IBM 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

97

In March2013, the FASB issued guidance on when foreign cur-

rency translation adjustments should be released to net income.

When a parent entity ceases to have a controlling financial interest

in a subsidiary or group of assets that is a business within a for-

eign entity, the parent is required to release any related cumulative

translation adjustment into net income. Accordingly, the cumula-

tive translation adjustment should be released into net income

only if the sale or transfer results in the complete or substantially

complete liquidation of the foreign entity in which the subsidiary

or group of assets had resided. The guidance was effective Janu-

ary1, 2014 and did not have a material impact in the consolidated

financial results.

In February 2013, the FASB issued guidance for the recognition,

measurement and disclosure of obligations resulting from joint

and several liability arrangements for which the total amount of the

obligation within the scope of the guidance is fixed at the report-

ing date. Examples include debt arrangements, other contractual

obligations and settled litigation matters. The guidance requires

an entity to measure such obligations as the sum of the amount

that the reporting entity agreed to pay on the basis of its arrange-

ment among its co-obligors plus additional amounts the reporting

entity expects to pay on behalf of its co-obligors. The guidance

was effective January1, 2014 and did not have a material impact

in the consolidated financial results.

In February 2013, the FASB issued additional guidance regard-

ing reclassifications out of AOCI. The guidance requires entities

to report the effect of significant reclassifications out of AOCI on

the respective line items in net income unless the amounts are

not reclassified in their entirety to net income. For amounts that

are not required to be reclassified in their entirety to net income

in the same reporting period, entities are required to cross-refer-

ence other disclosures that provide additional detail about those

amounts. For the company, the new guidance was effective on a

prospective basis for all interim and annual periods beginning Jan-

uary1, 2013 with early adoption permitted. The company adopted

the guidance in its December31, 2012 financial statements. There

was no impact in the consolidated financial results as the guidance

related only to additional disclosures.

In July 2012, the FASB issued amended guidance that simpli-

fies how entities test indefinite-lived intangible assets other than

goodwill for impairment. After an assessment of certain qualita-

tive factors, if it is determined to be more likely than not that an

indefinite-lived intangible asset is impaired, entities must perform

the quantitative impairment test. Otherwise, the quantitative test

is optional. The amended guidance was effective for annual and

interim impairment tests performed for fiscal years beginning after

September15, 2012, with early adoption permitted. The company

adopted this guidance for its 2012 impairment testing of indefinite-

lived intangible assets performed in the fourth quarter. There was

no impact in the consolidated financial results.

NOTE C.

ACQUISITIONS/DIVESTITURES

Acquisitions

Purchase price consideration for all acquisitions, as reflected in

the tables in this note, is paid primarily in cash. All acquisitions

are reported in the Consolidated Statement of Cash Flows net of

acquired cash and cash equivalents.

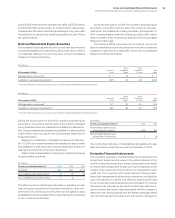

2014

In 2014, the company completed six acquisitions at an aggregate

cost of $608 million.

The Software segment completed acquisitions of five privately

held companies: in the first quarter, Aspera, Inc. (Aspera) and Clou-

dant, Inc. (Cloudant); in the second quarter, Silverpop Systems, Inc.

(Silverpop) and Cognea Group Pty LTD (Cognea); and in the third

quarter, CrossIdeas Srl (CrossIdeas). Global Technology Services

(GTS) completed one acquisition: in the third quarter, Lighthouse

Security Group, LLC (Lighthouse), a privately held company.

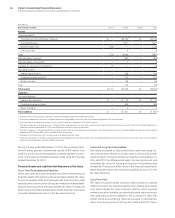

The following table reflects the purchase price related to these

acquisitions and the resulting purchase price allocations as of

December31, 2014:

2014 Acquisitions

($ in millions)

Amortization

Life (in Years)

Total

Acquisitions

Current assets $ 56

Fixed assets/noncurrent assets 39

Intangible assets

Goodwill N/A 442

Completed technology 5–7 68

Client relationships 7 77

Patents/trademarks 1–7 18

Total assets acquired 701

Current liabilities (26)

Noncurrent liabilities (67)

Total liabilities assumed (93)

Total purchase price $608

N/A—Not applicable

Each acquisition further complemented and enhanced the

company’s portfolio of product and services offerings. Aspera’s

technology helps make cloud computing faster, more predict-

able and more cost effective for big data transfers such as