IBM 2014 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

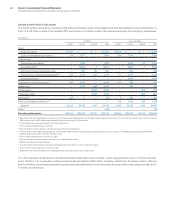

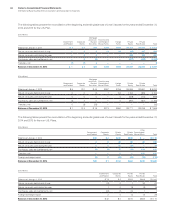

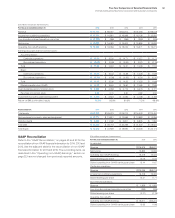

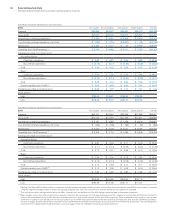

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

144

Defined Contribution Plans

The company contributed $1,239 million and $1,361 million in cash

to the defined contribution plans during the years ended Decem-

ber 31, 2014 and 2013, respectively. In 2015, the company estimates

cash contributions to the defined contribution plans to be approxi-

mately $1.2 billion.

Nonpension Postretirement Benefit Plans

The company contributed $144 million and $80 million to the

nonpension postretirement benefit plans during the years ended

December 31, 2014 and 2013, respectively. These contribution

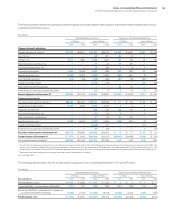

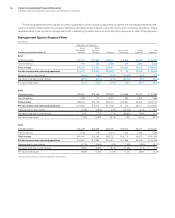

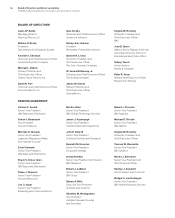

($ in millions)

Qualified

U.S. Plan

Payments

Nonqualified

U.S. Plans

Payments

Qualified

Non-U.S. Plans

Payments

Nonqualified

Non-U.S. Plans

Payments

Total

Expected

Benefit

Payments

2015 $ 3,449 $113 $ 1,849 $ 348 $ 5,758

2016 3,476 115 1,854 344 5,790

2017 3,492 117 1,880 348 5,837

2018 3,501 118 1,911 357 5,887

2019 3,458 120 1,949 374 5,901

2020–2024 17,566 607 10,290 2,060 30,523

The 2015 expected benefit payments to defined benefit pension plan participants not covered by the respective plan assets (underfunded

plans) represent a component of compensation and benefits, within current liabilities, in the Consolidated Statement of Financial Position.

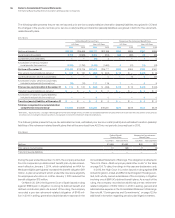

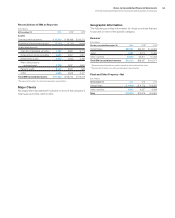

Nonpension Postretirement Benefit Plan Expected Payments

The following table reflects the total expected benefit payments to nonpension postretirement benefit plan participants. These payments

have been estimated based on the same assumptions used to measure the plans’ APBO at December 31, 2014.

($ in millions)

U.S. Plan

Payments

Qualified

Non-U.S. Plans

Payments

Nonqualified

Non-U.S. Plans

Payments

Total

Expected

Benefit

Payments

2015 $ 426 $ 8 $ 31 $ 465

2016 405 8 35 448

2017 410 9 38 457

2018 412 9 41 463

2019 412 10 44 466

2020–2024 1,871 59 257 2,187

The 2015 expected benefit payments to nonpension postretirement benefit plan participants not covered by the respective plan assets

represent a component of compensation and benefits, within current liabilities, in the Consolidated Statement of Financial Position.

amounts exclude the Medicare-related subsidy discussed on

page 145.

Expected Benefit Payments

Defined Benefit Pension Plan Expected Payments

The following table presents the total expected benefit payments

to defined benefit pension plan participants. These payments

have been estimated based on the same assumptions used to

measure the plans’ PBO at December 31, 2014 and include ben-

efits attributable to estimated future compensation increases,

where applicable.