IBM 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

Management Discussion

International Business Machines Corporation and Subsidiary Companies

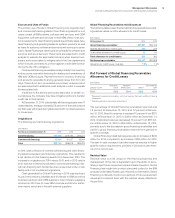

Events that could temporarily change the historical cash flow

dynamics discussed above include significant changes in oper-

ating results, material changes in geographic sources of cash,

unexpected adverse impacts from litigation, future pension funding

requirements during periods of severe downturn in the capital mar-

kets or the timing of tax payments. Whether any litigation has such

an adverse impact will depend on a number of variables, which

are more completely described in noteM, “Contingencies and

Commitments,” on pages 122 to 124. With respect to pension fund-

ing, in 2014, the company contributed $519 million to its non-U.S.

defined benefit plans versus $507 million in 2013. As highlighted in

the Contractual Obligations table, the company expects to make

legally mandated pension plan contributions to certain non-U.S.

plans of approximately $3.0 billion in the next five years. The 2015

contributions are currently expected to be approximately $600

million. Cash disbursements related to all retirement-related plans

is expected to be approximately $2.7 billion in 2015, an increase

of approximately $0.1 billion compared to 2014. Financial market

performance could increase the legally mandated minimum con-

tributions in certain non-U.S. countries that require more frequent

remeasurement of the funded status. The company is not quan-

tifying any further impact from pension funding because it is not

possible to predict future movements in the capital markets or

pension plan funding regulations.

The Pension Protection Act of 2006 was enacted into law in

2006, and, among other things, increased the funding require-

ments for certain U.S. defined benefit plans beginning after

December31, 2007. No mandatory contribution is required for

the U.S. defined benefit plan in 2015 as of December31, 2014.

The company’s U.S. cash flows continue to be sufficient to fund

its current domestic operations and obligations, including invest-

ing and financing activities such as dividends and debt service.

The company’s U.S. operations generate substantial cash flows,

and, in those circumstances where the company has additional

cash requirements in the U.S., the company has several liquidity

options available. These options may include the ability to borrow

additional funds at reasonable interest rates, utilizing its commit-

ted global credit facility, repatriating certain foreign earnings and

utilizing intercompany loans with certain foreign subsidiaries.

The company does earn a significant amount of its pre-tax

income outside the U.S. The company’s policy is to indefinitely

reinvest the undistributed earnings of its foreign subsidiaries, and

accordingly, no provision for federal income taxes has been made

on accumulated earnings of foreign subsidiaries. The company

periodically repatriates a portion of these earnings to the extent

that it does not incur an additional U.S. tax liability. Quantifica-

tion of the deferred tax liability, if any, associated with indefinitely

reinvested earnings is not practicable. While the company cur-

rently does not have a need to repatriate funds held by its foreign

subsidiaries, if these funds are needed for operations and obliga-

tions in the U.S., the company could elect to repatriate these funds

which could result in a reassessment of the company’s policy and

increased tax expense.

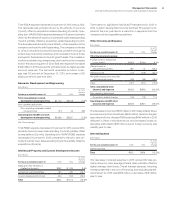

Contractual Obligations

($ in millions)

Total Contractual

Payment Stream

Payments Due In

2015 2016–17 2018–19 After 2019

Long-term debt obligations $39,708 $ 4,586 $10,564 $ 6,686 $17,872

Interest on long-term debt obligations 10,437 1,120 2,036 1,437 5,845

Capital (finance) lease obligations 29 13 9 4 2

Operating lease obligations 6,152 1,350 2,149 1,602 1,051

Purchase obligations 1,227 680 437 72 38

Other long-term liabilities:

Minimum defined benefit plan pension funding (mandated)* 3,000 600 1,200 1,200 —

Excess 401(k) Plus Plan 1,730 71 149 158 1,352

Long-term termination benefits 1,823 733 209 153 728

Tax reserves** 3,642 995

Divestiture related 2,391 1,344 799 184 65

Other 1,018 134 200 111 574

Total $71,157 $11,625 $17,751 $11,607 $27,527

* As funded status on plans will vary, obligations for mandated minimum pension payments after 2019 could not be reasonably estimated.

** These amounts represent the liability for unrecognized tax benefits. The company estimates that approximately $995 million of the liability is expected to be settled within the

next 12 months. The settlement period for the noncurrent portion of the income tax liability cannot be reasonably estimated as the timing of the payments will depend on the

progress of tax examinations with the various tax authorities; however, it is not expected to be due within the next 12 months.