IBM 2014 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

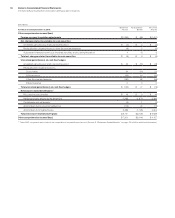

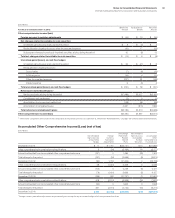

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

118

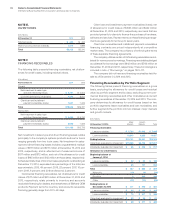

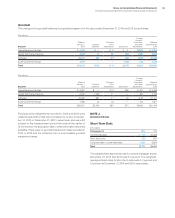

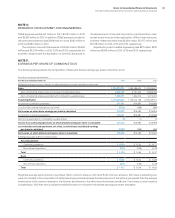

NOTE K.

OTHER LIABILITIES

($ in millions)

At December 31: 2014 2013

Income tax reserves $3,146 $3,189

Excess 401(k) Plus Plan 1,658 1,673

Disability benefits 675 699

Derivative liabilities 31 126

Special restructuring actions 431 440

Workforce reductions 469 500

Deferred taxes 288 1,741

Other taxes payable 17 186

Environmental accruals 240 231

Warranty accruals 91 171

Asset retirement obligations 136 129

Acquisition related 50 205

Divestiture related* 1,124 40

Other 536 604

Total $8,892 $9,934

*

Primarily includes accruals in 2014 related to the expected divestiture of the Micro-

electronics business.

In response to changing business needs, the company periodi-

cally takes workforce reduction actions to improve productivity,

cost competitiveness and to rebalance skills. The noncurrent

contractually obligated future payments associated with these

activities are reflected in the workforce reductions caption in the

previous table.

In addition, the company executed certain special restruc-

turing-related actions prior to 2006. The previous table provides

the noncurrent liabilities associated with these special actions.

Current liabilities are included in other accrued expenses and

liabilities in the Consolidated Statement of Financial Position and

were immaterial at December31, 2014.

The noncurrent liabilities are workforce accruals related to ter-

minated employees who are no longer working for the company

who were granted annual payments to supplement their incomes

in certain countries. Depending on the individual country’s legal

requirements, these required payments will continue until the

former employee begins receiving pension benefits or passes away.

The company employs extensive internal environmental protec-

tion programs that primarily are preventive in nature. The company

also participates in environmental assessments and cleanups at

a number of locations, including operating facilities, previously

owned facilities and Superfund sites. The company’s maximum

exposure for all environmental liabilities cannot be estimated and

no amounts have been recorded for non-ARO environmental

liabilities that are not probable or estimable. The total amounts

accrued for non-ARO environmental liabilities, including amounts

classified as current in the Consolidated Statement of Financial

Position, that do not reflect actual or anticipated insurance recov-

eries, were $254 million and $245 million at December31, 2014

and 2013, respectively. Estimated environmental costs are not

expected to materially affect the consolidated financial position or

consolidated results of the company’s operations in future periods.

However, estimates of future costs are subject to change due to

protracted cleanup periods and changing environmental remedia-

tion regulations.

As of December31, 2014, the company was unable to esti-

mate the range of settlement dates and the related probabilities for

certain asbestos remediation AROs. These conditional AROs are

primarily related to the encapsulated structural fireproofing that is

not subject to abatement unless the buildings are demolished and

non-encapsulated asbestos that the company would remediate

only if it performed major renovations of certain existing buildings.

Because these conditional obligations have indeterminate settle-

ment dates, the company could not develop a reasonable estimate

of their fair values. The company will continue to assess its ability

to estimate fair values at each future reporting date. The related

liability will be recognized once sufficient additional information

becomes available. The total amounts accrued for ARO liabilities,

including amounts classified as current in the Consolidated State-

ment of Financial Position were $180 million and $160 million at

December31, 2014 and 2013, respectively.

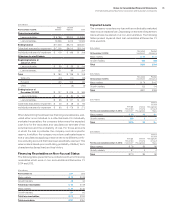

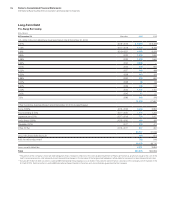

NOTE L.

EQUITY ACTIVITY

The authorized capital stock of IBM consists of 4,687,500,000

shares of common stock with a $.20 per share par value, of which

990,523,759 shares were outstanding at December31, 2014 and

150,000,000 shares of preferred stock with a $.01 per share par

value, none of which were outstanding at December31, 2014.

Stock Repurchases

The Board of Directors authorizes the company to repurchase IBM

common stock. The company repurchased 71,504,867 common

shares at a cost of $13,395 million, 73,121,942 common shares

at a cost of $13,993 million and 61,246,371 common shares at a

cost of $12,008 million in 2014, 2013 and 2012, respectively. These

amounts reflect transactions executed through December31 of

each year. Actual cash disbursements for repurchased shares may

differ due to varying settlement dates for these transactions. At

December31, 2014, $6,264 million of Board common stock repur-

chase authorization was available. The company plans to purchase

shares on the open market or in private transactions from time to

time, depending on market conditions.