IBM 2014 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

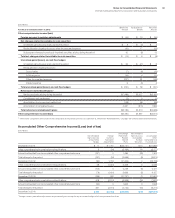

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

117

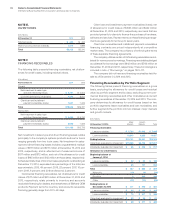

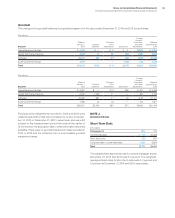

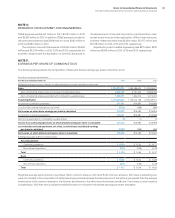

Post-Swap Borrowing (Long-Term Debt, Including Current Portion)

(in millions)

2014 2013

For the year ended December 31: Amount Average Rate Amount Average Rate

Fixed-rate debt $27,255 3.09% $30,123 3.07%

Floating-rate debt* 12,420 0.82% 6,587 0.87%

Total $39,675 $36,710

* Includes $5,839 million in 2014 and $3,106 million in 2013 of notional interest rate swaps that effectively convert fixed-rate long-term debt into floating-rate debt. (See note D,

“Financial Instruments,” on pages 105 through 109).

The company’s indenture governing its debt securities and its

various credit facilities each contain significant covenants which

obligate the company to promptly pay principal and interest, limit

the aggregate amount of secured indebtedness and sale and

leaseback transactions to 10percent of the company’s consoli-

dated net tangible assets, and restrict the company’s ability to

merge or consolidate unless certain conditions are met. The credit

facilities also include a covenant on the company’s consolidated

net interest expense ratio, which cannot be less than 2.20 to 1.0,

as well as a cross default provision with respect to other defaulted

indebtedness of at least $500 million.

The company is in compliance with all of its significant debt

covenants and provides periodic certifications to its lenders. The

failure to comply with its debt covenants could constitute an event

of default with respect to the debt to which such provisions apply.

If certain events of default were to occur, the principal and interest

on the debt to which such event of default applied would become

immediately due and payable.

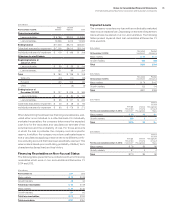

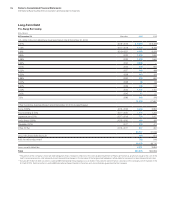

Pre-swap annual contractual maturities of long-term debt out-

standing at December31, 2014, are as follows:

($ in millions)

Total

2015 $ 4,600

2016 5,331

2017 5,242

2018 2,621

2019 4,069

2020 and beyond 17,874

Total $39,737

Interest on Debt

($ in millions)

For the year ended December 31: 2014 2013 2012

Cost of financing $ 542 $ 587 $ 545

Interest expense 484 405 470

Net investment derivative activity 0(3) (11)

Interest capitalized 422 18

Total interest paid and accrued $1,030 $1,011 $1,022

Refer to the related discussion on page 148 in note T, “Segment

Information,” for total interest expense of the Global Financing seg-

ment. See note D, “Financial Instruments,” on pages 105 through

109 for a discussion of the use of currency and interest rate swaps

in the company’s debt risk management program.

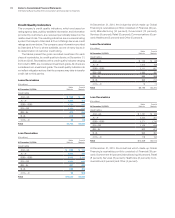

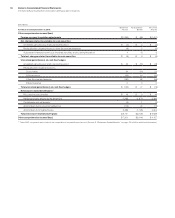

Lines of Credit

In 2014, the company extended the term of its five-year, $10 billion

Credit Agreement (the “Credit Agreement”) by one year to Novem-

ber 10, 2019. The total expense recorded by the company related

to this global credit facility was $5.4 million in 2014, $5.4 million in

2013 and $5.3 million in 2012. The Credit Agreement permits the

company and its Subsidiary Borrowers to borrow up to $10 billion

on a revolving basis. Borrowings of the Subsidiary Borrowers will be

unconditionally backed by the company. The company may also,

upon the agreement of either existing lenders, or of the additional

banks not currently party to the Credit Agreement, increase the

commitments under the Credit Agreement up to an additional $2.0

billion. Subject to certain terms of the Credit Agreement, the com-

pany and Subsidiary Borrowers may borrow, prepay and reborrow

amounts under the Credit Agreement at any time during the Credit

Agreement. Interest rates on borrowings under the Credit Agree-

ment will be based on prevailing market interest rates, as further

described in the Credit Agreement. The Credit Agreement contains

customary representations and warranties, covenants, events of

default, and indemnification provisions. The company believes that

circumstances that might give rise to breach of these covenants

or an event of default, as specified in the Credit Agreement, are

remote. As of December 31, 2014, there were no borrowings by the

company, or its subsidiaries, under the Credit Agreement.

The company also has other committed lines of credit in some

of the geographies which are not significant in the aggregate. Inter-

est rates and other terms of borrowing under these lines of credit

vary from country to country, depending on local market conditions.