IBM 2014 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

125

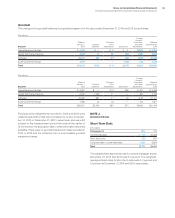

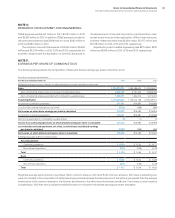

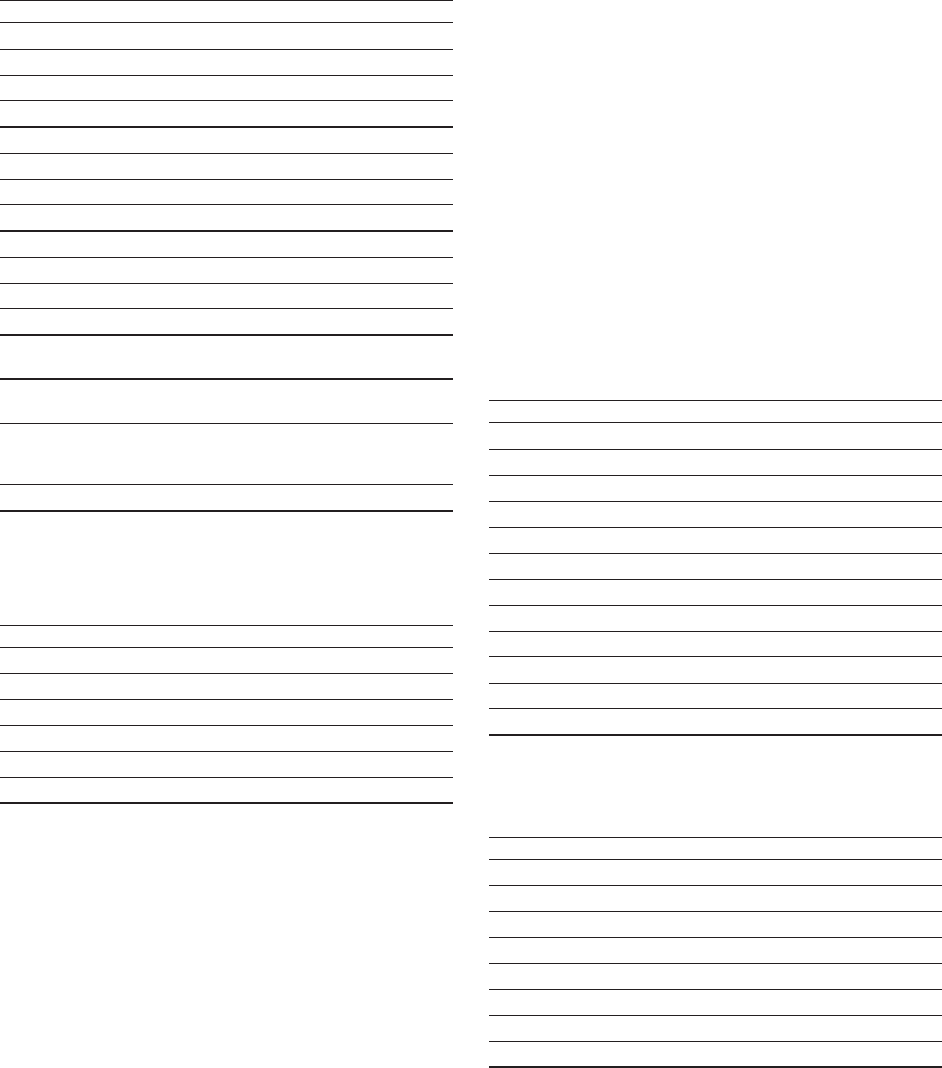

The components of the income from continuing operations provi-

sion for income taxes by taxing jurisdiction are as follows:

($ in millions)

For the year ended December 31: 2014 2013*2012*

U.S. federal

Current $ 1,134 $1,694 $1,556

Deferred 105 (708) 415

1,239 986 1,971

U.S. state and local

Current 541 277 168

Deferred (105) (330) 291

436 (53) 459

Non-U.S.

Current 2,825 3,067 3,006

Deferred (266) (637) 105

2,559 2,430 3,111

Total continuing operations provision

for income taxes 4,234 3,363 5,541

Discontinued operations provision

for income taxes (1,617) (322)(243)

Provision for social security,

real estate, personal property

and other taxes 4,068 4,198 4,331

Total taxes included in net income $ 6,685 $7,238 $9,629

* Reclassified to reflect discontinued operations presentation.

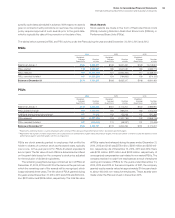

A reconciliation of the statutory U.S. federal tax rate to the com-

pany’s effective tax rate from continuing operations is as follows:

For the year ended December 31: 2014 2013*2012*

Statutory rate 35% 35% 35%

Foreign tax differential (14) (13) (10)

State and local 10 1

Domestic incentives (2) (3) (1)

Other 1(2) 0

Effective rate 21% 17% 25%

Percentages rounded for disclosure purposes.

* Reclassified to reflect discontinued operations presentation.

The significant components reflected within the tax rate reconcili-

ation above labeled “Foreign tax differential” include the effects

of foreign subsidiaries’ earnings taxed at rates other than the U.S.

statutory rate, foreign export incentives, the U.S. tax impacts of

non-U.S. earnings repatriation and any net impacts of intercom-

pany transactions. These items also reflect audit settlements or

changes in the amount of unrecognized tax benefits associated

with each of these items.

The 2014 continuing operations tax rate increased 4.6points

from 2013 due to the lack of the following 2013 benefits: the com-

pletion of the 2008–2010 U.S. tax audit and associated reserve

redeterminations (11.1points), the retroactive impact of the 2012

American Taxpayer Relief Act (0.7points), a tax agreement requir-

ing a reassessment of certain valuation allowances on deferred

tax assets (1.4points), the resolution of certain non-U.S. tax audits

(0.7points) and newly enacted U.S. state tax legislation (0.6points),

as well as a tax charge related to the divestiture of the industry

standard server business (0.9points).

These increases were partially offset by benefits due to the

following: the year-to-year reduction in tax charges related to cer-

tain intercompany payments made by foreign subsidiaries and the

licensing of certain intellectual property (3.7points), the increased

utilization of foreign tax credits (4.7points), and a more favorable

geographic mix of pre-tax income in 2014 (2.5points).

The effect of tax law changes on deferred tax assets and lia-

bilities did not have a material impact on the company’s effective

tax rate.

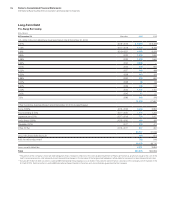

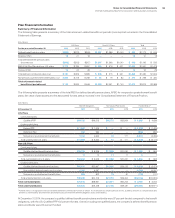

The significant components of deferred tax assets and liabili-

ties that are recorded in the Consolidated Statement of Financial

Position were as follows:

Deferred Tax Assets

($ in millions)

At December 31: 2014 2013*

Retirement benefits $ 4,795 $ 3,704

Share-based and other compensation 1,328 1,262

Domestic tax loss/credit carryforwards 858 982

Deferred income 957 964

Foreign tax loss/credit carryforwards 686 651

Bad debt, inventory and warranty reserves 529 592

Depreciation 329 382

Accruals 1,176 322

Other 1,306 1,452

Gross deferred tax assets 11,964 10,311

Less: valuation allowance 646 734

Net deferred tax assets $11,318 $ 9,577

* Reclassified to conform with 2014 presentation.

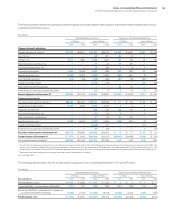

Deferred Tax Liabilities

($ in millions)

At December 31: 2014 2013

Depreciation $ 487 $1,346

Retirement benefits 205 1,219

Goodwill and intangible assets 1,263 1,173

Leases 912 1,119

Software development costs 421 558

Deferred transition costs 374 424

Other 1,111 841

Gross deferred tax liabilities $4,773 $6,680