IBM 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

Management Discussion

International Business Machines Corporation and Subsidiary Companies

Sources and Uses of Funds

The primary use of funds in Global Financing is to originate client

and commercial financing assets. Client financing assets for end

users consist of IBM systems, software and services, and OEM

equipment, software and services to meet IBM clients’ total solu-

tions requirements. Client financing assets are primarily sales-type,

direct financing and operating leases for systems products, as well

as loans for systems, software and services with terms up to seven

years. Global Financing’s client loans are primarily for software and

services, and are unsecured. These loans are subjected to credit

analysis to evaluate the associated risk and, when deemed nec-

essary, actions are taken to mitigate risks in the loan agreements

which include covenants to protect against credit deterioration

during the life of the obligation.

Commercial financing receivables arise primarily from inventory

and accounts receivable financing for dealers and remarketers of

IBM and OEM products. Payment terms for inventory financing

and accounts receivable financing generally range from 30 to 90

days. These short-term receivables are primarily unsecured and

are also subjected to additional credit analysis in order to evaluate

the associated risk.

In addition to the actions previously described, in certain cir-

cumstances, the company may take mitigation actions to transfer

credit risk to third parties.

At December31, 2014, substantially all financing assets were IT

related assets, and approximately 59percent of the total external

portfolio was with investment grade clients with no direct exposure

to consumers.

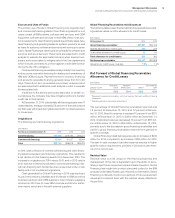

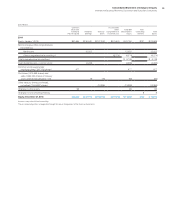

Originations

The following are total financing originations:

($ in millions)

For the year ended December 31: 2014 2013 2012

Client financing $15,099 $15,792 $16,277

Commercial financing 43,664 41,027 36,944

Total $58,762 $56,819 $53,222

In 2014, cash collection of commercial financing and client financ-

ing assets exceeded new financing originations. This resulted in

a net decline in total financing assets from December2013. The

increase in originations in 2014 versus 2013, and in 2013 versus

2012, was due to improving volumes in commercial financing. Inter-

nal loan financing with Global Services is executed under a loan

facility and is not considered originations.

Cash generated by Global Financing in 2014 was deployed

to pay intercompany payables and dividends to IBM as well as

business partners and OEM suppliers. Intercompany payables

declined in 2014 due to lower IBM volumes and shorter settle-

ment terms, which are in line with external suppliers.

Global Financing Receivables and Allowances

The following table presents external financing receivables exclud-

ing residual values, and the allowance for credit losses:

($ in millions)

At December 31: 2014 2013

Gross financing receivables $31,007 $32,319

Specific allowance for credit losses 484 279

Unallocated allowance for credit losses 96 113

Total allowance for credit losses 580 392

Net financing receivables $30,427 $31,928

Allowance for credit losses coverage 1.9% 1.2%

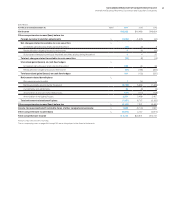

Roll Forward of Global Financing Receivables

Allowance for Credit Losses

($ in millions)

January 1, 2014

Allowance

Used*

Additions/

(Reductions) Other**

December 31,

2014

$392 $(26 ) $240 $(25 ) $580

* Represents reserved receivables, net of recoveries, that were written off during

the period.

** Primarily represents translation adjustments.

The percentage of Global Financing receivables reserved was

1.9percent at December31, 2014, and 1.2percent at Decem-

ber31, 2013. Specific reserves increased 74percent from $279

million at December31, 2013, to $484 million at December31,

2014. Unallocated reserves decreased 15percent from $113 mil-

lion at December31, 2013, to $96 million at December31, 2014,

primarily due to the decrease in gross financing receivables and

a shift in gross financing receivables reserves from general to

specific coverage.

Global Financing’s bad debt expense was an increase of $240

million for 2014, compared to an increase of $85 million for 2013.

The year-to-year increase in bad debt expense was due to higher

specific reserve requirements, primarily in China and Latin Amer-

ica, in the current year.

Residual Value

Residual value is a risk unique to the financing business and

management of this risk is dependent upon the ability to accu-

rately project future equipment values at lease inception. Global

Financing has insight into product plans and cycles for the IBM

products under lease. Based upon this product information, Global

Financing continually monitors projections of future equipment

values and compares them with the residual values reflected in

the portfolio.