IBM 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 Management Discussion

International Business Machines Corporation and Subsidiary Companies

Results of Continuing Operations

Segment Details

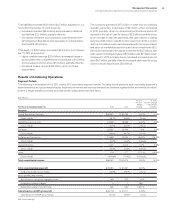

The following is an analysis of the fourth quarter of 2014 versus the fourth quarter of 2013 reportable segment external revenue and gross

margin results. Segment pre-tax income includes transactions between the segments that are intended to reflect an arms-length transfer

price and excludes certain unallocated corporate items.

($ in millions)

For the fourth quarter: 2014 2013

Yr.-to-Yr.

Percent/

Margin

Change

Yr.-to-Yr.

Percent Change

Adjusted for

Currency

Revenue

Global Technology Services $ 9,167 $ 9,917 (7.6)% 1.6%*

Gross margin 38.5% 38.8% (0.3) pts.

Global Business Services 4,349 4,747 (8.4)% (3.0)%

Gross margin 32.0% 30.7% 1.4 pts.

Software 7,578 8,140 (6.9)% (3.4)%

Gross margin 90.0% 90.5% (0.6) pts.

Systems and Technology 2,406 3,947 (39.0)% (12.2)%*

Gross margin 49.6% 42.2% 7.3 pts.

Global Financing 532 534 (0.5)% 4.6%

Gross margin 48.7% 43.3% 5.3 pts.

Other 82 100 (17.7)% (14.2)%

Gross margin (401.7)% (234.8)% (166.9) pts.

Total consolidated revenue $24,113 $27,385 (11.9)% (2.3)%*

Total consolidated gross profit $12,862 $14,337 (10.3)%

Total consolidated gross margin 53.3% 52.4% 1.0 pts.

Non-operating adjustments

Amortization of acquired intangible assets 101 103 (2.0)%

Acquisition-related charges —1 (100.0)%

Retirement-related costs/(income) 33 154 (78.8)%

Operating (non-GAAP) gross profit $12,996 $14,596 (11.0)%

Operating (non-GAAP) gross margin 53.9% 53.3% 0.6 pts.

* Adjusted for divestitures and currency.

Global Services

In the fourth quarter of 2014, the Global Services segments, GTS

and GBS, delivered revenue of $13,516 million, a decrease of

7.8percent as reported, but flat year to year adjusted for currency

(6points) and the divested customer care and industry standard

server businesses (2points). Pre-tax income in the fourth quar-

ter decreased 25.0percent and the pre-tax margin decreased

3.5points to 15.9percent. Total outsourcing revenue of $6,042

million decreased 9.3percent as reported, but flat year to year

adjusted for currency (6points) and the divestitures (3points).

Total transactional revenue of $5,839 million decreased 5.9per-

cent (flat adjusted for currency).

Global Technology Services revenue of $9,167 million

decreased 7.6percent as reported, but increased 2percent

adjusted for currency (6points) and the divested businesses

(4points). Within GTS, outsourcing revenue of $5,109 million

decreased 9.6percent as reported, but increased 1percent

adjusted for currency (6points) and the divestitures (5points).

Clients are continuing to sign large outsourcing engagements

that leverage the company’s cloud, business analytics and mobile

solutions. Clients are using these outsourcing engagements as

a way to optimize their IT infrastructure while at the same time

enabling new services to their customers. Lufthansa and ABN

AMRO, both signings which were over $1 billion in contract