IBM 2014 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

126

For income tax return purposes, the company has foreign and

domestic loss carryforwards, the tax effect of which is $579 mil-

lion, as well as domestic and foreign credit carryforwards of $965

million. Substantially all of these carryforwards are available for at

least two years or are available for 10years or more.

The valuation allowance at December31, 2014 principally

applies to certain foreign, state and local loss carryforwards that,

in the opinion of management, are more likely than not to expire

unutilized. However, to the extent that tax benefits related to these

carry forwards are realized in the future, the reduction in the valu-

ation allowance will reduce income tax expense.

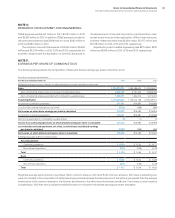

The amount of unrecognized tax benefits at December31, 2014

increased by $646 million in 2014 to $5,104 million. A reconciliation

of the beginning and ending amount of unrecognized tax benefits

is as follows:

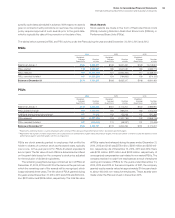

($ in millions)

2014 2013 2012

Balance at January1 $4,458 $ 5,672 $5,575

Additions based on tax positions

related to the current year 697 829 401

Additions for tax positions

of prior years 586 417 215

Reductions for tax positions

of prior years (including impacts

due to a lapse in statute) (579) (2,201) (425)

Settlements (58) (259) (94)

Balance at December 31 $5,104 $ 4,458 $5,672

The additions to unrecognized tax benefits related to the current

and prior years are primarily attributable to non-U.S. issues, certain

tax incentives and credits, divestitures, acquisition-related matters

and state issues. The settlements and reductions to unrecognized

tax benefits for tax positions of prior years are primarily attribut-

able to currency, non-U.S. audits and impacts due to lapses in

statutes of limitation.

In April 2010, the company appealed the determination of the

Japan Tax Authorities with respect to certain foreign tax losses.

The tax benefit of these losses totals $1,000 million as of Decem-

ber31, 2014. The 2014 decrease of $141 million was driven by

currency and has been included in the 2014 reductions for tax

positions of prior years. In April 2011, the company received notifi-

cation that the appeal was denied, and in June 2011, the company

filed a lawsuit challenging this decision. In May 2014, the Tokyo

District Court ruled in favor of the company. The Japanese gov-

ernment has appealed the ruling to the Tokyo High Court. No final

determination has been reached on this matter.

The liability at December31, 2014 of $5,104 million can be

reduced by $875 million of offsetting tax benefits associated with

the correlative effects of potential transfer pricing adjustments, U.S.

tax credits, state income taxes and timing adjustments. The net

amount of $4,229 million, if recognized, would favorably affect the

company’s effective tax rate. The net amounts at December31,

2013 and 2012 were $3,902 million and $5,099 million, respectively.

Interest and penalties related to income tax liabilities are

included in income tax expense. During the year ended Decem-

ber31, 2014, the company recognized $216 million in interest

expense and penalties; in 2013, the company recognized a benefit

of $93 million in interest expense and penalties, and in 2012, the

company recognized $134 million in interest expense and penal-

ties. The company has $593 million for the payment of interest

and penalties accrued at December31, 2014, and had $417 million

accrued at December31, 2013.

Within the next 12 months, the company believes it is reason-

ably possible that the total amount of unrecognized tax benefits

associated with certain positions may be significantly reduced.

The potential decrease in the amount of unrecognized tax benefits

is primarily associated with the anticipated resolution of the com-

pany’s U.S. income tax audit for 2011 and 2012, as well as various

non-U.S. audits. The company estimates that the unrecognized tax

benefits at December31, 2014 could be reduced by approximately

$1 billion.

The company is subject to taxation in the U.S. and various

state and foreign jurisdictions. With respect to major U.S. state

and foreign taxing jurisdictions, the company is generally no longer

subject to tax examinations for years prior to 2009. The company is

no longer subject to income tax examination of its U.S. federal tax

return for years prior to 2011. The open years contain matters that

could be subject to differing interpretations of applicable tax laws

and regulations related to the amount and/or timing of income,

deductions and tax credits. Although the outcome of tax audits is

always uncertain, the company believes that adequate amounts of

tax and interest have been provided for any significant adjustments

that are expected to result for these years.

In the fourth quarter of 2013, the company received a draft tax

assessment notice for approximately $866 million (approximately

$850 million at 2014 year-end currency rates) from the Indian Tax

Authorities for 2009. The company believes it will prevail on these

matters and that this amount is not a meaningful indicator of liabil-

ity. At December31, 2014, the company has recorded $471 million

as prepaid income taxes in India. A significant portion of this bal-

ance represents cash tax deposits paid over time to protect the

company’s right to appeal various income tax assessments made

by the Indian Tax Authorities.

In the first quarter of 2014, the IRS commenced its audit of

the company’s U.S. tax returns for 2011 and 2012. The company

anticipates that this audit will be completed by the end of 2015.

The company has not provided deferred taxes on $61.4 billion

of undistributed earnings of non-U.S. subsidiaries at December31,

2014, as it is the company’s policy to indefinitely reinvest these

earnings in non-U.S. operations. However, the company periodi

-

cally repatriates a portion of these earnings to the extent that it

does not incur an additional U.S. tax liability. Quantification of the

deferred tax liability, if any, associated with indefinitely reinvested

earnings is not practicable.