IBM 2014 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

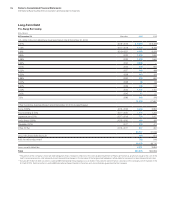

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

112

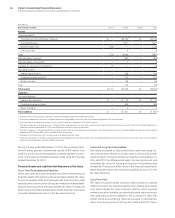

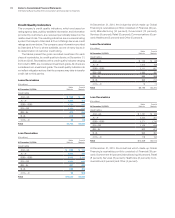

Credit Quality Indicators

The company’s credit quality indicators, which are based on

rating agency data, publicly available information and information

provided by customers, are reviewed periodically based on the

relative level of risk. The resulting indicators are a numerical rating

system that maps to Standard & Poor’s Ratings Services credit

ratings as shown below. The company uses information provided

by Standard & Poor’s, where available, as one of many inputs in

its determination of customer credit rating.

The tables present the gross recorded investment for each

class of receivables, by credit quality indicator, at December31,

2014 and 2013. Receivables with a credit quality indicator ranging

from AAA to BBB- are considered investment grade. All others are

considered non-investment grade. The credit quality indicators do

not reflect mitigation actions that the company may take to transfer

credit risk to third parties.

Lease Receivables

($ in millions)

At December 31, 2014:

Major

Markets

Growth

Markets

Credit rating

AAA – AA- $ 563 $ 46

A+ – A- 1,384 178

BBB+ – BBB- 1,704 900

BB+ – BB 1,154 272

BB- – B+ 470 286

B – B- 372 176

CCC+ – D 55 85

Total $5,702 $1,943

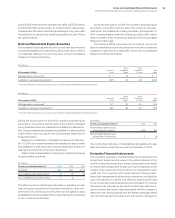

Loan Receivables

($ in millions)

At December 31, 2014:

Major

Markets

Growth

Markets

Credit rating

AAA – AA- $ 993 $ 110

A+ – A- 2,438 425

BBB+ – BBB- 3,003 2,148

BB+ – BB 2,034 649

BB- – B+ 827 683

B – B- 655 420

CCC+ – D 98 203

Total $10,049 $4,639

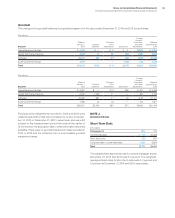

At December31, 2014, the industries which made up Global

Financing’s receivables portfolio consisted of: Financial (40per-

cent), Manufacturing (14percent), Government (13percent),

Services (9percent), Retail (8percent), Communications (6per-

cent), Healthcare (5percent) and Other (5percent).

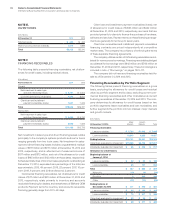

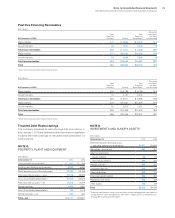

Lease Receivables

($ in millions)

At December 31, 2013:

Major

Markets

Growth

Markets

Credit rating

AAA – AA- $ 743 $ 68

A+ – A- 1,513 168

BBB+ – BBB- 2,111 957

BB+ – BB 1,393 350

BB- – B+ 595 368

B – B- 365 214

CCC+ – D 76 74

Total $6,796 $2,200

Loan Receivables

($ in millions)

At December 31, 2013:

Major

Markets

Growth

Markets

Credit rating

AAA – AA- $ 1,151 $ 125

A+ – A- 2,344 307

BBB+ – BBB- 3,271 1,745

BB+ – BB 2,158 638

BB- – B+ 922 672

B – B- 565 391

CCC+ – D 118 134

Total $10,529 $4,012

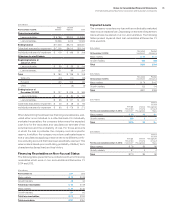

At December31, 2013, the industries which made up Global

Financing’s receivables portfolio consisted of: Financial (39per-

cent), Government (14percent), Manufacturing (14percent), Retail

(8percent), Services (8percent), Healthcare (6percent), Com-

munications (6percent) and Other (4percent).