IBM 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.71

Management Discussion

International Business Machines Corporation and Subsidiary Companies

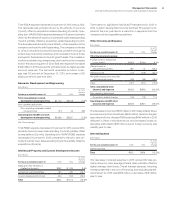

Factors that could cause actual results to materially differ from

the estimates include significant changes in the used-equipment

market brought on by unforeseen changes in technology innovations

and any resulting changes in the useful lives of used equipment.

To the extent that actual residual value recovery is lower than

management’s estimates by 10percent, Global Financing’s seg-

ment pre-tax income and the company’s income from continuing

operations before income taxes for 2014 would have been lower

by an estimated $84 million. If the actual residual value recovery is

higher than management’s estimates, the increase in income will

be realized at the end of lease when the equipment is remarketed.

Currency Rate Fluctuations

Changes in the relative values of non-U.S. currencies to the U.S.

dollar affect the company’s financial results and financial position.

At December31, 2014, currency changes resulted in assets and

liabilities denominated in local currencies being translated into

fewer dollars than at year-end 2013. The company uses financial

hedging instruments to limit specific currency risks related to

financing transactions and other foreign currency-based trans-

actions. Further discussion of currency and hedging appears in

noteD, “Financial Instruments-Derivative Financial Instruments,”

on pages 105 through 109.

Foreign currency fluctuations often drive operational responses

that mitigate the simple mechanical translation of earnings. During

periods of sustained movements in currency, the marketplace and

competition adjust to the changing rates. For example, when pric-

ing offerings in the marketplace, the company may use some of

the advantage from a weakening U.S. dollar to improve its position

competitively, and price more aggressively to win the business,

essentially passing on a portion of the currency advantage to

its customers. Competition will frequently take the same action.

Consequently, the company believes that some of the currency-

based changes in cost impact the prices charged to clients. The

company also maintains currency hedging programs for cash

management purposes which mitigate, but do not eliminate, the

volatility of currency impacts on the company’s financial results.

The company translates revenue, cost and expense in its non-

U.S. operations at current exchange rates in the reported period.

References to “adjusted for currency” or “constant currency”

reflect adjustments based upon a simple constant currency math-

ematical translation of local currency results using the comparable

prior period’s currency conversion rate. However, this constant

currency methodology that the company utilizes to disclose this

information does not incorporate any operational actions that

management may take in reaction to fluctuating currency rates.

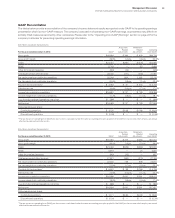

Currency movements impacted the company’s year-to-year reve-

nue and earnings per share growth in 2014. Based on the currency

rate movements in 2014, total revenue decreased 5.7percent as

reported and 4.0percent at constant currency versus 2013. On

an income from continuing operations before income taxes basis,

these translation impacts offset by the net impact of hedging activ

-

ities resulted in a theoretical maximum (assuming no pricing or

sourcing actions) decrease of approximately $300 million in 2014.

The same mathematical exercise resulted in a decrease of approx-

imately $400 million in 2013. The company views these amounts as

a theoretical maximum impact to its as-reported financial results.

Considering the operational responses mentioned above, move-

ments of exchange rates, and the nature and timing of hedging

instruments, it is difficult to predict future currency impacts on

any particular period, but the company believes it could be sub-

stantially less than the theoretical maximum given the competitive

pressure in the marketplace.

For non-U.S. subsidiaries and branches that operate in U.S.

dollars or whose economic environment is highly inflationary,

translation adjustments are reflected in results of operations.

Generally, the company manages currency risk in these entities

by linking prices and contracts to U.S. dollars.

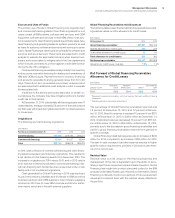

The company continues to monitor the economic conditions

in Venezuela. In March 2013, the Venezuelan government created

a new foreign exchange mechanism called the “Complimentary

System of Foreign Currency Acquirement” (or the “SICAD 1”). This

system operates similar to an auction system and allows entities

in specific sectors to bid for U.S. dollars to be used for specific

import transactions. In December 2013, the Venezuelan gov-

ernment published the SICAD 1 rate implied by the transactions

settled in these auctions, and issued Exchange Agreement No.

24 which clarified the use of the SICAD 1 mechanism. In Janu-

ary 2014, the government issued Exchange Agreement No. 25,

and significantly expanded the transactions that qualify for use of

SICAD 1 and stated that a new agency called the National Center of

Foreign Commerce (CENCOEX) would assume the role of CADIVI,

which historically controlled the sale and purchase of foreign cur-

rency in Venezuela. In February 2014, the Venezuelan government

signed into law a plan to open a new exchange control mechanism

(“SICAD2”), and indicated that the official rate of 6.3 BsF per USD

would increasingly be reserved for the settlement of USD denomi-

nated obligations related to purchases of “essential goods and

services.” In March 2014, the Venezuelan government published

operating rules for SICAD 2 in Exchange Agreement No. 27. SICAD

2 began operating on March24, 2014. In March2014, the company

adopted the SICAD 1 rate of 10.7 BsF per USD. In the first quarter

of 2014, the company recorded a pre-tax loss of $31 million as

a result of the devaluation in Other (income) and expense in the

Consolidated Statement of Earnings. At December31, 2014, the

company’s net asset position in Venezuela was $42 million. The

company’s operations in Venezuela comprised less than 1percent

of total 2014, 2013 and 2012 revenue, respectively. In February 2015,

the Venezuelan government created a new foreign exchange plat-

form, the Marginal Currency System, or SIMADI. The company will

monitor transactions from this new system going forward in 2015.