IBM 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 Management Discussion

International Business Machines Corporation and Subsidiary Companies

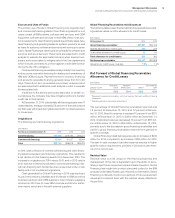

Total revenue in 2014 increased $218 million versus 2013 as a

result of:

• An increase in internal revenue of 9.0percent driven by an

increase in used equipment sales revenue (up 11.1percent to

$2,080 million); partially offset by a decrease in financing

revenue (down 0.7percent to $408 million); and

• An increase in external revenue of 0.6percent (up 3percent

adjusted for currency) driven by an increase in financing

revenue (up 3.4percent to $1,543 million), partially offset by a

decrease in used equipment sales revenue (down 7.2percent

to $491 million).

The decrease in internal financing revenue was primarily due to

lower asset yields, partially offset by an increase in the average

asset balance. The increase in external financing revenue was

due to a higher average asset balance, partially offset by lower

asset yields and a decrease in remarketing lease revenue. Global

Financing gross profit increased 7.2percent compared to 2013 due

to an increase in used equipment sales gross profit, partially offset

by a decrease in financing gross profit. The gross profit margin

increased 1.3points due to an increase in the equipment sales

margin, partially offset by a decrease in the financing margin.

Total revenue in 2013 increased $232 million versus 2012 as a

result of:

• An increase in internal revenue of 10.8percent driven by an

increase in used equipment sales revenue (up 20.0percent

to $1,871 million), partially offset by a decrease in financing

revenue (down 17.9percent to $411 million); and

• An increase in external revenue of 0.4percent (3percent

adjusted for currency) driven by an increase in financing

revenue (up 1.4percent to $1,493 million), partially offset by a

decrease in used equipment sales revenue (down 2.3per-

cent to $528 million).

The decrease in internal financing revenue was primarily due to

lower asset yields and a decrease in remarketing lease revenue.

The increase in external financing revenue was due to a higher

average asset balance, partially offset by lower asset yields and

a decrease in remarketing lease revenue. Global Financing gross

profit in 2013 increased 8.0percent compared to 2012 due to

an increase in used equipment sales gross profit, partially offset

by a decrease in financing gross profit. The gross profit margin

increased 1.5points due to an increase in equipment sales mar-

gins, partially offset by a shift in mix toward lower margin used

equipment sales.

Global Financing pre-tax income increased 0.8percent in

2014 versus 2013, following an increase of 6.8percent in 2013

versus 2012. The increase in 2014 was driven by the increase in

gross profit ($207 million), partially offset by increases in financ-

ing receivables provisions ($155 million) and SG&A expenses ($32

million). The increase in 2013 was driven by the increase in gross

profit ($215 million), partially offset by increases in financing receiv-

ables provisions ($60 million) and SG&A expenses ($20 million).

The increase in financing receivable provisions in 2014 was due to

higher specific reserve requirements, primarily in China and Latin

America. At December31, 2014, the overall allowance for credit

losses coverage rate was 1.9percent, an increase of 70 basis

points year over year.

The decreases in return on equity from 2013 to 2014 and 2012

to 2013 were driven by higher average equity balances.

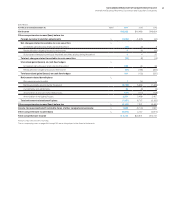

Financial Condition

Balance Sheet

($ in millions)

At December 31: 2014 2013

Cash and cash equivalents $ 1,538 $ 1,446

Net investment in sales-type

and direct financing leases 8,263 9,739

Equipment under operating leases:

External clients

(a) 774 947

Client loans 14,290 14,297

Total client financing assets 23,327 24,982

Commercial financing receivables 8,424 8,541

Intercompany financing receivables

(b)(c) 4,611 4,216

Other receivables 368 352

Other assets 577 601

Total assets $38,845 $40,138

Intercompany payables

(b) $ 3,631 $ 5,766

Debt

(d) 29,103 27,504

Other liabilities 2,094 3,043

Total liabilities 34,828 36,314

Total equity 4,017 3,825

Total liabilities and equity $38,845 $40,138

(a)

Includes intercompany markup, priced on an arm’s-length basis, on products pur-

chased from the company’s product divisions, which is eliminated in IBM’s

consolidated results.

(b) Entire amount eliminated for purposes of IBM’s consolidated results and therefore

does not appear on page 82.

(c) These assets, along with all other financing assets in this table, are leveraged at the

value in the table using Global Financing debt.

(d)

Global Financing debt is comprised of intercompany loans and external debt. A por-

tion of Global Financing debt is in support of the company’s internal business, or

related to intercompany markup embedded in the Global Financing assets.