Kodak 2006 Annual Report Download - page 203

Download and view the complete annual report

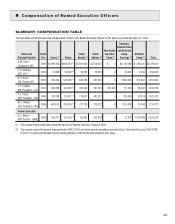

Please find page 203 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48

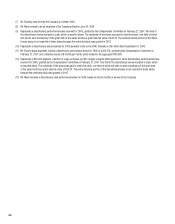

James T. Langley

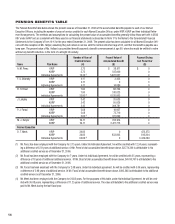

The Company employed Mr. Langley under an offer letter dated August 12, 2003. Under his agreement, Mr. Langley is eligible to receive a base salary

of $500,000 and a target award under the EXCEL plan of 62% of his base salary. The offer letter provides Mr. Langley a retention bonus, eligibility for

an individual long-term bonus and additional relocation benefi ts. Pursuant to his offer letter, Mr. Langley is also eligible to receive an enhanced retire-

ment benefi t, which is described under the Pension Benefi ts Table on page 58 of this Proxy Statement.

Under the terms of his offer letter, Mr. Langley was eligible to receive a cash payment of $100,000, provided he remained employed with the Company. His

retention bonus was payable in four equal installments of $25,000. The fi rst installment was paid when he commenced employment in 2003, the second

was paid in 2004 on the fi rst anniversary of the commencement of his employment, the third was paid in 2005 on the second anniversary of the com-

mencement of his employment and the remaining installment was paid in 2006 on the third anniversary of the date of his commencement of employment.

To incent achievement of certain pre-established goals in the Graphic Communications Group, Mr. Langley’s offer letter established an individual

long-term incentive plan, which provides for a target aggregate award of $1,000,000. The plan was completely performance based; if the plan’s goals

were not achieved, no payments could be made under the plan. Under the plan, a separate target performance goal is established for each of the

plan’s three years, beginning in 2004. To receive the entire amount of the target award for a particular year, Mr. Langley had to achieve 100% of the

established “target performance goal” for that year. If Mr. Langley did not achieve the target performance goal for a particular year, he could neverthe-

less receive a portion of the target award for that year if he achieved at least the plan’s minimum performance goal for that year. The target award for

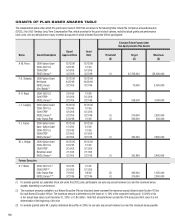

each year of the plan was: 2004 - $200,000; 2005 - $300,000; and 2006 - $500,000. The performance metrics for the 2006 performance period

are described under the Grants of Plan-Based Awards Table on page 50 of this Proxy Statement. In 2006, the performance targets were met, with the

exception of a 2% miss on digital revenue growth, and Mr. Langley received an award of $490,000 for the 2006 performance period.

At the time of Mr. Langley’s employment, the Company agreed to pay the airfare for up to 10 roundtrip fl ights per year for both he and Mrs. Langley to

travel between Rochester, NY and Boise, ID. For 2006, the amount of the Company-paid airfare for these trips is refl ected in the “All Other Compensa-

tion” column to the Summary Compensation Table on page 43 of this Proxy Statement.

On February 28, 2007, Mr. Langley’s letter agreement was amended to extend his individual bonus plan through 2007 (which under his August 12,

2003 letter agreement expired on December 31, 2006) to again incent achievement of certain pre-established goals in the Graphic Communica-

tions Group. This plan is completely performance based; minimum performance goals and maximum performance goals will be determined by the

CEO. Mr. Langley will receive the maximum payout of the award if the Graphic Communications Group achieves 100% of the established maximum

performance goals. If the Graphics Communications Group does not achieve the maximum performance goals, Mr. Langley will receive a portion of the

maximum payout for 2007 if the minimum performance goals are met. The maximum payout under this plan is $300,000, and if received, will be paid

in a lump sum on March 15, 2008. If Mr. Langley is terminated without cause from the Company prior to January 1, 2008, he will be entitled to the

maximum payout. If Mr. Langley terminates for good reason prior to January 1, 2008, he will receive a prorated award, based on the number of days

he was employed by the Company. If Mr. Langley is terminated for any other reason, he will forfeit this award. The amendment to Mr. Langley’s letter

agreement also provides for his enhanced retirement benefi ts to be paid in a lump sum.

The term of Mr. Langley’s employment is indefi nite. For information regarding his potential severance payments and benefi ts in connection with ter-

mination of his employment under various circumstances, please read the narrative descriptions and tables below, beginning on page 63 of this Proxy

Statement.

Philip J. Faraci

The Company employed Mr. Faraci under an offer letter dated November 3, 2004. In addition to the information provided elsewhere in this Proxy

Statement, Mr. Faraci is eligible to receive a base salary of $520,000 and a target award under the EXCEL plan of 62% of his base salary. Mr. Faraci is

eligible to participate in all incentive compensation, retirement, supplemental retirement and deferred compensation plans, policies and arrangements

that are provided to other senior executives of the Company. The offer letter also provides Mr. Faraci with an enhanced pension benefi t, as described on

page 60 of this Proxy Statement.

On February 28, 2007, Mr. Faraci’s letter agreement was amended to provide for lump-sum payment of his enhanced pension benefi ts. The amended

terms provide that if Mr. Faraci is terminated before June 1, 2007, he will receive his enhanced pension benefi t in a monthly annuity, with payments

beginning the fi rst month following the six-month anniversary of Mr. Faraci’s termination and continuing until the end of 2007, with the remainder paid

in a lump sum on or after January 1, 2008. However, if Mr. Faraci is terminated after January 1, 2008, he will receive his enhanced pension benefi t in

a lump sum following the six-month anniversary of his termination.

The term of Mr. Faraci’s employment is indefi nite, but he will be eligible to certain severance benefi ts in connection with termination of his employment

under various circumstances. For information regarding his potential severance payments and benefi ts in connection with termination of his employ-

ment under various circumstances, please read the narrative descriptions and tables below, beginning on page 63 of this Proxy Statement.