shareholder derivative lawsuit that had been commenced against the

Company, as a nominal defendant, and eleven current and former directors and officers of the Company, in the New York State Supreme Court,

Monroe County. The Complaint seeks to allege claims on behalf of the Company that, between April 2003 and September 2003, the defendant officers

and directors caused the Company to make allegedly improper statements, in press release and other public statements, which falsely represented or

omitted material information about the Company’s financial results and guidance. The plaintiff alleges that this conduct was a breach of the defen-

dants’ common law fiduciary obligations to the Company, and constituted an abuse of control, gross mismanagement, waste and unjust enrichment.

Defendants’ initial responses to the Complaint are not yet due. The Company intends to defend this lawsuit vigorously.

In addition to the matters described above, the Company and its subsidiary companies are involved in other lawsuits, claims, investigations and

proceedings, including product liability, commercial, intellectual property, environmental, and health and safety matters, which are being handled and

defended in the ordinary course of business. There are no such matters pending representing contingent losses that the Company and its General

Counsel expect to be material in relation to the Company’s business, financial position, results of operations or cash flows.

NOTE 12: GUARANTEES

The Company guarantees debt and other obligations of certain customers. At December 31, 2006, these guarantees totaled a maximum of $150 mil-

lion, with outstanding guaranteed amounts of $131 million. The maximum guarantee amount includes guarantees of up to: $148 million of customer

amounts due to banks and leasing companies in connection with financing of customers’ purchases of product and equipment from the Company

($130 million outstanding), and $2 million to other third parties (less than $1 million outstanding).

The guarantees for the third party debt mature between 2007 and 2011. The customer financing agreements and related guarantees typically have a

term of 90 days for product and short-term equipment financing arrangements, and up to five years for long-term equipment financing arrangements.

These guarantees would require payment from the Company only in the event of default on payment by the respective debtor. In some cases, particu-

larly for guarantees related to equipment financing, the Company has collateral or recourse provisions to recover and sell the equipment to reduce any

losses that might be incurred in connection with the guarantees.

Management believes the likelihood is remote that material payments will be required under any of the guarantees disclosed above. With respect to

the guarantees that the Company issued in the year ended December 31, 2006, the Company assessed the fair value of its obligation to stand ready to

perform under these guarantees by considering the likelihood of occurrence of the specified triggering events or conditions requiring performance as

well as other assumptions and factors.

The Company also guarantees debt owed to banks for some of its consolidated subsidiaries. The maximum amount guaranteed is $799 million,

and the outstanding debt under those guarantees, which is recorded within the short-term borrowings and long-term debt, net of current portion

components in the accompanying Consolidated Statement of Financial Position, is $255 million. These guarantees expire in 2007 through 2025. As of

the closing of the $2.7 billion Secured Credit Facilities on October 18, 2005, a $160 million KPG credit facility was closed. Debt outstanding under the

KPG credit facility of $57 million was repaid and the guarantees of $160 million were terminated. Pursuant to the terms of the Company’s $2.7 billion

Senior Secured Credit Agreement dated October 18, 2005, obligations under the $2.7 billion Secured Credit Facilities and other obligations of the

Company and its subsidiaries to the $2.7 billion Secured Credit Facilities lenders are guaranteed.

Indemnifications

The Company issues indemnifications in certain instances when it sells businesses and real estate, and in the ordinary course of business with its

customers, suppliers, service providers and business partners. Further, the Company indemnifies its directors and officers who are, or were, serving

at the Company’s request in such capacities. Historically, costs incurred to settle claims related to these indemnifications have not been material to the

Company’s financial position, results of operations or cash flows. Additionally, the fair value of the indemnifications that the Company issued during

the year ended December 31, 2006 was not material to the Company’s financial position, results of operations or cash flows.