IBM 2014 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

121

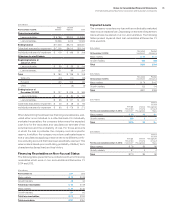

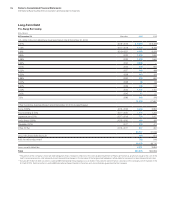

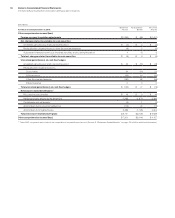

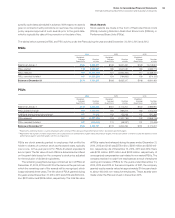

($ in millions)

For the year ended December 31, 2012:

Before Tax

Amount

Tax (Ex pense)/

Benefit

Net of Tax

Amount

Other comprehensive income/(loss)

Foreign currency translation adjustments $ (44) $ 10 $ (34)

Net changes related to available-for-sale securities

Unrealized gains/(losses) arising during the period $ 8 $ (4) $ 4

Reclassification of (gains)/losses to other (income) and expense (42)17 (25)

Subsequent changes in previously impaired securities arising during the period 20 (8) 12

Total net changes related to available-for-sale securities $ (14) $ 5 $ (9)

Unrealized gains/(losses) on cash flow hedges

Unrealized gains/(losses) arising during the period $ 32 $ (27) $ 5

Reclassification of (gains)/losses to:

Cost of sales (7) (6) (13)

SG&A expense (16) 4 (12)

Other (income) and expense (237) 91 (146)

Interest expense 6 (3) 3

Total unrealized gains/(losses) on cash flow hedges $ (220) $ 59 $ (161)

Retirement-related benefit plans

(1)

Net (losses)/gains arising during the period $(7,489) $2,327 $(5,162)

Curtailments and settlements (2) 0 (2)

Amortization of prior service (credits)/cost (148) 59 (89)

Amortization of net (gains)/losses 2,457 (874) 1,583

Total retirement-related benefit plans $(5,182) $1,513 $(3,669)

Other comprehensive income/(loss) $(5,460) $1,587 $(3,874)

(1) These AOCI components are included in the computation of net periodic pension cost. (See noteS, “Retirement-Related Benefits,” on pages 131 to 145 for additional information.)

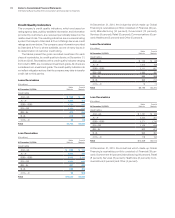

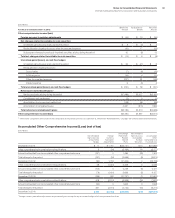

Accumulated Other Comprehensive Income/(Loss) (net of tax)

($ in millions)

Net Unrealized

Gains/(Losses)

on Cash Flow

Hedges

Foreign

Currency

Translation

Adjustments*

Net Change

Retirement-

Related

Benefit

Plans

Net Unrealized

Gains/(Losses)

on Available-

For-Sale

Securities

Accumulated

Other

Comprehensive

Income/(Loss)

December 31, 2011 $ 71 $ 1,767 $(23,737) $ 13 $(21,885)

Other comprehensive income before reclassifications 5 (34) (5,164) 16 (5,177)

Amount reclassified from accumulated other comprehensive income (167) 0 1,495 (25) 1,303

Total change for the period (161) (34) (3,669) (9) (3,874)

December 31, 2012 (90) 1,733 (27,406) 4 (25,759)

Other comprehensive income before reclassifications 28 (1,401) 3,409 0 2,036

Amount reclassified from accumulated other comprehensive income (103) 0 2,229 (5) 2,121

Total change for the period (76) (1,401) 5,639 (5) 4,157

December 31, 2013 (165) 332 (21,767) (1) (21,602)

Other comprehensive income before reclassifications 618 (2,074) (6,348) (18) (7,822)

Amount reclassified from accumulated other comprehensive income (60) 0 1,605 3 1,548

Total change for the period 557 (2,074) (4,742) (15) (6,274)

December 31, 2014 $ 392 $(1,742) $(26,509) $(15 ) $(27,875)

* Foreign currency translation adjustments are presented gross except for any associated hedges which are presented net of tax.