IBM 2014 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

Management Discussion

International Business Machines Corporation and Subsidiary Companies

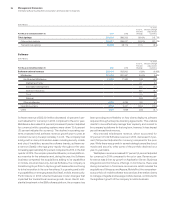

Total geographic revenue of $92,326 million decreased 5.6per-

cent as reported and 1percent adjusted for divestitures (2points)

and currency (2points) in 2014 compared to the prior year. In total,

major market countries decreased 4.3percent as reported and

1percent adjusted for divestitures (2points) and currency (1 point).

Growth market countries decreased 9.9percent as reported

and 3percent adjusted for divestitures (3points) and currency

(4points) compared to 2013.

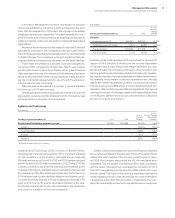

The year-to-year decline in growth markets revenue adjusted

for currency and the divestitures reflected growth in the Latin Amer-

ican and Europe growth markets, more than offset by decreased

revenue in the Asia Pacific growth markets. The Latin American

growth market countries decreased 1.0percent as reported, but

grew 8percent adjusted for divestitures (2points) and currency

(7points). Within Latin America, Brazil decreased 3.1percent as

reported, but grew 4percent adjusted for divestitures (1point)

and currency (6points). There was also growth in most other

Latin American countries at constant currency. European growth

markets were down 5.3percent as reported, but increased 1per-

cent adjusted for divestitures (3points) and currency (3points)

compared to the prior year. Asia Pacific growth market countries

decreased 14.6percent as reported and 9percent adjusted for

divestitures (3points) and currency (2points). This performance

was driven by China and several of the other larger growth market

countries. China decreased 17.2percent as reported and 15per-

cent adjusted for divestitures (3points) and currency (0points), but

reflected improvement in its sequential year-to-year growth rate

in the last quarter of the year with strong software performance

and several large mainframe transactions. In the fourth quarter,

China revenue decreased 19.9percent as reported, but declined

1percent adjusted for currency and divestitures. Australia, India

and Korea, which are some of the larger countries within the Asia

Pacific growth markets, also declined compared to the prior year.

Within the BRIC countries, combined revenue decreased 10.7per-

cent as reported and 5percent adjusted for divestitures (3points)

and currency (3points) compared to the prior year. On an adjusted

basis, this performance reflects growth in Brazil and Russia, more

than offset by the declines in China and India.

Americas revenue of $41,410 million decreased 4.3percent as

reported and 1percent adjusted for divestitures (2points) and

currency (1point) compared to the prior year. On an adjusted

basis, there was increased revenue in the growth markets offset

by year-to-year declines in the major market countries. Within the

North American major markets, the U.S. declined 4.0percent as

reported and 2percent adjusted for divestitures (2points). Canada

was down 9.8percent as reported and 2percent adjusted for

divestitures (1point) and currency (7points).

Europe/Middle East/Africa (EMEA) revenue of $30,700 mil-

lion decreased 2.9percent as reported and 1percent adjusted

for divestitures (3points) and offset by currency (1point). Major

market countries were down 2.6percent as reported and 1per

-

cent adjusted for divestitures (2points), offset by currency (1point).

This was offset by growth of 1percent on an adjusted basis in the

growth market countries. Major market performance adjusted for

the divestitures and currency included growth in Germany, Italy

and Spain, which was more than offset by declines in the UK and

France compared to the prior year.

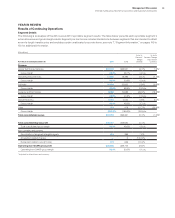

Geographic Revenue

In addition to the revenue presentation by reportable segment, the company also measures revenue performance on a geographic basis.

The following geographic, regional and country-specific revenue performance excludes OEM revenue.

($ in millions)

For the year ended December 31: 2014 2013

Yr.-to-Yr.

Percent

Change

Yr.-to-Yr.

Percent Change

Adjusted for

Currency*

Total revenue $92,793 $98,367 (5.7)% (1.5)%

Geographies $92,326 $97,800 (5.6)% (1.5)%

Americas 41,410 43,249 (4.3) (0.8)

Europe/Middle East/Africa 30,700 31,628 (2.9) (0.6)

Asia Pacific 20,216 22,923 (11.8) (4.1)

Major markets (4.3)% (1.0)%

Growth markets (9.9)% (3.2)%

BRIC countries (10.7)% (4.5)%

* Adjusted for divestitures and currency.