IBM 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

101

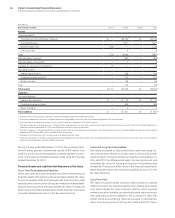

Summarized financial information for discontinued operations

is shown below.

($ in millions)

For the year ended December 31: 2014 2013 2012

Total revenue $ 1,335 $1,384 $1,633

Loss from discontinued operations,

before tax (619) (720)(638)

Loss on disposal, before tax (4,726) — —

Total loss from discontinued

operations, before income taxes (5,346) (720)(638)

Provision (benefit) for income taxes (1,617) (322)(243)

Loss from discontinued

operations, net of tax $(3,729) $ (398 ) $ (395 )

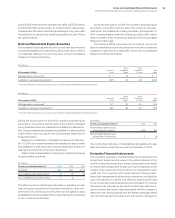

The assets and liabilities at December 31, 2014 presented below

are classified as held for sale.

($ in millions)

At December 31: 2014 2013

Assets:

Accounts receivable $245 $ 166

Inventory 380 481

Property, plant & equipment, net —2,322

Other assets 92 90

Total assets $717 $3,059

Liabilities:

Accounts payable $177 $ 172

Deferred income 87 84

Other liabilities 163 20

Total liabilities $427 $ 276

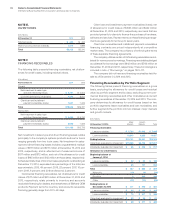

Industry Standard Server—On January23, 2014, IBM and Lenovo

Group Limited (Lenovo) announced a definitive agreement in which

Lenovo would acquire the company’s industry standard server

portfolio for an adjusted purchase price of $2.1 billion, consisting

of approximately $1.8 billion in cash, with the balance in Lenovo

common stock. The stock represented less than 5percent

equity ownership in Lenovo. The company would sell to Lenovo

its Systemx, BladeCenter and Flex System blade servers and

switches, x86-based Flex integrated systems, NeXtScale and

iDataPlex servers and associated software, blade networking and

maintenance operations.

IBM and Lenovo have entered into a strategic relationship

which will include a global OEM and reseller agreement for sales of

IBM’s industry-leading entry and midrange Storwize disk storage

systems, tape storage systems, General Parallel File System soft-

ware, SmartCloud Entry offering, and elements of IBM’s system

software, including Systems Director and Platform Computing

solutions. Effective with the initial closing of the transaction, Lenovo

has assumed related customer service and maintenance opera-

tions. IBM will continue to provide maintenance delivery and

warranty services on Lenovo’s behalf for an extended period of

time. In addition, as part of the transaction agreement, the com-

pany will provide Lenovo with certain transition services, including

IT and supply chain services. The initial term for these transition

services ranges from less than one year to three years. Lenovo

can renew certain services for an additional year.

The transaction will be completed in phases. The initial closing

occurred on October1, 2014. A subsequent closing occurred in

most other countries in which there was a large business footprint

on December31, 2014. The remaining countries are expected to

close in early 2015.

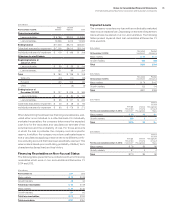

The company expects to recognize a total pre-tax gain on the

sale of approximately $1.5 billion, which does not include associ-

ated costs related to transition and performance-based costs. Net

of these charges, the pre-tax gain is approximately $1.2 billion, of

which $1.1 billion was recorded in the fourth quarter of 2014. The

balance of the gain is expected to be recognized in 2019 upon

conclusion of the maintenance delivery agreement.

The company’s industry standard server business is reported

in the Systems and Technology segment, and the associated main-

tenance operations are part of the Global Technology Services

segment. In 2013, this combined business delivered approximately

$4.6 billion of revenue and was essentially breakeven on a pre-tax

income basis.

The classification of the industry standard server business as

held for sale at September30, 2014 was based on meeting all

of the criteria for such classification in the applicable account-

ing guidance. While the company met certain criteria for held for

sale classification in prior periods, it did not meet the criteria that

the disposal group was available for immediate sale in its present

condition until September30, 2014. Prior to that date, the company

was engaged in the regulatory review process and in the activi-

ties necessary to separate the tangible assets and prepare such

assets for sale. At December31, 2014, the assets and liabilities

remaining as held for sale were immaterial.

In addition, at September30, 2014, the company concluded

that the industry standard server systems business did not meet

the criteria for discontinued operations reporting. The disposal

group consists of the industry standard server systems business

and associated maintenance operations. The industry standard

server systems business constitutes a component under account-

ing guidance, while the maintenance operations do not meet the

definition of a component. Due to the significance of the continuing

cash flows with the disposal group after the transaction closes, the

company did not meet the criteria to report the industry standard

server systems business as a discontinued operation.