IBM 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

Management Discussion

International Business Machines Corporation and Subsidiary Companies

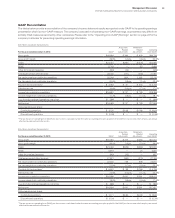

Total SG&A expense decreased 0.1percent in 2013 versus 2012.

The decrease was primarily driven by the effects of currency

(1point), offset by acquisition-related spending (2points). Oper-

ating (non-GAAP) SG&A expense decreased 0.6percent primarily

driven by the effects of currency (1point) and lower base spending

(1point), partially offset by acquisition-related spending (1point).

The decrease was driven by lower SG&A—other expense, as the

company continued to shift its spending. The company continued

to drive productivity across the business, primarily through its

enterprise productivity initiatives, and reinvested most of those

savings into the business to drive its growth areas. The increase in

workforce rebalancing charges was due to actions the company

took in the second quarter of 2013. Bad debt expense increased

$106 million in 2013 versus 2012, primarily driven by higher specific

account reserves. The accounts receivable provision cover-

age was 1.6percent at December31, 2013, an increase of 20

basispoints from year-end 2012.

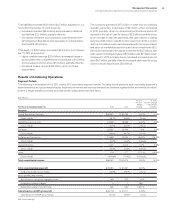

Research, Development and Engineering

($ in millions)

For the year ended December 31: 2013 2012

Yr.-to-Yr.

Percent

Change

Total consolidated research,

development and engineering $5,743 $5,816 (1.3)%

Non-operating adjustment

Non-operating retirement-related

(costs)/income (57)20 NM

Operating (non-GAAP) research,

development and engineering $5,686 $5,837 (2.6)%

NM—Not meaningful

Total RD&E expense decreased 1.3percent in 2013 versus 2012,

primarily driven by lower base spending (3points), partially offset

by acquisitions (2points). Operating (non-GAAP) RD&E expense

decreased 2.6percent in 2013 compared to the prior year pri-

marily driven by lower base spending (5points), partially offset by

acquisitions (2points).

Intellectual Property and Custom Development Income

($ in millions)

For the year ended December 31: 2013 2012

Yr.-to-Yr.

Percent

Change

Sales and other transfers of

intellectual property $352 $ 324 8.8%

Licensing/royalty-based fees 150 251 (40.1)

Custom development income 320 500 (36.0)

Total $822 $1,074 (23.5)%

There were no significant individual IP transactions in 2013 or

2012. Custom development income declined 36percent com-

pared to the prior year due to a reduction in payments from the

company’s technology alliance partners.

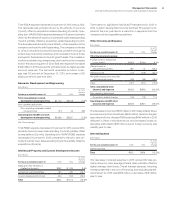

Other (Income) and Expense

($ in millions)

For the year ended December 31: 2013 2012

Yr.-to-Yr.

Percent

Change

Other (income) and expense

Foreign currency transaction

losses/(gains) $(260) $(240) 8.4%

(Gains)/losses on

derivative instruments 166 72 132.5

Interest income (74) (109)(32.2)

Net (gains)/losses from securities

and investment assets (29)(55)(48.0)

Other (137)(511)(73.3)

Total consolidated other

(income) and expense $(333)$(843)(60.5)%

Non-operating adjustment

Acquisition-related charges (16)(13)17.4

Operating (non-GAAP) other

(income) and expense $(349)$(857)(59.3)%

The decrease in income of $510 million in 2013 was primarily driven

by lower income from divestitures ($405 million) driven by the gain

associated with the divested RSS business ($446 million) in 2012

reflected in Other in the table above, and increased losses on

derivative instruments ($95 million) due to foreign currency rate

volatility year to year.

Interest Expense

($ in millions)

For the year ended December 31: 2013 2012

Yr.-to-Yr.

Percent

Change

Interest expense

Total $402 $459 (12.5)%

The decrease in interest expense in 2013 versus 2012 was pri-

marily driven by lower average interest rates, partially offset by

higher average debt levels. Overall interest expense, including

interest presented in the cost of financing, and excluding capital-

ized interest, for 2013 was $989 million, a decrease of $15 million

year to year.