IBM 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 Management Discussion

International Business Machines Corporation and Subsidiary Companies

Retirement-Related Plans

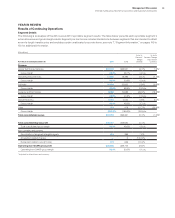

The following table provides the total pre-tax cost for all retirement-

related plans. These amounts are included in the Consolidated

Statement of Earnings within the caption (e.g., Cost, SG&A, RD&E)

relating to the job function of the plan participants.

($ in millions)

For the year ended December 31: 2014 2013

Yr.-to-Yr.

Percent

Change

Retirement-related plans—cost

Service cost $ 482 $ 545 (11.5)%

Amortization of prior

service cost/(credits) (114) (114) (0.1)

Cost of defined contribution plans 1,253 1,384 (9.5)

Total operating costs $ 1,621 $ 1,815 (10.7)%

Interest cost 3,994 3,728 7.1

Expected return on plan assets (6,351) (6,187) 2.7

Recognized actuarial losses 2,467 3,434 (28.2)

Plan amendments/curtailments/

settlements 25 0 NM

Multi-employer plan/other costs 218 86 154.5

Total non-operating costs/

(income) $ 353 $ 1,062 (66.7)%

Total retirement-related

plans—cost $ 1,974 $ 2,876 (31.4)%

NM—Not meaningful

In 2014, total retirement-related plan cost decreased by $902

million compared to 2013, primarily driven by a decrease in rec-

ognized actuarial losses ($967 million), higher actual return on plan

assets ($165 million) and lower defined contribution plans cost

($131 million), partially offset by higher interest cost ($266 million)

and higher pension obligations related to litigation ($139 million).

As discussed in the “Operating (non-GAAP) Earnings” section

on page 22, the company characterizes certain retirement-related

costs as operating and others as non-operating. Utilizing this char-

acterization, operating retirement-related costs in 2014 were $1,621

million, a decrease of $194 million compared to 2013, primarily

driven by lower defined contribution plans cost ($131 million) and

decreased service cost ($63 million). Non-operating costs of $353

million decreased $709 million in 2014, compared to the prior year,

driven primarily by the decrease in recognized actuarial losses

($967 million) and higher actual return on plan assets ($165 million),

partially offset by higher interest cost ($266 million) and higher

pension obligations related to litigation ($139 million).

Income Taxes

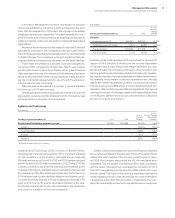

The continuing operations effective tax rate for 2014 was 21.2per-

cent, an increase of 4.6points versus the prior year, driven by the

following factors:

• The year-to-year impact of factors that benefited the 2013

rate (14.5points), including completion of the U.S. 2008–2010

tax audit and the associated reserve redeterminations

(11.1points), the retroactive impact of the 2012 American

Taxpayer Relief Act (0.7points), a tax agreement which

required a reassessment of certain valuation allowances on

deferred tax assets (1.4points), the resolution of certain

non-U.S. tax audits (0.7points) and newly enacted U.S. state

tax legislation (0.6points); and

• A tax charge related to the sale of the industry standard

server business (0.9points); partially offset by;

• A year-to-year benefit of reduced tax charges related to

certain intercompany payments made by foreign subsidiaries

and the intercompany licensing of certain IP (3.7points);

• An increased benefit in the utilization of foreign tax credits

(4.7points); and

• A benefit due to a more favorable geographic mix of pre-tax

income in 2014 (2.5points).

The continuing operations operating (non-GAAP) effective tax rate

was 21.0percent, an increase of 4.0points versus 2013 principally

driven by the same factors described above.

Earnings Per Share

Basic earnings per share is computed on the basis of the

weighted-average number of shares of common stock outstand-

ing during the period. Diluted earnings per share is computed on

the basis of the weighted-average number of shares of common

stock outstanding plus the effect of dilutive potential common

shares outstanding during the period using the treasury stock

method. Dilutive potential common shares include outstanding

stock options and stock awards.

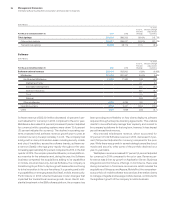

For the year ended December 31: 2014 2013

Yr.-to-Yr.

Percent

Change

Earnings per share of common stock

from continuing operations

Assuming dilution $15.59 $15.30 1.9%

Basic $15.68 $15.42 1.7%

Diluted operating (non-GAAP) $16.53 $16.64 (0.7)%

Weighted-average shares

outstanding (in millions)

Assuming dilution 1,010.0 1,103.0 (8.4)%

Basic 1,004.3 1,094.5 (8.2)%