Kodak 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The actual charges for initiatives under this program are recorded in the period in which the Company commits to formalized restructuring plans or

executes the specific actions contemplated by the program and all criteria for restructuring charge recognition under the applicable accounting guid-

ance have been met.

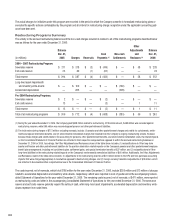

Restructuring Programs Summary

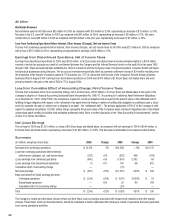

The activity in the accrued restructuring balances and the non-cash charges incurred in relation to all of the restructuring programs described below

was as follows for the year ended December 31, 2006:

Other

Balance Adjustments Balance

Dec. 31, Cash Non-cash and Dec. 31,

(in millions) 2005 Charges Reversals Payments (1) Settlements Reclasses (2) 2006

2004 – 2007 Restructuring Program:

Severance reserve $ 271 $ 318 $ (3) $ (416) $ — $ 58 $ 228

Exit costs reserve 23 69 (1) (67) — — 24

Total reserve $ 294 $ 387 $ (4) $ (483) $ — $ 58 $ 252

Long-lived asset impairments

and inventory write-downs $ — $ 100 $ — $ — $ (100) $ — $ —

Accelerated depreciation — 285 — — (285) — —

Pre-2004 Restructuring Programs:

Severance reserve $ 2 $ — $ — $ (2) $ — $ — $ —

Exit costs reserve 13 — — (3) — 1 11

Total reserve $ 15 $ — $ — $ (5) $ — $ 1 $ 11

Total of all restructuring programs $ 309 $ 772 $ (4) $ (488) $ (385) $ 59 $ 263

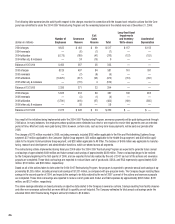

(1) During the year ended December 31, 2006, the Company paid $548 million related to restructuring. Of this total amount, $488 million was recorded against

restructuring reserves, while $60 million was recorded against pension and other postretirement liabilities.

(2) The total restructuring charges of $772 million, excluding reversals, include: (1) pension and other postretirement charges and credits for curtailments, settle-

ments and special termination benefits, and (2) environmental remediation charges that resulted from the Company’s ongoing restructuring actions. However,

because these charges and credits relate to the accounting for pensions, other postretirement benefits, and environmental remediation costs, the related impacts

on the Consolidated Statement of Financial Position are reflected in their respective components as opposed to within the accrued restructuring balances at

December 31, 2006 or 2005. Accordingly, the Other Adjustments and Reclasses column of the table above includes: (1) reclassifications to Other long-term

assets and Pension and other postretirement liabilities for the position elimination-related impacts on the Company’s pension and other postretirement employee

benefit plan arrangements, including net curtailment gains, settlement gains, and special termination benefits of $37 million, and (2) reclassifications to Other

long-term liabilities for the restructuring-related impacts on the Company’s environmental remediation liabilities of $(9) million. Additionally, the Other Adjustments

and Reclasses column of the table above includes: (1) adjustments to the restructuring reserves of $20 million related to the KPG and Creo purchase accounting

impacts that were charged appropriately to Goodwill as opposed to Restructuring charges, and (2) foreign currency translation adjustments of $10 million, which

are reflected in Accumulated other comprehensive loss in the Consolidated Statement of Financial Position.

The costs incurred, net of reversals, which total $768 million for the year ended December 31, 2006, include $285 million and $12 million of charges

related to accelerated depreciation and inventory write-downs, respectively, which were reported in cost of goods sold in the accompanying Consoli-

dated Statement of Operations for the year ended December 31, 2006. The remaining costs incurred, net of reversals, of $471 million, were reported

as restructuring costs and other in the accompanying Consolidated Statement of Operations for the year ended December 31, 2006. The severance

reserve and exit costs reserve generally require the outlay of cash, while long-lived asset impairments, accelerated depreciation and inventory write-

downs represent non-cash items.