IBM 2014 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

127

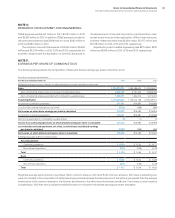

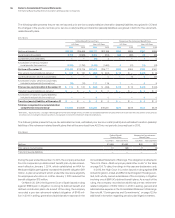

NOTE O.

RESEARCH, DEVELOPMENT AND ENGINEERING

RD&E expense was $5,437 million in 2014, $5,743 million in 2013

and $5,816 million in 2012. In addition, RD&E expense included in

discontinued operations was $368 million in 2014, $483 million in

2013 and $486 million in 2012.

The company incurred total expense of $5,595 million, $5,959

million and $6,034 million in 2014, 2013 and 2012, respectively, for

scientific research and the application of scientific advances to

the development of new and improved products and their uses,

as well as services and their application. Within these amounts,

software-related expense was $3,064 million, $3,077 million and

$3,078 million in 2014, 2013 and 2012, respectively.

Expense for product-related engineering was $211 million, $267

million and $268 million in 2014, 2013 and 2012, respectively.

NOTE P.

EARNINGS PER SHARE OF COMMON STOCK

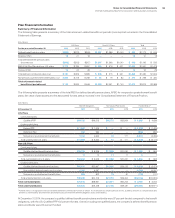

The following table presents the computation of basic and diluted earnings per share of common stock.

($ in millions except per share amounts)

For the year ended December 31: 2014 2013 2012

Weighted-average number of shares on which earnings per share calculations are based

Basic 1,004,272,584 1,094,486,604 1,142,508,521

Add—incremental shares under stock-based compensation plans 4,332,155 6,751,240 10,868,426

Add—incremental shares associated with contingently issuable shares 1,395,741 1,804,313 2,072,370

Assuming dilution 1,010,000,480 1,103,042,156 1,155,449,317

Income from continuing operations $15,751 $16,881 $16,999

Loss from discontinued operations, net of tax (3,729) (398) (395)

Net income on which basic earnings per share is calculated $12,022 $16,483 $16,604

Income from continuing operations $15,751 $16,881 $16,999

Net income applicable to contingently issuable shares (3) (1) (1)

Income from continuing operations on which diluted earnings per share is calculated $15,749 $16,880 $16,998

Loss from discontinued operations, net of tax, on which basic and diluted earnings

per share is calculated (3,729) (398 ) (395 )

Net income on which diluted earnings per share is calculated $12,020 $16,483 $16,603

Earnings/(loss) per share of common stock

Assuming dilution

Continuing operations $ 15.59 $ 15.30 $ 14.71

Discontinued operations (3.69) (0.36) (0.34)

Total $ 11.90 $ 14.94 $ 14.37

Basic

Continuing operations $ 15.68 $ 15.42 $ 14.88

Discontinued operations (3.71) (0.36) (0.35)

Total $ 11.97 $ 15.06 $ 14.53

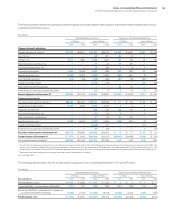

Weighted-average stock options to purchase 17,420 common shares in 2014 and 8,797 common shares in 2013 were outstanding, but

were not included in the computation of diluted earnings per share because the exercise price of the options was greater than the average

market price of the common shares for the full year, and therefore, the effect would have been antidilutive. There were no stock options

outstanding in 2012 that were considered antidilutive and not included in the diluted earnings per share calculation.