IBM 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

Management Discussion

International Business Machines Corporation and Subsidiary Companies

differentiation, such as solutions that address the strategic imper

-

atives, there was good growth and gross margin performance.

However, in the more traditional parts of the portfolio, there was

continued price and profit pressure. The company will continue

to invest in the strategic imperatives and accelerate the transi-

tion to global delivery. Additionally, Global Process Services, the

business process outsourcing business, will be integrated with

GBS beginning in 2015 to create a seamless end-to-end business

transformation capability for clients.

Global Services Backlog

The estimated Global Services backlog at December 31, 2014

was $128 billion. This included a backlog reduction in 2014 of $3.7

billion associated with the customer care and industry standard

server divestitures. Adjusting for the divested businesses, backlog

was down 7.5percent as reported, but flatadjusted for currency

year to year. The estimated transactional backlog at December

31, 2014 decreased 7.6percent (1percent adjusted for currency)

from the December 31, 2013 levels. The estimated outsourcing

backlog decreased 11.0percent as reported, but increased 1per-

cent adjusted for the customer care divestiture (4points) and

currency (8points).

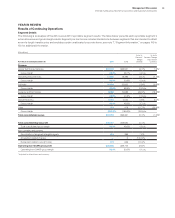

($ in billions)

At December 31: 2014 2013

Yr.-to-Yr.

Percent

Change

Yr.-to-Yr.

Percent Change

Adjusted for

Currency

Backlog

Total backlog $128.4 $142.8 (10.1)% (2.9)%

Adjusted for divested businesses (7.5) (0.2)

Outsourcing backlog 80.8 90.8 (11.0) (3.3)

Adjusted for customer care (7.1) 0.8

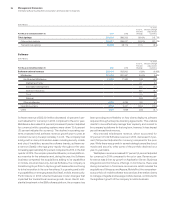

GTS gross profit margin increased 0.2points to 38.3percent in

2014. Pre-tax income decreased 9.2percent to $6,340 million and

the pre-tax margin declined 1.0points to 16.7percent compared

to the prior year. While there was a benefit from the pre-tax gain

of $202 million related to the customer care divestiture in 2014,

this benefit was offset by investments in areas like new resil-

iency centers, additional security skills and the SoftLayer cloud

hub expansion, plus the lost profit from the divested businesses.

Overall, the profit performance in GTS reflects the actions that

the company has taken to transform the business. The company

has invested in its strategic imperatives to accelerate growth,

continued to optimize its delivery platform through workforce

rebalancing and broader use of automation, and divested busi-

nesses, all impacting the year-to-year results. While these actions

all have near-term impacts to profit, they position the business

more effectively going forward and will enable it to deliver more

value to clients.

GBS gross profit margin of 30.8percent was flat year to

year compared to 2013. Pre-tax income decreased 6.7percent

to $2,999 million and the pre-tax margin declined 0.5points to

16.3percent. In 2014, profit was impacted by lower revenue on a

relatively fixed cost base. In areas where the company has strong

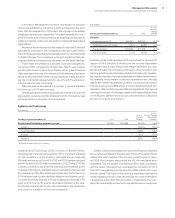

Total Global Services backlog includes GTS Outsourcing, ITS,

GBS Outsourcing, Consulting and Systems Integration and Main-

tenance. Outsourcing backlog includes GTS Outsourcing and GBS

Outsourcing. Transactional backlog includes ITS and Consulting

and Systems Integration. Total backlog is intended to be a state-

ment of overall work under contract and therefore does include

Maintenance. Backlog estimates are subject to change and are

affected by several factors, including terminations, changes in the

scope of contracts, periodic revalidations, adjustments for revenue

not materialized and adjustments for currency.

Global Services signings are management’s initial estimate of

the value of a client’s commitment under a Global Services con-

tract. There are no third-party standards or requirements governing

the calculation of signings. The calculation used by management

involves estimates and judgments to gauge the extent of a client’s

commitment, including the type and duration of the agreement,

and the presence of termination charges or wind-down costs.

Signings include GTS Outsourcing, ITS, GBS Outsourcing and

Consulting and Systems Integration contracts. Contract exten-

sions and increases in scope are treated as signings only to the

extent of the incremental new value. Maintenance is not included

in signings as maintenance contracts tend to be more steady state,

where revenues equal renewals.

Contract portfolios purchased in an acquisition are treated as

positive backlog adjustments provided those contracts meet the

company’s requirements for initial signings. A new signing will be

recognized if a new services agreement is signed incidental or

coincidental to an acquisition or divestiture.