IBM 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

Management Discussion

International Business Machines Corporation and Subsidiary Companies

EMEA revenue of $8,001 million decreased 12.8percent as

reported, but only 1percent adjusted for divestitures (5points)

and currency (7points) year to year in the fourth quarter of 2014.

Major market countries were down 13.2percent as reported

and 2percent adjusted for divestitures (4points) and currency

(7points). Growth market countries were down 9.7percent,

but were up 7percent adjusted for divestitures (10points) and

currency (6points). On an adjusted basis, Europe’s overall perfor

-

mance improved from the third quarter. In the major markets, there

were improvements in the UK and Italy, and continued growth in

Spain. Compared to the prior year, the UK decreased 10.0percent

as reported and 1percent adjusted for divestitures (7points) and

currency (2points) compared with a decline of 5percent on an

adjusted basis in the prior quarter. Italy decreased 7.5percent as

reported, but grew 5percent adjusted for divestitures (3points)

and currency (9points) compared with a decline of 2percent on

an adjusted basis in the prior quarter. Spain decreased 7.8per-

cent as reported, but grew 3percent adjusted for divestitures

(2points) and currency (9points). The increase in the growth mar-

kets when adjusted for currency and the divestitures was driven

by strength in the central and eastern European countries.

Asia Pacific fourth quarter revenue decreased 16.7percent as

reported and 2percent adjusted for divestitures (8points) and

currency (7points) year over year. Japan decreased 14.5percent

as reported, but grew 2percent adjusted for divestitures (4points)

and currency (12points). Asia Pacific growth market countries

decreased 18.1percent as reported and 5percent adjusted

for divestitures (11points) and currency (3points) year to year.

Although there was improved performance this quarter in China

on an adjusted basis, there were continued year-to-year declines

in some of the other larger growth market countries.

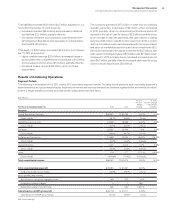

Total Expense and Other (Income)

($ in millions)

For the fourth quarter: 2014 2013

Yr.-to-Yr.

Percent/

Margin

Change

Total consolidated expense

and other (income) $5,767 $7,235 (20.3)%

Non-operating adjustments

Amortization of acquired

intangible assets (93) (93) (0.1)

Acquisition-related charges (2) (16) (87.5)

Non-operating retirement-related

(costs)/income (74) (104) (28.5)

Operating (non-GAAP)

expense and other (income) $5,598 $7,023 (20.3)%

Total consolidated

expense-to-revenue ratio 23.9% 26.4%(2.5) pts.

Operating (non-GAAP)

expense-to-revenue ratio 23.2% 25.6%(2.4) pts.

Total expense and other (income) decreased 20.3percent in the

fourth quarter with an expense-to-revenue ratio of 23.9percent

compared to 26.4percent in the fourth quarter of 2013. Total oper-

ating (non-GAAP) expense and other (income) also decreased

20.3percent in the fourth quarter. The decrease in total oper-

ating expense and other (income) was primarily driven by lower

base expense (17points) and currency (4points), partially offset

by increased expense from acquisitions over the past 12 months

(1point). The decline in base expense was driven by the gain

from the industry standard server divestiture, partially offset by

the workforce reduction charge recorded in the fourth quarter.

Other (income)/expense included the pre-tax gain from the indus-

try standard server divestiture of $1.4 billion; while selling, general

and administrative expense included the workforce rebalancing

change of approximately $580 million. Additionally, expense asso-

ciated with the industry standard server business is no longer in

the run rate which also contributed to the year-to-year decline in

the fourth quarter.

Results of Discontinued Operations

Loss from discontinued operations, net of tax, was $31 million in

the fourth quarter of 2014 compared to $32 million in 2013.

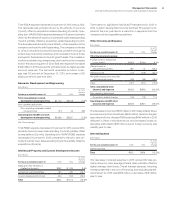

Cash Flow

The company generated $6,059 million in cash flow provided by

operating activities, a decrease of $468 million compared to the

fourth quarter of 2013, driven primarily by declines in operational

performance within net income and an increase in cash taxes paid

($203 million). Net cash used in investing activities of $1,236 mil-

lion decreased $1,666 million compared to the prior year, primarily

due to cash proceeds received from the divestiture of the industry

standard server business. Net cash used in financing activities

of $5,699 million increased $2,686 million compared to the prior

year primarily due to debt retirements during the quarter, offset

by decreased cash used for gross common stock repurchases

($5,665 million).