IBM 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

Management Discussion

International Business Machines Corporation and Subsidiary Companies

with diluted earnings per share of $5.51. The company generated

$6.1 billion in cash from operations and $6.6 billion in free cash flow

in the fourth quarter driving shareholder returns of $1.2 billion in

gross common stock repurchases and dividends.

The company’s results in the fourth quarter were impacted

by the dramatic strengthening of the U.S. dollar which began in

September and continued at a rapid pace. In addition, nearly all the

currencies moved in an unfavorable direction for the company’s

business profile and impacted revenue and earnings. Although the

company hedges a portion of its cross-border cash flows which

defers the impacts of currency movement, it does not eliminate it.

The company’s hedges are designed to provide stability around

the receipt of cash, but there is no year-to-year benefit in the

income statement when a currency’s direction is sustained over

a longer period.

In the fourth quarter, total consolidated revenue decreased

11.9percent as reported and 2percent adjusted for currency

(5points) and the divestitures of the industry standard server and

customer care businesses (5points). These impacts represented

approximately $2.8 billion in revenue and a 10-point impact to

the year-to-year growth rate. In the fourth quarter, the company

continued its strong performance in its strategic imperatives

that address the market shifts in data, cloud and engagement.

Together they delivered double-digit growth, as they did in every

quarter during 2014.

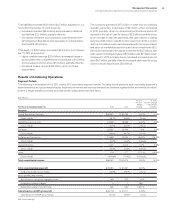

Within the company’s segments, Global Services revenue

declined 7.8percent as reported, but was flat year to year adjusted

for currency (6points) and the divestitures (2points). Global

Technology Services revenue decreased 7.6percent as reported,

but increased 2percent adjusted for currency (6points) and the

divested businesses (4points) with growth across all business

lines. Global Business Services revenue decreased 8.4percent

(3percent adjusted for currency). Software revenue decreased

6.9percent (3percent adjusted for currency). Systems and

Technology revenue decreased 39.0percent as reported and

12percent adjusted for the industry standard server divestiture

(24points) and currency (3points), reflecting the end of the product

cycle in Systemz and declines in Power Systems and Storage.

From a geographic perspective, revenue in the major markets

declined 10.8percent as reported and 2percent adjusted for cur-

rency (5points) and the divestitures (4points). The growth markets

declined 15.7percent as reported and 2percent adjusted for the

divestitures (9points) and currency (5points) compared to the

fourth quarter of the prior year. Within the growth markets, the

BRIC countries decreased 21.4percent as reported and 8percent

adjusted for the divestitures (9points) and currency (4points).

The consolidated gross profit margin increased 1.0points

versus the fourth quarter of 2013 to 53.3percent. The operating

(non-GAAP) gross margin of 53.9percent increased 0.6points

year to year driven primarily by improvements in GBS, and a mix

away from the low margin industry standard server business.

Total expense and other (income) decreased 20.3percent in

the fourth quarter of 2014 compared to the prior year. Total oper-

ating (non-GAAP) expense and other (income) also decreased

20.3percent year to year. The key drivers of the year-to-year

change in total expense and other (income) were approximately:

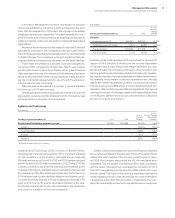

Total Operating

Consolidated (non-GAAP)

• Currency* (5) points (4) points

• Acquisitions** 1 points 1 points

• Base expense (17) points (17) points

* Reflects impacts of translation and hedging programs.

** Includes acquisitions completed in prior 12-month period; operating (non-GAAP) is

net of non-operating acquisition-related charges.

The reported level of expense in the fourth quarter reflected not

only the ongoing run rate of the business, but also the impact of

the industry standard server divestiture and a charge for workforce

rebalancing. The entire year-to-year decline was driven by the com-

bination of the gain on the divestiture and the fact that the expense

for the industry standard server business is no longer in the run

rate. Adjusting for this divestiture, total operating (non-GAAP)

expense and other (income) would have increased approximately

2percent (6percent adjusted for currency and acquisitions)

including the workforce rebalancing charge of approximately $580

million, nearly all of which was a year-to-year increase.

Pre-tax income from continuing operations of $7.1 billion

decreased 0.1percent year to year and the pre-tax margin was

29.4percent, an increase of 3.5points versus the fourth quar-

ter of 2013. The continuing operations effective tax rate for the

fourth quarter was 22.3percent, up 9.8points year to year. This

increase was primarily due to a benefit included in the prior year

rate associated with the settlement of a U.S. tax audit in the fourth

quarter of 2013. Income from continuing operations of $5.5 billion

decreased 11.3percent year to year and the net income margin

was 22.9percent, an increase of 0.2points. Net income of $5.5

billion decreased $701 million year to year. Operating (non-GAAP)

pre-tax income from continuing operations decreased 2.3per-

cent year to year and the operating (non-GAAP) pre-tax margin

was 30.7percent, an increase of 3.0points year to year. Operat-

ing (non-GAAP) income from continuing operations decreased

13.0percent and the operating (non-GAAP) income margin of

24.0percent decreased 0.3points compared to the prior year. The

operating (non-GAAP) effective tax rate from continuing operations

was 21.8percent versus 12.2percent in the fourth quarter of 2013

driven by the same factor described above.

Diluted earnings per share from continuing operations of $5.54

decreased 3.8percent year to year. Operating (non-GAAP) diluted

earnings per share of $5.81 decreased 5.7percent versus the

fourth quarter of 2013. Diluted earnings per share from discontin-

ued operations was ($0.03) in the fourth quarter of both years. In

the fourth quarter of 2014, the company repurchased 0.7 million

shares of its common stock.