IBM 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

96

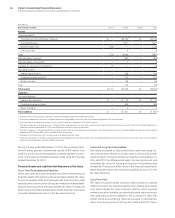

Write Off—Receivable losses are charged against the allowance

when management believes the uncollectibility of the receivable

is confirmed. Subsequent recoveries, if any, are credited to the

allowance.

Past Due—The company views receivables as past due when

payment has not been received after 90 days, measured from the

original billing date.

Impaired Loans—As stated above, the company evaluates all

financing receivables considered at-risk, including loans, for

impairment on a quarterly basis. The company considers any

loan with an individually evaluated reserve as an impaired loan.

Depending on the level of impairment, loans will also be placed

on non-accrual status as appropriate. Client loans are primarily

for software and services and are unsecured. These loans are

subjected to credit analysis to evaluate the associated risk and,

when deemed necessary, actions are taken to mitigate risks in the

loan agreements which include covenants to protect against credit

deterioration during the life of the obligation.

Estimated Residual Values of Lease Assets

The recorded residual values of lease assets are estimated at

the inception of the lease to be the expected fair value of the

assets at the end of the lease term. The company periodically

reassesses the realizable value of its lease residual values. Any

anticipated increases in specific future residual values are not rec-

ognized before realization through remarketing efforts. Anticipated

decreases in specific future residual values that are considered to

be other-than-temporary are recognized immediately upon iden-

tification and are recorded as an adjustment to the residual value

estimate. For sales-type and direct-financing leases, this reduction

lowers the recorded net investment and is recognized as a loss

charged to financing income in the period in which the estimate is

changed, as well as an adjustment to unearned income to reduce

future-period financing income.

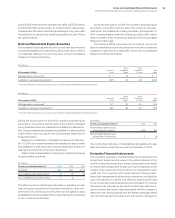

Common Stock

Common stock refers to the $.20 par value per share capital stock

as designated in the company’s Certificate of Incorporation. Trea-

sury stock is accounted for using the cost method. When treasury

stock is reissued, the value is computed and recorded using a

weighted-average basis.

Earnings Per Share of Common Stock

Earnings per share (EPS) is computed using the two-class method.

The two-class method determines EPS for each class of common

stock and participating securities according to dividends and

dividend equivalents and their respective participation rights

in undistributed earnings. Basic EPS of common stock is com-

puted by dividing net income by the weighted-average number

of common shares outstanding for the period. Diluted EPS of

common stock is computed on the basis of the weighted-average

number of shares of common stock plus the effect of dilutive

potential common shares outstanding during the period using the

treasury stock method. Dilutive potential common shares include

outstanding stock options, stock awards and convertible notes.

NOTE B.

ACCOUNTING CHANGES

New Standards to be Implemented

In May 2014, the Financial Accounting Standards Board (FASB)

issued guidance on the recognition of revenue from contracts with

customers. Revenue recognition will depict the transfer of prom-

ised goods or services to customers in an amount that reflects

the consideration to which the entity expects to be entitled in

exchange for those goods or services. The guidance also requires

disclosures regarding the nature, amount, timing and uncertainty

of revenue and cash flows arising from contracts with customers.

The guidance permits two methods of adoption: retrospectively to

each prior reporting period presented, or retrospectively with the

cumulative effect of initially applying the guidance recognized at

the date of initial application. The guidance is effective January1,

2017 and early adoption is not permitted. The company is cur-

rently evaluating the impact of the new guidance and the method

of adoption.

In April 2014, the FASB issued guidance that changed the cri-

teria for reporting a discontinued operation. Only disposals of a

component that represents a strategic shift that has (or will have)

a major effect on an entity’s operations and financial results is a

discontinued operation. The guidance also requires expanded

disclosures about discontinued operations and disposals of a

significant part of an entity that does not qualify for discontin-

ued operations reporting. The guidance is effective January1,

2015 with early adoption permitted, but only for disposals (or

classifications as held for sale) that have not been reported in

previously-issued financial statements. The company will adopt

the new guidance on January1, 2015. The impact to the company

will be dependent on any potential transaction that is within the

scope of the new guidance.

Standards Implemented

In July 2013, the FASB issued guidance regarding the presentation

of an unrecognized tax benefit when a net operating loss carryfor-

ward, a similar tax loss, or a tax credit carryforward exists. Under

certain circumstances, unrecognized tax benefits should be pre-

sented in the financial statements as a reduction to a deferred tax

asset for a net operating loss carryforward, a similar tax loss, or

a tax credit carryforward. The guidance was effective January1,

2014. The guidance was a change in financial statement presen-

tation only and did not have a material impact in the consolidated

financial results.