IBM 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 Management Discussion

International Business Machines Corporation and Subsidiary Companies

Total geographic revenue of $97,800 million decreased 4.4per-

cent (2percent adjusted for currency) in 2013. Revenue in the

major markets decreased 4.2percent (2percent adjusted for

currency). Revenue from the growth markets, which represented

approximately 23percent of the total geographic revenue for the

year, decreased 4.9percent on a year-to-year basis (2percent

adjusted for currency). Performance at constant currency in the

growth markets was mixed, with year-to-year growth in the first half

offset by declines in the second half. The company had strength

in Latin America and the Middle East and Africa region. How-

ever, declines in some of the larger growth markets, for example

China and Australia, impacted the overall performance in the

growth markets. Within the BRIC countries of Brazil, Russia, India

and China, combined revenue declined 8.2percent (6percent

adjusted for currency).

Americas revenue decreased 2.9percent (2percent adjusted

for currency) year to year. The major market countries were down

3.9percent (4percent adjusted for currency), partially offset by an

increase in the Latin America growth markets of 4.4percent (9per-

cent adjusted for currency). Within the major market countries,

the U.S. was down 3.4percent and Canada was down 6.3per-

cent (3percent adjusted for currency). Within the growth market

countries, Brazil increased 3.3percent (10percent adjusted for

currency) and Mexico increased 7.8percent (8percent adjusted

for currency).

Europe/Middle East/Africa revenue decreased 0.5percent

(2percent adjusted for currency) compared to 2012. The major

market countries were down 0.5percent (3percent adjusted for

currency), while the growth market countries were down 0.6percent

(up 1percent adjusted for currency). In the major market countries,

the UK decreased 1.4percent (flat adjusted for currency), Germany

decreased 0.1percent (3percent adjusted for currency), France

decreased 1.8percent (5percent adjusted for currency), and Italy

decreased 2.1percent (5percent adjusted for currency). Within

the EMEA growth markets, the Middle East and Africa region

increased 5.0percent (11percent adjusted for currency), but this

growth was offset primarily by a decrease in Russia of 22.7percent

(22percent adjusted for currency).

Asia Pacific revenue decreased 11.6percent (3percent

adjusted for currency) year to year. Japan revenue decreased

15.2percent as reported, but increased 4percent overall and

grew in every quarter on a constant currency basis. This growth

reflected the benefits of shifting investment and redirection of the

company’s go-to-market focus to improve performance in Japan.

The Asia Pacific growth markets decreased 9.1percent (7percent

adjusted for currency), with China down 12.2percent (14percent

adjusted for currency) and Australia down 15.9percent (10per-

cent adjusted for currency). During 2013, performance in China

was impacted by the process surrounding the implementation of

a broad governmental economic reform plan.

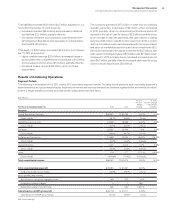

Total Expense and Other (Income)

($ in millions)

For the year ended December 31: 2013 2012

Yr.-to-Yr.

Percent/

Margin

Change

Total consolidated expense

and other (income) $28,440 $27,821 2.2%

Non-operating adjustments

Amortization of acquired

intangible assets (370) (328) 12.9

Acquisition-related charges (40) (35) 14.9

Non-operating retirement-related

(costs)/income (433) (274)58.3

Operating (non-GAAP)

expense and other (income) $27,597 $27,184 1.5%

Total consolidated

expense-to-revenue ratio 28.9% 27.0%1.9 pts.

Operating (non-GAAP)

expense-to-revenue ratio 28.1%26.4%1.7 pts.

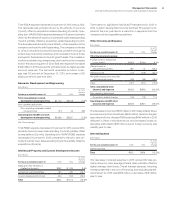

Selling, General and Administrative

($ in millions)

For the year ended December 31: 2013 2012

Yr.-to-Yr.

Percent

Change

Selling, general and

administrative expense

Selling, general and

administrative—other $19,178 $19,532 (1.8)%

Advertising and promotional

expense 1,294 1,339 (3.4)

Workforce rebalancing charges 1,031 784 31.6

Retirement-related costs 986 932 5.8

Amortization of acquired

intangible assets 370 328 12.9

Stock-based compensation 435 498 (12.6)

Bad debt expense 156 50 209.8

Total consolidated selling, general

and administrative expense $23,451 $23,463 (0.1)%

Non-operating adjustments

Amortization of acquired

intangible assets (370)(328)12.9

Acquisition-related charges (25)(22)13.3

Non-operating retirement-related

(costs)/income (376)(294)28.1

Operating (non-GAAP)

selling, general and

administrative expense $22,680 $22,820 (0.6)%