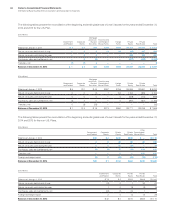

IBM 2014 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

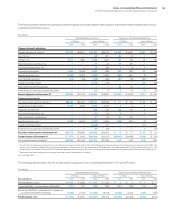

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

134

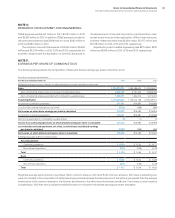

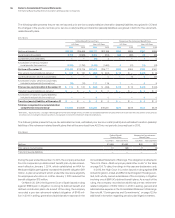

($ in millions)

Defined Benefit Pension Plans

U.S. Plans Non-U.S. Plans

For the year ended December 31: 2014 2013 2012 2014 2013 2012

Service cost $ — $ — $ — $ 449 $ 501 $ 443

Interest cost 2,211 1,980 2,196 1,533 1,524 1,779

Expected return on plan assets (4,096) (3,981) (4,043) (2,247) (2,195) (2,303)

Amortization of transition assets —— — 00 0

Amortization of prior service costs/(credits) 10 10 10 (111) (119) (154)

Recognized actuarial losses 1,056 1,790 1,331 1,400 1,600 1,027

Curtailments and settlements —— — 26 0 0

Multi-employer plans/other costs* —— — 217 85 247

Total net periodic (income)/cost $ (818) $ (202) $ (507) $ 1,267 $ 1,396 $ 1,040

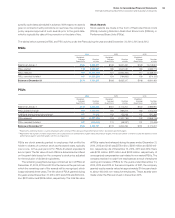

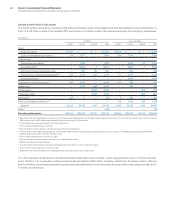

($ in millions)

Nonpension Postretirement Benefit Plans

U.S. Plan Non-U.S. Plans

For the year ended December 31: 2014 2013 2012 2014 2013 2012

Service cost $ 26 $ 35 $ 36 $ 7 $10 $14

Interest cost 187 164 200 63 60 64

Expected return on plan assets 0(1) — (9) (9) (9)

Amortization of transition assets —— — 00 0

Amortization of prior service costs/(credits) (7) — — (5) (5) (4)

Recognized actuarial losses 021 32 11 23 17

Curtailments and settlements —— — 00 0

Total net periodic cost $206 $218 $268 $66 $79 $82

* The 2014 Non-U.S. plans amount includes $148 million related to the IBM Spain pension litigation and the 2012 Non-U.S. plans amount includes $162 million related to the IBM UK

pension litigation. See page 136 for additional information.

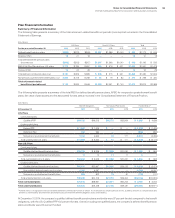

Defined Benefit Pension and Nonpension Postretirement

Benefit Plan Financial Information

The following tables through page 136 represent financial informa-

tion for the company’s retirement-related benefit plans, excluding

defined contribution plans. The defined benefit pension plans

under U.S. Plans consists of the Qualified PPP, the Excess PPP

and the Retention Plan. The defined benefit pension plans and the

nonpension postretirement benefit plans under Non-U.S. Plans

consists of all plans sponsored by the company’s subsidiaries. The

nonpension postretirement benefit plan under U.S. Plan consists

of only the U.S. Nonpension Postretirement Benefit Plan.

The tables below present the components of net periodic

(income)/cost of the retirement-related benefit plans recognized

in the Consolidated Statement of Earnings, excluding defined con-

tribution plans.