IBM 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

Management Discussion

International Business Machines Corporation and Subsidiary Companies

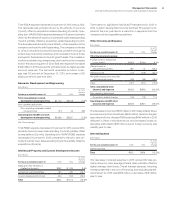

Total liabilities increased $3.1 billion ($4.5 billion adjusted for cur-

rency) from December31, 2012 driven by:

• Increased total debt ($6.4 billion) and increases in deferred

tax liabilities ($1.3 billion); partially offset by

• Decreased retirement and nonpension postretirement ben-

efit obligations ($4.2 billion) and decreases in compensation

and benefits ($0.9 billion).

Total equity of $22.9 billion increased $3.9 billion from Decem-

ber31, 2012 as a result of:

• Higher retained earnings ($12.4 billion), decreased losses in

accumulated other comprehensive income/(loss) of $4.2 billion

and increased common stock ($1.5 billion), partially offset by

• Increased treasury stock ($14.1 billion) driven by share

repurchases.

The company generated $17.5 billion in cash flow provided by

operating activities, a decrease of $2.1 billion when compared

to 2012, primarily driven by operational performance and a net

increase in the use of cash for taxes of $2.2 billion primarily driven

by an increase in cash tax payments. Net cash used in investing

activities of $7.3 billion was $1.7 billion lower than 2012, primarily

due to a decrease in cash used associated with the net purchases

and sales of marketable securities and other investments ($1.2

billion) and decreased net capital investments ($0.5 billion). Net

cash used in financing activities of $9.9 billion was $2.1 billion lower

compared to 2012, primarily due to increased proceeds from net

debt ($4.7 billion), partially offset by increased cash used for gross

common stock repurchases ($1.9 billion).

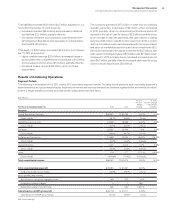

Results of Continuing Operations

Segment Details

The following is an analysis of the 2013 versus 2012 reportable segment results. The table below presents each reportable segment’s

external revenue and gross margin results. Segment pre-tax income includes transactions between segments that are intended to reflect

an arm’s-length transfer price and excludes certain unallocated corporate items.

($ in millions)

For the year ended December 31: 2013 2012

Yr.-to-Yr.

Percent/

Margin

Change

Yr.-to-Yr.

Percent Change

Adjusted for

Currency

Revenue

Global Technology Services $38,551 $ 40,236 (4.2)% (1.4)%

Gross margin 38.1% 36.6% 1.5 pts.

Global Business Services 18,396 18,566 (0.9)% 2.6%

Gross margin 30.9% 30.0% 0.9 pts.

Software 25,932 25,448 1.9% 2.9%

Gross margin 88.8% 88.7% 0.1 pts.

Systems and Technology 12,988 16,034 (19.0)% (18.2)%

Gross margin 40.8% 43.4% (2.6) pts.

Global Financing 2,022 2,013 0.4% 2.8%

Gross margin 45.6% 46.5% (0.9 ) pts.

Other 478 577 (17.1)% (16.4)%

Gross margin (195.6)% (71.6)% (124.0) pts.

Total consolidated revenue $98,367 $102,874 (4.4)% (2.3)%

Total consolidated gross profit $48,684 $ 50,361 (3.3)%

Total consolidated gross margin 49.5% 49.0% 0.5 pts.

Non-operating adjustments

Amortization of acquired intangible assets 388 375 3.5%

Acquisition-related charges 5 1 NM

Retirement-related costs/(income) 629 264 138.1%

Operating (non-GAAP) gross profit $49,706 $ 51,001 (2.5)%

Operating (non-GAAP) gross margin 50.5% 49.6% 1.0 pts.

NM—Not meaningful