IBM 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49

Management Discussion

International Business Machines Corporation and Subsidiary Companies

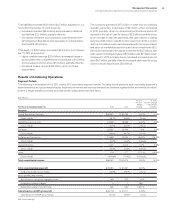

value, are recent examples of this. ITS revenue of $2,423 million

decreased 1.6percent from the fourth quarter of the prior year as

reported, but increased 4percent adjusted for currency. The year-

to-year increase was driven largely by the company’s high-value

security, mobility and resiliency offerings. SoftLayer continues to

attract new workloads to the platform, and in October, the com-

pany announced that IBM was selected by SAP to be the global

cloud provider for their enterprise cloud solution. IBM’s ability to

integrate public and private workloads within its hybrid cloud was

a critical differentiator for SAP. The company has continued to

expand its datacenter footprint and in the fourth quarter opened

cloud centers in Melbourne, Paris, Mexico City, Tokyo and Frank-

furt. Maintenance revenue of $1,635 million decreased 9.2percent

as reported, but was up 1percent for the quarter, adjusted for

currency (6points) and the industry standard server divestiture

(4points). The GTS gross profit margin of 38.5percent decreased

0.3points in the fourth quarter of 2014 compared to prior year.

In the fourth quarter, pre-tax income decreased 26.4percent

to $1,464 million and the pre-tax margin declined 3.9points to

15.6percent compared to the prior year. The year-to-year decrease

was driven by several key factors. First, GTS lost profit on a year-to-

year basis as a result of the customer care and industry standard

server divestitures. Second, the fourth quarter workforce rebalanc-

ing charge of $277 million impacted profit. Finally, the company

continued to invest in both offerings and operational capabilities.

This includes targeted investments in mobility, security and cloud

which complement clients’ systems-of-record, as well as opera-

tional improvements such as the yield from the rebalancing action

taken earlier in the year, and more broadly deployed automation in

the delivery centers.

Global Business Services revenue of $4,349 million decreased

8.4percent (3percent adjusted for currency) in the fourth quarter

of 2014. Consulting and Systems Integration revenue of $3,416

million declined 8.6percent (3percent adjusted for currency)

in the fourth quarter. Revenue was down in the traditional back

office implementations, particularly in North America. However,

the company again had strong double-digit growth in its practices

that address cloud, analytics, mobile and security. Through its

partnership with Apple, the company released the first 10 Mobile-

First for iOS solutions in the fourth quarter. GBS Outsourcing

revenue of $933 million decreased 7.5percent (2percent adjusted

for currency) in the fourth quarter, reflecting sequential improve-

ment at constant currency compared to the third quarter of 2014.

However, performance continued to be impacted by a challenging

pricing environment.

The GBS gross profit margin of 32.0percent expanded

1.4points in the fourth quarter of 2014 compared to prior year,

which is a good indicator of the value its offerings deliver. Pre-tax

income decreased 22.0percent to $733 million including a 15point

impact from the workforce rebalancing charge, which will pay back

in 2015. Pre-tax margin declined 2.7points to 16.4percent com-

pared to the prior year. Although the company continued to see a

slowdown in back office implementations in the traditional parts

of the portfolio, it is investing in strategic partnerships and those

should yield benefits in 2015.

Software

Software revenue of $7,578 million decreased 6.9percent (3per-

cent adjusted for currency) in the fourth quarter compared to the

prior year. Middleware decreased 5.6percent (2percent adjusted

for currency), while operating systems were down 18.8percent

(16percent adjusted for currency). As expected, there was not a

change in trajectory in the fourth quarter and performance was

similar to the previous quarter. Total growth reflected a headwind

from operating systems, driven by the divestiture of the indus-

try standard server business and Power Systems results. It also

reflected business model changes, which impacted transaction

revenue growth as customers continue to use the flexibility that

has been provided in the deployment of software purchased

through enterprise licensing agreements. This flexibility enables

clients to optimize their capacity on the company’s platform for

the long term. There was solid growth in many of the solution

areas, including security, mobile and cloud. Security software

again grew at a double-digit rate, marking the ninth consecu-

tive quarter of double-digit growth. With cybersecurity threats as

one of the key issues that all customers are facing, the company

has brought its analytics, big data, research IP, mobile and cloud

capabilities together to create security offerings to address this

market opportunity. The company’s software mobile offerings

more than doubled in the quarter, as it leveraged the integrated

MobileFirst portfolio, and software-as-a-service offerings were

up nearly 50percent.

Key branded middleware revenue, which accounted for

72percent of total Software revenue in the fourth quarter of

2014, decreased 6.4percent (3percent adjusted for currency)

compared to the prior year. Within key branded middleware, Web-

Sphere revenue decreased 6.4percent (4percent adjusted for

currency). Information Management revenue decreased 9.1per-

cent (6percent adjusted for currency). Tivoli revenue decreased

2.4percent, but was up 1percent adjusted for currency driven

by security software. Workforce Solutions revenue decreased

12.1percent (8percent adjusted for currency). Rational revenue

increased 4.1percent (10percent adjusted for currency) in the

fourth quarter with improved year-to-year performance compared

to the earlier quarters of 2014.

The Software gross profit margin remained strong at 90.0per-

cent in the fourth quarter compared to 90.5percent in fourth

quarter of the prior year. Software pre-tax income of $3,765 mil-

lion in the fourth quarter decreased 11.2percent year to year,

with a pre-tax margin of 44.7percent, a decline of 2.3points. The

fourth quarter of 2014 included a workforce rebalancing charge

of $120 million that represented approximately 3points of the

year-to-year decline.