IBM 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

Management Discussion

International Business Machines Corporation and Subsidiary Companies

in the UNIX market, and took two actions to improve its business

model in Power Systems. First, it is making the platform more rel-

evant to clients. To achieve this:

• In the fourth quarter of 2013, the company introduced a new

Integrated Facility for Linux offering which enables clients to

run Linux workloads in their existing servers. This mirrors the

successful strategy the company executed on the Systemz

platform;

• The company will expand its Linux relevance even further

with POWER8 in 2014, which will provide additional big data

and cloud capabilities; and

• Through the company’s OpenPOWER consortium it is making

Power technology available to an open development alliance,

building an ecosystem around the Power technologies.

Secondly, even with these additional capabilities, the company

recognizes that the size of the Power platform will not return to

prior revenue levels. The company will take action by right-sizing

the business for the demand characteristics it expects.

Systemx revenue decreased 13.5percent (13percent adjusted

for currency) in 2013 versus 2012. High-end Systemx revenue

decreased 16percent (16percent adjusted for currency) and

blades revenue declined 45percent (45percent adjusted for cur-

rency) in 2013 compared to 2012. The declines in both high-end

Systemx and blade were partially offset by increased revenue

driven by Pure Systems.

Storage revenue decreased 10.8percent (10percent adjusted

for currency) in 2013 versus 2012. The company’s flash solu-

tions continued to gain momentum in 2013 with positive revenue

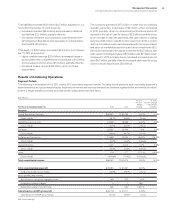

Geographic Revenue

In addition to the revenue presentation by reportable segment, the company also measures revenue performance on a geographic basis.

The following geographic, regional and country-specific revenue performance excludes OEM revenue.

($ in millions)

For the year ended December 31: 2013 2012

Yr.-to-Yr.

Percent

Change

Yr.-to-Yr.

Percent Change

Adjusted for

Currency

Total revenue $98,367 $102,874 (4.4)% (2.3)%

Geographies $97,800 $102,268 (4.4)% (2.2)%

Americas 43,249 44,556 (2.9) (2.0)

Europe/Middle East/Africa 31,628 31,775 (0.5) (2.1)

Asia Pacific 22,923 25,937 (11.6) (2.8)

Major markets (4.2)% (2.2)%

Growth markets (4.9)% (2.4)%

BRIC countries (8.2)% (5.6)%

growth. The Storwize products delivered double-digit growth,

which were more than offset by declines in legacy OEM mid-range

offerings, and declines in high-end offerings driven by significant

pricing pressure.

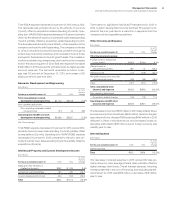

($ in millions)

For the year ended December 31: 2013 2012

Yr.-to-Yr.

Percent/

Margin

Change

Systems and Technology

External gross profit $5,299 $6,966 (23.9)%

External gross profit margin 40.8% 43.4% (2.6) pts.

Pre-tax income $ 213 $1,866 (88.6)%

Pre-tax margin 1.6%11.2%(9.6) pts.

The decrease in external gross profit in 2013 versus 2012 was due

to lower revenue and a lower overall gross profit margin reflecting

the business model challenges. Overall gross margin decreased

2.6points year to year in 2013 driven by lower margins in Power

Systems, Systemx and Storage as well as a decline due to revenue

mix, partially offset by margin improvement in Systemz.

Systems and Technology’s pre-tax income decreased

88.6percent to $213 million in 2013. Pre-tax margin decreased

9.6points in 2013 versus 2012.

Global Financing

See pages 73 through 77 for an analysis of Global Financing’s seg-

ment results.