IBM 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

111

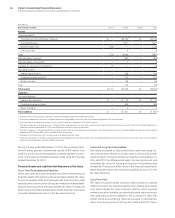

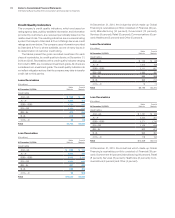

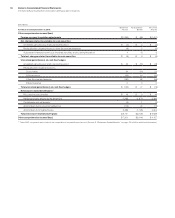

($ in millions)

At December 31, 2013:

Major

Markets

Growth

Markets Tota l

Financing receivables

Lease receivables $ 6,796 $2,200 $ 8,996

Loan receivables 10,529 4,012 14,542

Ending balance $17,325 $6,212 $23,537

Collectively evaluated for impairment $17,206 $6,013 $23,219

Individually evaluated for impairment $ 119 $ 199 $ 318

Allowance for credit losses:

Beginning balance at

January1, 2013

Lease receivables $ 59 $ 55 $ 114

Loan receivables 121 84 204

Total $ 180 $ 138 $ 318

Write-offs (23) (10) (33)

Provision (21) 105 84

Other 1 (6) (5)

Ending balance at

December 31, 2013 $ 137 $ 228 $ 365

Lease receivables $ 42 $ 80 $ 123

Loan receivables $ 95 $ 147 $ 242

Collectively evaluated for impairment $ 45 $ 48 $ 93

Individually evaluated for impairment $ 93 $ 179 $ 272

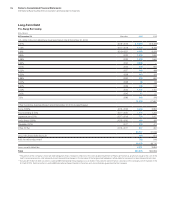

When determining the allowances, financing receivables are eval-

uated either on an individual or a collective basis. For individually

evaluated receivables, the company determines the expected

cash flow for the receivable and calculates an estimate of the

potential loss and the probability of loss. For those accounts

in which the loss is probable, the company records a specific

reserve. In addition, the company records an unallocated reserve

that is calculated by applying a reserve rate to its different portfo-

lios, excluding accounts that have been specifically reserved. This

reserve rate is based upon credit rating, probability of default, term,

characteristics (lease/loan) and loss history.

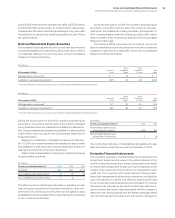

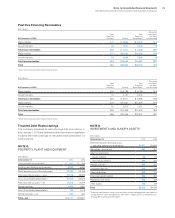

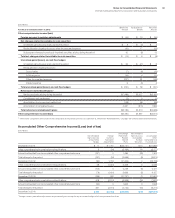

Financing Receivables on Non-Accrual Status

The following table presents the recorded investment in financing

receivables which were on non-accrual status at December31,

2014 and 2013.

($ in millions)

At December 31: 2014 2013

Major markets $ 13 $ 25

Growth markets 40 34

Total lease receivables $ 53 $ 59

Major markets $ 27 $ 40

Growth markets 151 92

Total loan receivables $178 $132

Total receivables $231 $191

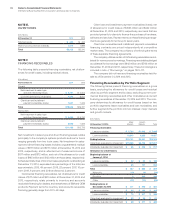

Impaired Loans

The company considers any loan with an individually evaluated

reserve as an impaired loan. Depending on the level of impairment,

loans will also be placed on a non-accrual status. The following

tables present impaired client loan receivables at December31,

2014 and 2013.

($ in millions)

At December 31, 2014:

Recorded

Investment

Related

Allowance

Major markets $ 54 $ 47

Growth markets 299 293

Total $353 $340

($ in millions)

At December 31, 2013:

Recorded

Investment

Related

Allowance

Major markets $ 79 $ 67

Growth markets 122 116

Total $201 $183

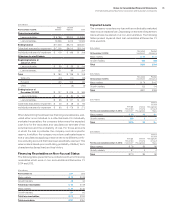

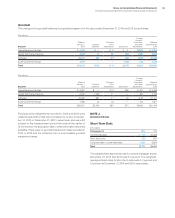

($ in millions)

For the year ended December 31, 2014:

Average

Recorded

Investment

Interest

Income

Recognized

Interest

Income

Recognized

on Cash

Basis

Major markets $ 68 $0 $—

Growth markets 208 0 —

Total $276 $0 $—

($ in millions)

For the year ended December 31, 2013:

Average

Recorded

Investment

Interest

Income

Recognized

Interest

Income

Recognized

on Cash

Basis

Major markets $ 76 $0 $0

Growth markets 97 0 0

Total $173 $0 $0