IBM 2014 Annual Report Download - page 103

Download and view the complete annual report

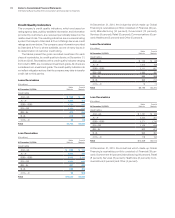

Please find page 103 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

102

Others—On June 30, 2014, the company completed the dives-

titures of its solidDB suite of products to UNICOM Systems, Inc.

and its Human Capital Management business line in France to

Sopra Group.

On August 31, 2014, the company completed the divestiture of

its Cognos Finance product to UNICOM Systems, Inc.

On September 30, 2014, the company completed the divesti-

tures of its IMS Tools Suite of products to Rocket Software, Inc.,

its Sterling Transportation Management System to Kewill Inc., and

its ILOG JViews and Elixir Visualization products to Rogue Wave

Software, Inc.

On December 31, 2014, the company completed the dives-

titure of its Focal Point and PurifyPlus product suite to UNICOM

Systems, Inc.

All of the above transactions closed in 2014 and the financial

terms related to these transactions were not material. Overall, the

company recorded a pre-tax gain of $132 million related to these

transactions in 2014.

2013

Customer Care—On September10, 2013, IBM and SYNNEX

announced a definitive agreement in which SYNNEX would

acquire the company’s worldwide customer care business

process outsourcing services business for $501 million, consist-

ing of approximately $430 million in cash, net of balance sheet

adjustments, and $71 million in SYNNEX common stock, which

represented less than 5percent equity ownership in SYNNEX. As

part of the transaction, SYNNEX entered into a multi-year agree-

ment with the company, and Concentrix, SYNNEX’s outsourcing

business, has become an IBM strategic business partner for global

customer care business process outsourcing services.

The initial closing of the transaction was completed on Janu-

ary31, 2014, with subsequent closings occurring in 2014. In the

fourth quarter of 2014, the company continued to work toward res-

olution of the required final balance sheet adjustments. A charge

in the amount of $10 million was recorded to reflect the expected

resolution. For the full year of 2014, the company recorded a pre-

tax gain of $202 million related to this transaction.

Others—In the first quarter of 2013, the company completed the

divestiture of its Showcase Reporting product set to Help/Sys-

tems. Showcase Reporting, which was acquired by the company

through the SPSS acquisition in 2009, is an enterprise-class busi-

ness intelligence platform that enables customers to build and

manage analytical reporting environments.

In the fourth quarter of 2013, the company completed two

divestitures, the Applicazioni Contabili Gestionali (ACG) business

and the Cognos Application Development Tools (ADT) business.

The ACG business was purchased by TeamSystem. The ACG

product is an Italian Enterprise Resource Planning solution for

small- and medium-sized companies. The Cognos ADT busi-

ness was purchased by UNICOM Systems, Inc. The Cognos ADT

product suite represents a legacy family of products that pro-

vide application development environments that would enable

programmers to develop COBOL applications at a higher pro-

ductivity level.

Financial terms of each transaction did not have a material

impact in the consolidated financial results.

2012

Retail Stores—On April17, 2012, the company announced that it

had signed a definitive agreement with Toshiba TEC for the sale of

its Retail Store Solutions business. As part of the transaction, the

company agreed to transfer the maintenance business to Toshiba

TEC within three years of the original closing of the transaction.

In the fourth quarter of 2014, the company completed the fourth

phase of the transfer of the maintenance workforce to Toshiba.

A subsequent wave closing is scheduled to be completed in the

first quarter of 2015. The parts and inventory transfer to Toshiba

will commence in the first quarter of 2015 and is expected to be

completed by the third quarter of 2015. The workforce transfer

and an assessment of the ongoing contractual terms of the overall

transaction resulted in the recognition of an additional pre-tax gain

of $6 million in the fourth quarter of 2014.

The company expects to close the final phase of the divestiture

in the third quarter of 2015. Overall, the company expects to rec-

ognize a cumulative total pre-tax gain on the sale of approximately

$517 million, of which $511 million has been recognized through

December 31, 2014.